HNA will go it alone to build at the former Kai Tak airport, denies joint project with Sun Hung Kai

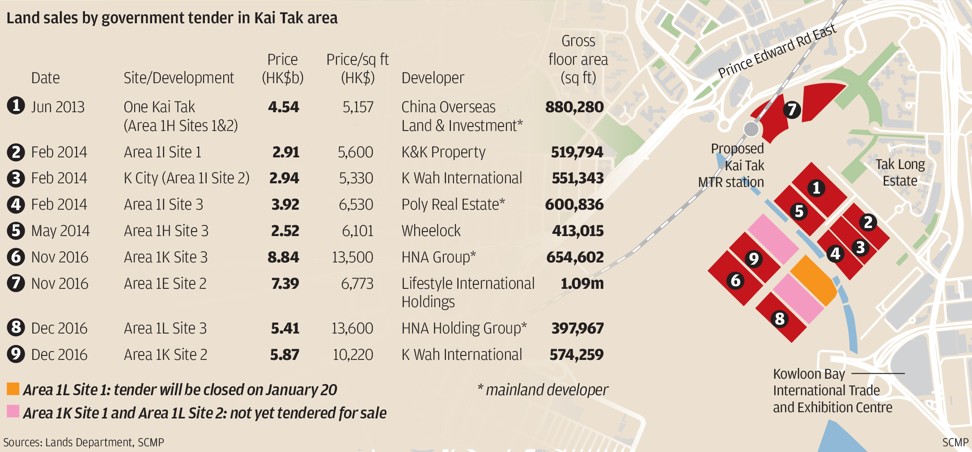

HNA Group, the Chinese conglomerate that muscled its way into Hong Kong’s real estate market in 2016 and 2017, said it will go it alone in building on the former Kai Tak airport site, for which it paid a record HK$27.2 billion (US$3.48 billion).

“We have discussed with various parties but have not come up with any plan to jointly develop the project,” said Liu Junchun, vice-chairman of HNA’s listed unit Hong Kong International Construction Investment Management Group. The company, a Hong Kong-listed unit of the mainland conglomerate HNA, owns two of the four sites bought in 2016 and 2017.

The other two sites are owned by Hong Kong International Investment Group, formerly known as HNA Holding International Investment Group, a private unit of HNA .

HNA, with 290,000 employees around the world, has 6,000 people in Hong Kong on its payroll. The company would build housing at Kai Tak for its staff, selling them at subsidised prices to help them afford to own property in the world’s priciest market, founder Chen Feng said in an interview with the South China Morning Post in June last year.

Companies within the group are developing the property on their own and construction work began last October on the four sites, covering 2 million square feet (185,800 square metres) in total.

Liu’s comment puts to rest media reports of a collaboration between HNA and Sun Hung Kai Properties, one of the city’s largest developers.

His remarks came soon after media reports that the mainland conglomerate was in talks to partner with Sun Hung Kai Properties for a loan to refinance its repayment liabilities linked to one of the sites owned by the private unit.

On Wednesday, HNA was reported to be inviting investors to buy two Hong Kong plots. The privately held Hong Kong International Investment was seeking minimum commitments of US$1 million per investor for a fund whose underlying assets will consist of the plots, according to Bloomberg.

Hong Kong International denied the report, saying that it was a proposal submitted by bankers, which had failed to get approval from the company.