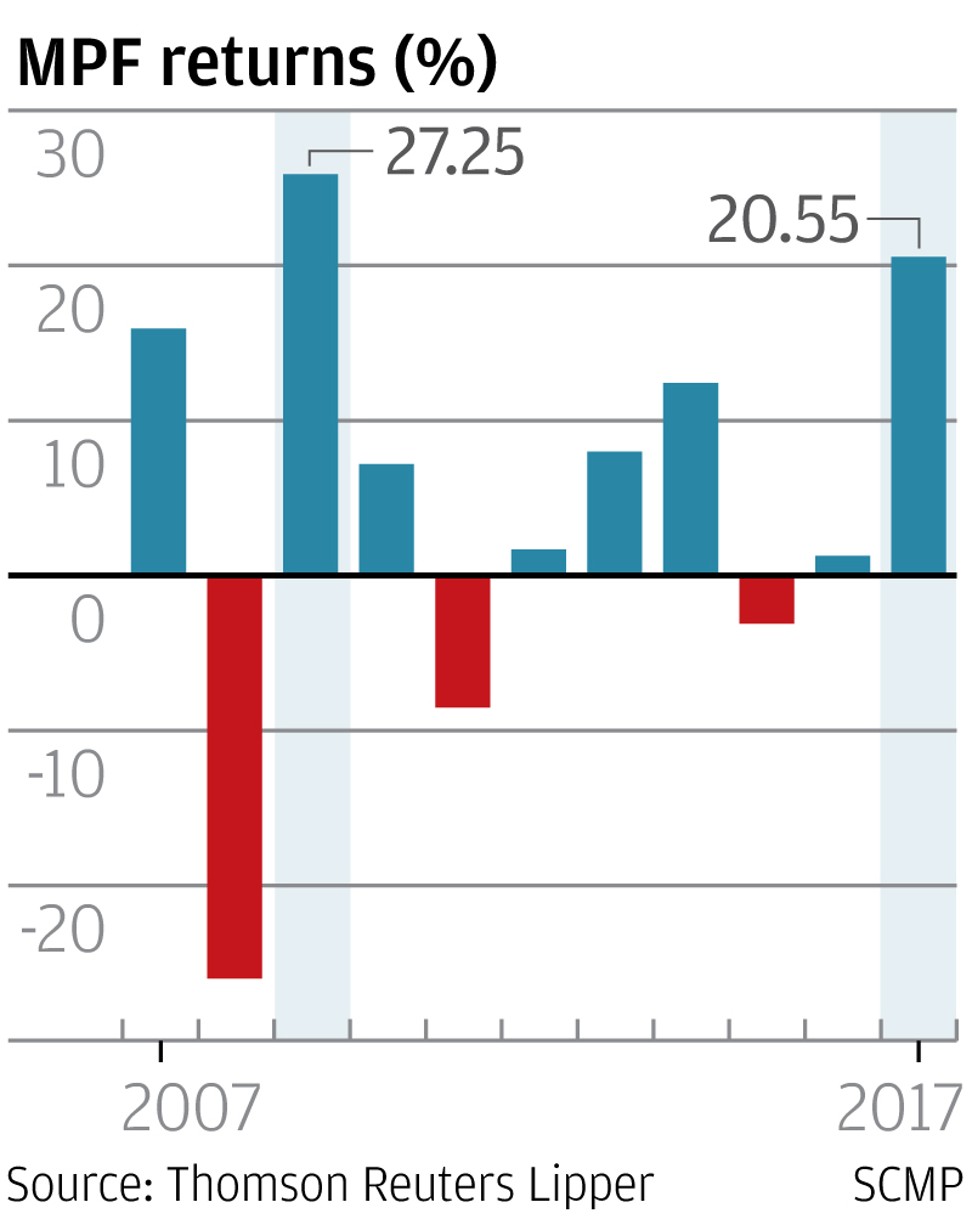

Hong Kong’s retirement fund posts best return since 2009 with 20.6 per cent growth

Employees who invested their contributions in equity funds were the biggest winners in 2017, with the best performers showing returns of nearly 40 per cent

Hong Kong’s Mandatory Provident Fund, the compulsory retirement plan for 2.8 million employees and self-employed people in the city, reported a 20.55 per cent return in 2017 – the strongest performance since 2009 on the back of the stellar performances of stock markets across the world, according to data from fund research company Thomson Reuters Lipper.

The performance was far better than the 1.24 per cent return in 2016, and a loss of 3.16 per cent in 2015. It was also the best year since 2009, when it posted a return of 27.25 per cent.

The returns meant that each Hong Kong employee on average would have earned about HK$20.55 for every HK$100 in their funds last year.

But the average performance of the 481 funds was still lower than the 36 per cent gain in Hong Kong’s benchmark Hang Seng Index, the best-performing stock market in the world last year. This is because many MPF funds had invested in money market or bond funds that gave lower returns, dragging down the overall profit.

The returns, however, were far better than the city’s inflation rate of 1.6 per cent in November.

Equity funds, the most popular investment choice with 42 per cent of employees picking them, turned out to be the biggest winners, giving them a larger share of the US$100 billion MPF assets.

Lipper data showed that 49 Hong Kong equity funds had an average return of 39.62 per cent in 2017, followed by China equity funds at 39.50 per cent. Funds investing in Asia-Pacific stock markets excluding Japan ranked third at 36.98 per cent, beating the Hang Seng Index’s performance.

The top individual fund was from Haitong Securities, which had a gain of 50.06 per cent.

Mixed-asset funds that invest in stocks and bonds reported an average return of 23.03 per cent during 2017. They accounted for 37 per cent of all MPF assets, the second most popular choice of employees enrolled in MPF.

No MPF funds reported a loss in 2017. Even the worst performing money market funds made a profit of 0.97 per cent. These money market funds invest only in bank deposits, which accounted for a mere 0.5 per cent of all MPF assets.

“The Hang Seng Index and many Asian markets performed strongly in 2017, which means as long as employees chose equity funds or mixed assets funds, they had strong returns,” said Louis Tse Ming-kwong, managing director of VC Wealth Management.

“Looking ahead, the stock markets in 2018 will still have growth but the growth rates will not be able to match those in 2017. Employees should be more cautious this year as the implication of the US interest rate rise and some political issues may hurt market sentiment.”