Exclusive | China wants local investors to have a share of the success of its US-listed tech giants

Sources tell the South China Morning Post that the Shanghai and Shenzhen exchanges are drafting detailed rules to enable domestic investors to be able to buy shares in firms like Alibaba

China’s market regulator is looking into ways to enable domestic investors to trade shares in US-listed Chinese tech firms, as the country looks to spread the benefits of the global success of companies such as Alibaba Group Holding.

Sources close to the market regulator told the South China Morning Post that the Shanghai and Shenzhen stock exchanges are drafting detailed rules, and that trading of US-listed Chinese tech firms could begin on domestic bourses as soon as this year.

They said the trigger was growing unease in top government circles about the number of top companies listing outside China.

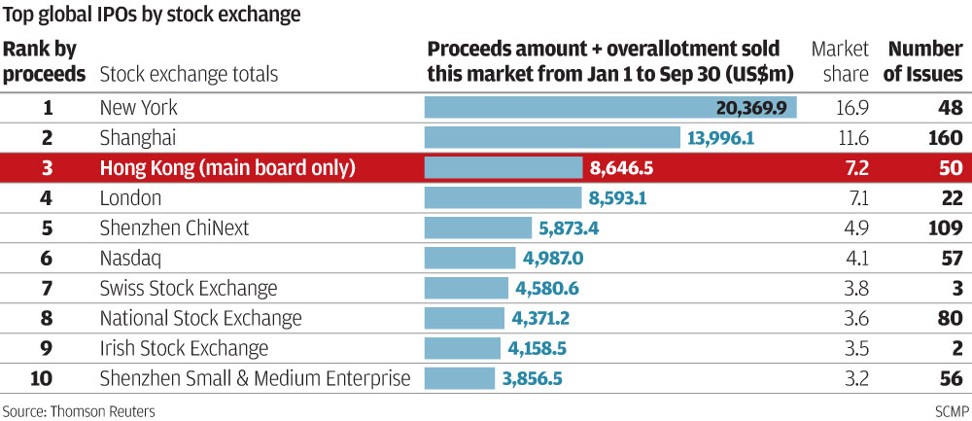

“China’s top leaders are concerned that China’s best tech companies are all listed in the US or Hong Kong, and has urged the securities regulator to produce a plan to solve the problem,” one of the sources said.

“The idea had been raised a while ago, but discussions and preparation have been accelerated after Xiaomi decided to go public in Hong Kong,” the source said.

Xiaomi, China’s leading smartphone manufacturer, is poised for an IPO in Hong Kong that would value it at up to US$100 billion and would be the world’s biggest tech listing 2018.

Overseas listings are popular with China’s top tech firms for a number of reasons, including flexibility and speed.

Another problem has been the more than two years on average it takes for authorities in China to approve IPOs, as well as strict rules on profitability requirements.

Domestic investors in China cannot trade US shares, but they can trade those in Hong Kong listed Chinese companies such as Tencent through Stock Connect schemes linking Hong Kong with the Shanghai and Shenzhen bourses.

The Shanghai exchange and the London Stock Exchange have also begun talks on a similar link, but any such scheme with a US market would be a complex undertaking.

The sources could not give details on how domestic Chinese investors might be able to trade in US-listed shares.

“It is unlikely that the VIE related restrictions will be scrapped in near future, but domestic trading of overseas listed shares could become easier to be realised,” one of the sources said.

A separate source close to the Shanghai exchange said that a possible method could be to select a basket of US-listed stocks and allow market makers to handle transactions and settlement during China’s trading hours.

“Trading of US stocks in mainland China sounds difficult, due to differences in time zones and trading rules,” said Kevin Leung, director of global investment strategy at Haitong International Securities in Hong Kong.

“But if it were made possible, turnover would be huge, although it may divert away from Hong Kong some of the capital that flows in from mainland China,” he said.

China has tried before to make its markets attractive to leaders in the new economy field, to boost confidence in local bourses.

The State Council announced a plan in December 2015 to establish a strategic emerging industries board on the Shanghai Stock Exchange, and had considered scrapping some IPO restrictions, including the no-VIE rule, for companies with a certain scale and growth potential in new economy sectors including the internet, biotech and new energy.

The plan was dumped after the stock market rout in June 2016, that wiped out trillions of yuan in market value in a few trading days.

As a measure of the success of firms listed overseas, the MSCI China Overseas index, the benchmark for tracking Chinese firms listed in the US and Singapore, surged 71.9 per cent in 2017. In comparison, China’s Shenzhen based ChiNext Index, which tracks local tech companies and start-ups, tumbled 10.7 per cent in the year.

Alibaba owns the South China Morning Post.