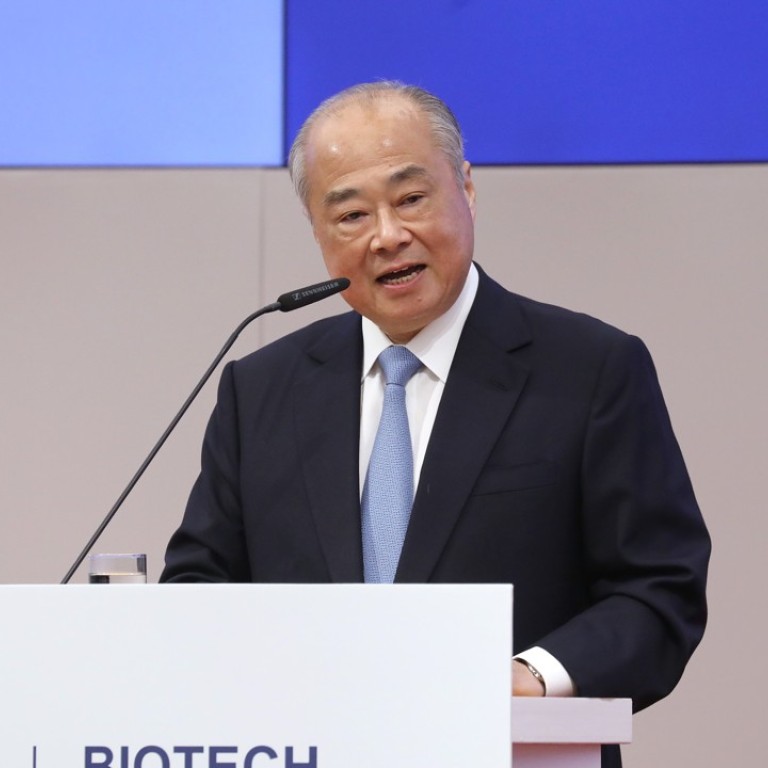

Expanded listing reforms in progress, says HKEX chairman

Hong Kong Exchanges and Clearing may expand its listing reform to allow more flexible structure technology companies to list, according to outgoing chairman Chow Chung-kong.

The planned move came as HKEX is facing heated competition from stock exchanges in Shanghai and Shenzhen, the US and Singapore.

The State Council announced on Friday the launch of the China Depository Receipt (CDR) scheme to attract tech giants.

Hong Kong ranked third globally in IPOs in Q1

Beijing’s move is seen by local brokers as a way to compete with the HKEX to attract the largest technology companies. The HKEX plans to launch later in April its largest listing reform in three decades, allowing the listing of some companies with multiple-class shares and biotech companies without revenue.

Chow said the exchange will consult the market after three months on whether the reform should be expanded so as to allow corporations, instead of just individuals, to hold premium shareholding rights.

The dual-class shareholding structure is favoured by tech companies such as Facebook or Google, as they allow the founders and key management to hold premium class shares with more voting rights than others.

Chow said on Thursday in a media gathering that the HKEX does not consider Shanghai or Shenzhen as a direct competitor, as the CDR scheme does not prevent mainland tech giants from listing in Hong Kong.

We are always eyeing the US as the major competitor in terms of fighting for technology and biotechnology firms to list

“We are always eyeing the US as the major competitor in terms of fighting for technology and biotechnology firms to list,” he said.

Chow said since January, some tech companies have inquired about the ability to hold premium voting rights as a corporate entity, a proposal which is under consideration.

“However, we would need another consultation before we could move on this step. Allowing companies to hold the premium class shares would be controversial. It would be hard to determine which corporate should qualify,” he said.

“The market consensus is to allow individuals who are the founders or key management of the tech firms, to hold shares with more voting rights. This is because the market also recognises these individuals have important roles to play in the development of these companies. This is why the premium class of shares would expire when these directors die or leave the company,” he said.

The Financial Services Development Council (FSDC), the government appointed advisory body, said in a statement last month that it believes the HKEX reform should be widened to allow companies to own premium class shares. The US allows such structures to be held by companies.

The FSDC chairwoman Laura Cha Shih May-lung is widely viewed as a likely successor for Chow at the HKEX.

Chow, who will step down as chairman on April 25, refused to comment about his successor.

Chow said he would like to see the listing reform implemented and the first application under the new regime made before he steps down.

HKEX says listing reforms could be in place by late April

Chow said the bond connect as well as the two stock connects schemes that link the stock markets of Hong Kong, Shanghai and Shenzhen, to be the most important achievements during his six years as chairman.

“These cross border trading schemes established the linkage between international investors and the mainland markets via HKEX,” he said.

Bourse operator unveils HKEX Connect Hall at trading hall site

Chow also led HKEX’s HK$16.92 billion (US$2.69 billion) acquisition of the London Metal Exchange in 2012 as a way for the local exchange operator to expand into commodities.

“I do not have any plans yet,” Chow said in reference to retirement. “I may spend time more keeping fit and reading history books. I am watching the Chinese history video via YouTube. I am watching the 76th episode out of a total 100 about the Ming dynasty.”