China move to allow VC investors quicker exit route post IPO aimed at nurturing tech unicorns

China’s securities watchdog will give preferential treatment for venture funds’ stock divestment, allowing them to exit their investments within two months of the expiry of a lock-up period

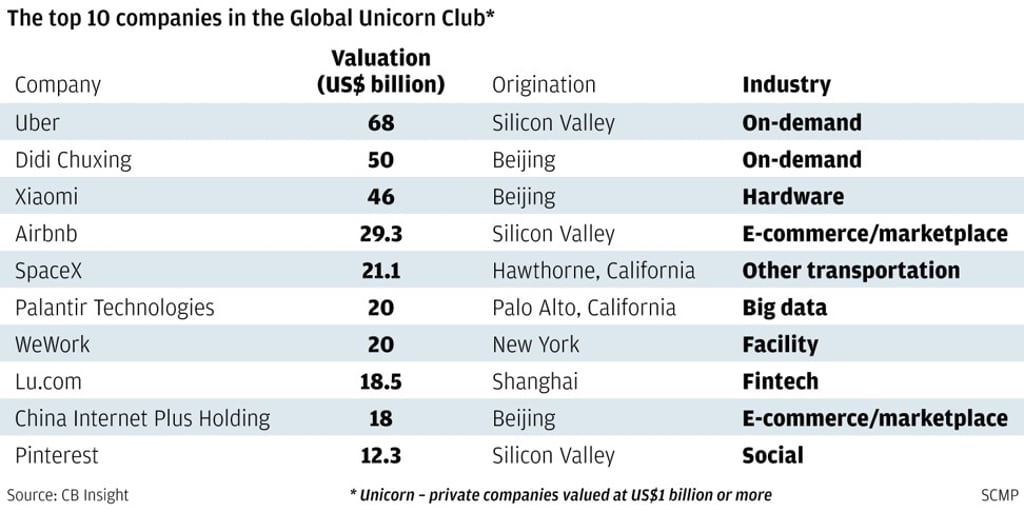

New rules announced by China’s securities regulator to enable venture capital investors to step up exit of their investments underlines the central government’s move to groom more technology start-ups into unicorns and eventually get them listed on the mainland’s stock markets, say analysts.

The China Securities Regulatory Commission (CSRC) announced last Friday that preferential treatment will be given to venture capital funds to dispose of their equity, allowing them to exit their investments post IPO within 30 and 60 days after the expiry of a lock-up period.

The rules come into effect from June 2 this year.

“Venture capital funds have become an important accelerator, incubator for early-stage small- and medium enterprises and advanced technology companies,” the CSRC said in a statement explaining the new rules. “Giving them policy support in their [divestment] will facilitate more capital [to be directed towards] SMEs and advanced technology start-ups.”

The rules are designed to incentivise venture capital investors that specialise in early-stage start-ups – defined as companies that have less than five years of operations – with quicker exit through the stock market. This is distinct to venture capital funds because other types of shareholders in listed companies are subject to a different set of divestment period, which is regulated at 90 days for major shareholders.