Why most small players may not survive China’s pharmaceutical industry consolidation

Strategy aims to turn China’s predominantly off-patent drug copying pharmaceutical industry into one that’s capable of coming up with innovative patentable products

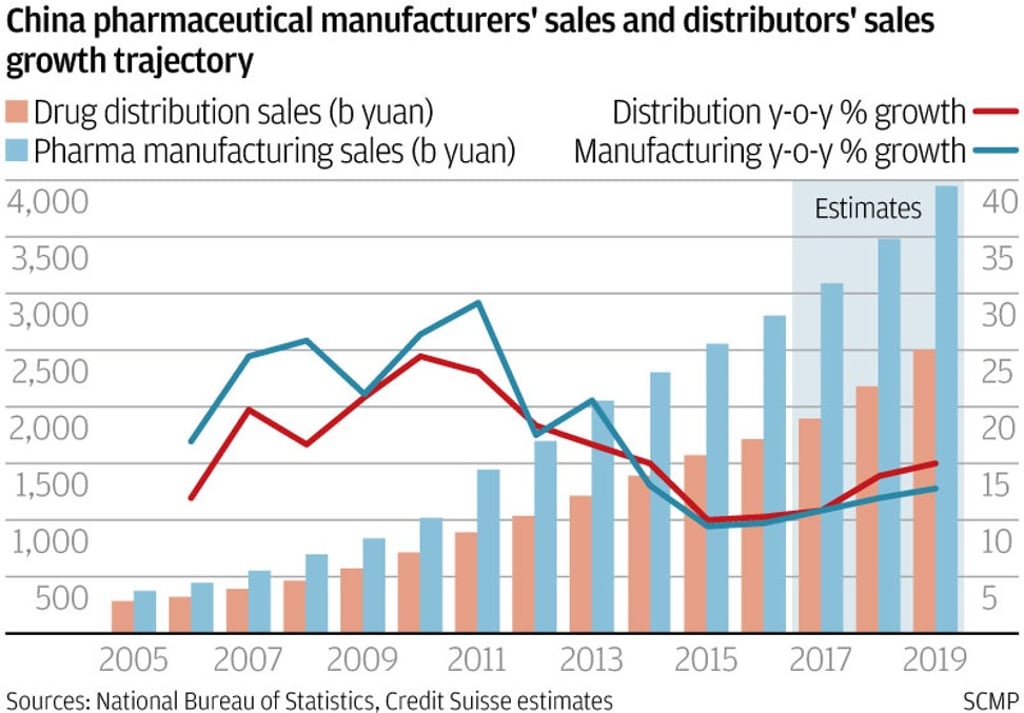

China’s fragmented pharmaceutical industry is expected to undergo a wave of consolidation over the next five years, thanks to more stringent drug quality regulations and a reduction in layers of distribution intermediaries.

From upstream drug discovery and manufacturing to downstream distribution, companies face greater competitive pressure as Beijing implements a raft of measures announced over the past two years to weed out practices that had led to mediocre drug quality and inefficiencies.

According to Credit Suisse’s head of China health care research, Serena Shao, the new policies could see over half the nation’s 2,900 or so small domestic drug makers disappear, with some acquired by larger rivals for a song.

“For the smaller generic drug makers that did not comply with tightened quality standards, the value of their assets could be limited since many do not have the financial muscle to re-conduct clinical trials on their products to fulfil regulatory requirements,” she said in an interview with the South China Morning Post.

“It could cost over 10 million yuan (US$1.56 million) to go through trials and procedures to obtain regulatory approval for a drug.”