Moody’s downgrades outlook on ratings of HNA-owned Swissport as loan repayment concerns

HNA, which is rushing to sell assets and pay down debt, will raise US$896m from a secondary offering in Park Hotels and Resorts, the property arm of Hilton

Moody’s Investors Service on Wednesday downgraded the outlook on all the ratings of HNA-owned Swissport Group and its units from stable to negative, citing concerns about the airport cargo handler’s potential failure to collect loan repayment from an HNA affiliate and cash flow problems.

Separately, Park Hotels & Resorts, the real-estate spin-off of Hilton Worldwide Holdings, said in a statement on Tuesday night US time that HNA has priced a secondary offering of its 34.48 million shares at US$25.75 apiece. The deal, expected to close on March 9, will raise US$896.8 million.

The statement came days after Park Hotels said HNA was seeking to offload its 25 per cent stake, or 53.65 million shares, in the US company, as the Chinese conglomerate races to raise cash to tackle its debt.

The 25 per cent stake in Park Hotels is worth about US$1.4 billion based on its current market cap.

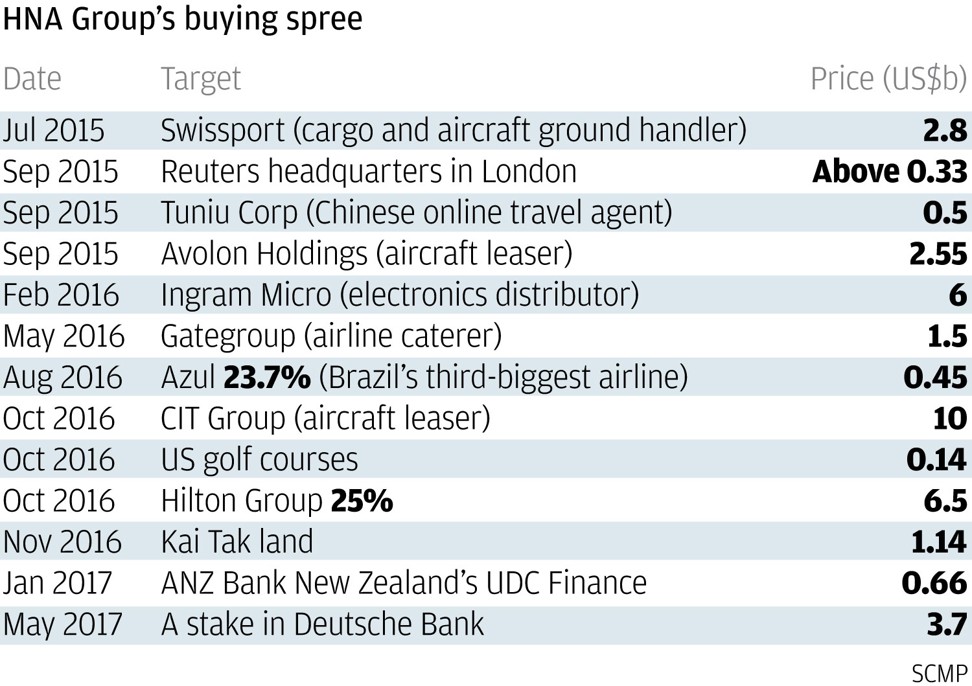

HNA, laden with huge debt, has been looking for ways to pay down debt as Chinese authorities tighten the screws on overseas investment and acquisition sprees by domestic corporate heavyweights.

“Moody’s decision to change the outlook to negative from stable reflects sustained negative free cash flow generation in 2016 and 2017, as well as concerns over the timely repayment in May 2018 of the loan provided to an affiliate of HNA,” said Emmanuel Savoye, assistant vice-president and lead analyst for Swissport at Moody’s.

He said the Swiss firm’s free cash flow generation has been negative over a number of quarters and is likely to remain negative in 2018 despite potential improvement.

In the future, Moody’s could downgrade the ratings if free cash flow generation remains negative over the coming quarters, or in case of non-repayment of the loan from the HNA affiliate in May 2018.

The ratings could be improved if free cash flow generation improves, resulting in a stronger liquidity position.

HNA bought Swissport, the world’s biggest ground and cargo handler at airports, for 2.73 billion Swiss francs (US$2.9 billion) in 2015. In January, the Swiss firm said it was considering an IPO on the SIX Swiss Exchange in Zurich to improve liquidity conditions.

On Tuesday, Swiss airline caterer Gategroup, also a unit of HNA, said it was planning an IPO for around the end of this month to raise 350 million Swiss francs.