Hong Kong needs more than tax breaks for the aircraft leasing hub to get off the ground

Hong Kong is aiming for an 18 per cent share of an industry that can create 15,340 jobs, add HK$10 billion in tax receipts and contribute HK$430 billion to the city’s economy

With typical Hong Kong efficiency, ICBC Financial Leasing delivered its first jetliner to a customer less than six months after a new tax regime to attract aircraft leasing companies to set up shop here, a speedy response that augurs well for the city’s vision to claim a stake in the US$261 billion industry.

The late-December delivery of a new Boeing 787-9 aircraft to Korean Airlines is a boost to the city’s efforts to remake itself into an aircraft leasing hub banking on a share of a global market where 50 per cent of the world’s commercial aircraft will come from a lessor over the next two decades, compared with the current 40 per cent.

Out of that growing pie, currently 85 per cent claimed by Ireland and Singapore, Hong Kong is aiming for the crumbs at third place. Still, that translates into financial leasing for 3,240 aircraft valued at HK$700 billion (US$89.6 billion), with the potential to create 15,340 jobs over 20 years, according to 2017 projections by the Financial Services Development Council, the advisory body to the government. The government also expects the industry to add HK$10 billion to its coffers and contribute HK$430 billion to the economy.

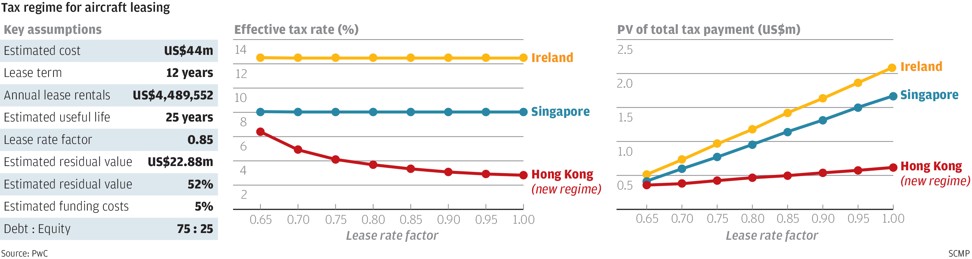

“Hong Kong has been a huge laggard in aircraft leasing, so the new tax regime brings it more in line with Singapore and Ireland’s,” said Corrine Png, CEO of Crucial Perspective, an independent equity research house in Singapore. “This has essentially levelled the playing field and improved Hong Kong’s competitiveness in terms of tax efficiency for nurturing the aircraft leasing industry ... there is a lot of catching up to do in the coming years.”

ICBC Financial, a unit of one of China’s largest banks, switched its transaction to Hong Kong from Ireland, making the victory especially sweet for the city.

Between 11,000 and 12,000 aircraft are leased every year by global airlines, with Ireland taking the lion’s share of the market at up to 65 per cent, after being in the business for 40 years. Singapore has 20 per cent of the global market in second place, after being in the business for two decades. An estimated 15 per cent of the market - equivalent to 1,000 planes - is now handled in China between Shanghai, Shenzhen and the Dongjiang free trade zone in Tianjin. Hong Kong is aiming for an 18 per cent share of an enlarged pie.

A major clincher is the number of double taxation agreements, which spare lessors from paying taxes on their profits twice in both their area of domicile and incorporation; the more agreements there are, the more attractive a location is. Hong Kong has 36 such agreements, half of Ireland’s 72 and Singapore’s 80-plus.

Hong Kong has been a huge laggard in aircraft leasing so the new tax regime brings it more in line with Singapore and Ireland’s

Hong Kong is working to change that. “Hong Kong has the fundamental elements and has taken the first step,” said Stanley Hui Hon-chung, president of the Hong Kong Aircraft Leasing & Aviation Finance Association, and the former chief executive of the Hong Kong Airport Authority.

The city government introduced a concessionary regime in July 2017 to remove tax impediments that had deterred lessors from setting up operations.

Hong Kong lessors will pay tax at 8.25 per cent on profit, half of the 16.5 per cent corporate tax rate, and be taxed on 20 per cent of their gross leasing income less deductible expenses.

Under the regime, a Hong Kong-based lessor will not be subject to tax on an aircraft disposal after three years. Assuming a significant profit on the disposal of an aircraft, the overall effective tax rate in Hong Kong should be much lower, Leung said.

It also means the concessions would appeal to companies with an initial public offering (IPO) exit strategy.

Hong Kong has the fundamental elements and has taken the first step

From a cash perspective, however, lessors in other jurisdictions appear to have an edge, as a Hong Kong company would have to pay a small cash tax on its profits. Ireland and Singapore do not impose such a tax, but offer tax depreciation.

But Leung said many Hong Kong and Chinese companies were already cash-rich, and with a lack of bankable projects, aircraft leasing is an attractive investment.

CK Asset Holdings, held by Hong Kong’s richest man Li Ka-shing, runs a fleet of 53 aircraft, and fellow tycoon Henry Cheng Kar-shun’s NWS Holdings operates a 90-plane fleet, according to their websites.

An increasing number of Chinese companies are getting into the business – Minsheng Financial Leasing, Ping An International Financial Leasing and Avic Capital, to name but three.

Many who invest in this business hope to raise funds through an IPO “in Hong Kong or Shanghai,” Leung said. “In an IPO, the first thing the stock exchange reviews is your profit and loss.”

It is also one of the world’s major financial centres and has one of the planet’s busiest airports and an aviation hub.

Working in Hong Kong’s favour is also Asia’s expanding aviation market – projected by Boeing to reach US$2.5 trillion in value in 20 years to become the world’s biggest travel market, powered by growth in China, India and Southeast Asia.

Demand for air travel has been buoyed by the region’s strong economic growth and an increasingly affluent middle-class population, as well as industry deregulation that has bolstered the rise of low-cost carriers.

As start-ups, budget carriers have an immediate need for aircraft at the outset, and that makes leasing an attractive option. To make the cut, they would need capital to tide them over for two to three years, said BOC Aviation’s CEO Robert Martin, who sees supporting “well-capitalised start-ups as part of the company’s business. Anything that stimulates market growth is good for us.”

This is where leasing companies play a crucial role in providing the planes to fill the demand-supply gap.

“If you talk to any leasing companies, China is the one they are focusing on,” said Liu Li, executive vice-president of GE Capital Aviation Services (GECAS). The company, which operates the world’s largest leasing fleet, has its team “actively engaged” and “looking into” the suitability of the city as a tax platform, she said.

Many who invest in this business hope to IPO, whether it is in Hong Kong or Shanghai

Chinese capital, according to aviation data provider FlightGlobal, accounted for 27 per cent of the US$261 billion that lessors have deployed into the market. Hong Kong, with its proximity to China, becomes an obvious choice for Chinese companies looking for a global platform.

These are among the factors that drew CDB Aviation Lease Finance, a wholly owned Irish subsidiary of CDB Financial Leasing, to move its office from Shenzhen to Hong Kong in 2016.

Hong Kong has a number of desirable factors, such as its status as a global banking hub and neighbour to China, which puts it on an accelerated path to become a global leasing centre, said CDB Aviation’s president Peter Chang.

“The purpose for Hong Kong to pursue this policy has to be that we’d eventually have the infrastructure of an aviation finance market, where that would be defined as professionals, technicians, the entire satellite ecosystem,” Chang said. “Right now there’s very little. There’re a lot but they are not directly related to aviation.”

Chang said people and talent were the crux of the industry, but there was currently no institution for training financial aviation managers.

As a lessor, he said the company would do its part to push Hong Kong’s progress, including helping local universities develop relevant courses, offering monetary support and expertise, and making investments.

The challenges are not insurmountable; Hong Kong just needs to make a concerted effort. Aircraft lessors say they are fully behind it.

After ICBC’s first delivery, a second transaction by CALC is likely to be on its way in early 2018, said CALC chief executive Mike Poon.

“We are in negotiations with a number of clients to lease more aircraft through Hong Kong,” he said.

CDB Aviation’s Chang said more leasing centres would raise the sophistication level of the service lessors provide and help them reach their customers better.

Still, mapping out the vision is only the easy part, he stressed. The test is what comes after.

“For sure, it is a process of hard work, consistency and all the things required to develop an industry”.