China fast tracks IPO by leading biotech firm WuXi AppTec, in race as Asia’s hub for fundraising

Mainland’s leading biotech firm privatised in New York two years ago, but has been fast-tracked towards the A-share market just seven weeks after applying to list

WuXi AppTec, the mainland’s leading biotechnology firm which privatised in New York two years ago, has been given the green light to relist on the A-share market via an initial public offering (IPO) in Shanghai, just seven weeks after filing its application.

The listing is expected to raise more than 5.7 billion yuan (US$907.5 million), which the firm will use to expand research facilities and build new plants.

The lighting-fast approval adds further evidence that competition among exchanges in Hong Kong, China and Singapore is heating up as they scramble to list promising technology companies.

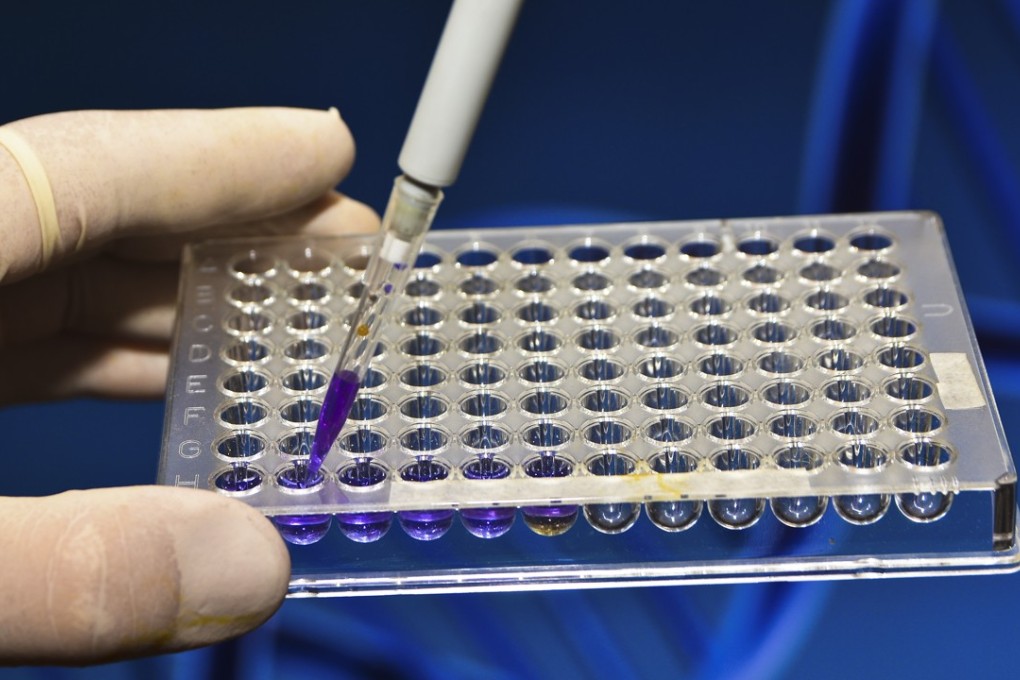

AppTec was the first Chinese tech firm to privatise in New York. The company is a contract research organisation (CRO) which helps drug makers shorten their discovery and development procedures, while lowering overall costs.

It is considered China’s leading CRO, according to Ivan Li, an asset manager with hedge fund Loyal Wealth Management.

“The regulator is believed to have been closely monitoring its fundamentals and operations for a while. AppTec is among China’s profit stars of the future,” he added.