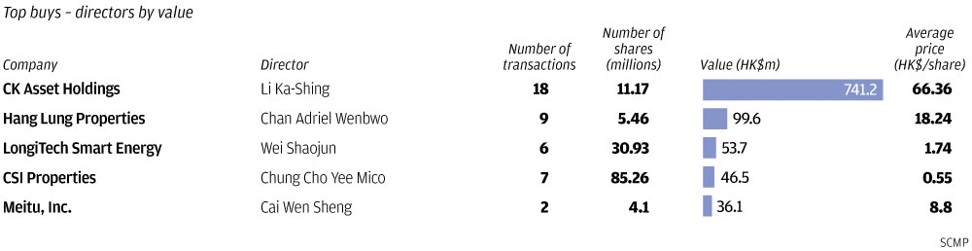

Li Ka-shing tops insider buy-backs, purchasing 11.2 million shares in CK Asset Holdings

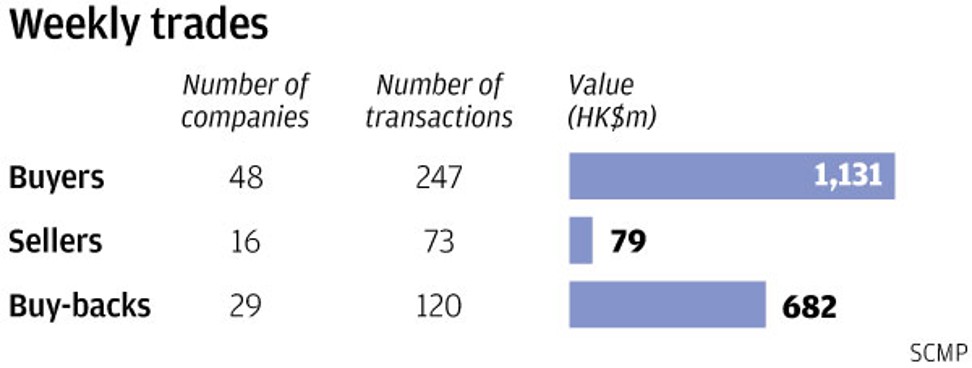

The buying fell while the selling among directors was flat based on exchange filings from April 16 to 20. Buyers outweighed sellers with 48 companies that recorded 247 purchases worth HK$1.13 billion (US$144.1 million) versus 16 companies with 73 disposals worth HK$79 million.

The buy value, however, was sharply up from the previous week’s acquisitions worth HK$482 million. The huge buy value was mainly due to tycoon Li Ka-shing with 11.2 million shares purchased in CK Asset Holdings worth HK$741 million. The purchases were significant as those are his first trades in CK Asset since June 2015. The stock closed flat from the chairman’s purchase price of HK$66.36 to HK$67.65 on Friday. On the selling side, the number of companies and trades were not far off from the previous week’s 17 companies and 66 disposals.

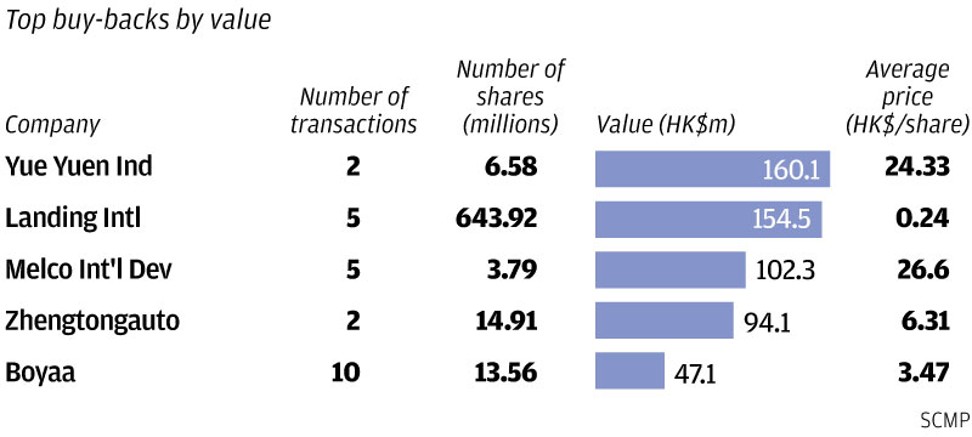

While the buying by directors fell last week, the buy-back activity surged with 29 companies that posted 120 repurchases worth HK$682 million based on filings from April 13 to 19.

There were several rare acquisitions last week with buy-backs in Yue Yuen Industrial, Asia Financial Holdings, Beijing Enterprises Water and Emperor Watch & Jewellery and insider buys in Eagle Nice Holdings.

Footwear manufacturer Yue Yuen Industrial recorded its first buy-back since December 2017 with 6.58 million shares purchased on April 13 at HK$24.33 each. The trade was made on the back of the 36 per cent drop in the share price since January 22. The group previously acquired 427,000 shares from November 30 to December 1, 2017 at an average of HK$27.79 each. The stock closed at HK$22.35 on Friday.

Insurance firm Asia Financial Holdings bought back for the first time since November 2016 with 1.274 million shares purchased from April 13 to 19 at an average of HK$4.82 each. The buy-backs were made after the company announced in late March a 27.3 per cent gain in year-end profit to HK$469.88 million. The group previously acquired 40.7 million shares from March to November 2016 at an average of HK$2.11 each. The stock closed at HK$4.92 on Friday.

Sewage treatment and water supply services provider Beijing Enterprises Water Group bought back for the first time since 2016 with 2.9 million shares purchased from April 6 to 17 at an average of HK$4.30 each. The trades were made on the back of a 37 per cent drop in the share price since November 2017. The Group previously acquired 19.3 million shares in January 2016 at HK$4.24 each. The stock closed at HK$4.34 on Friday.

Luxury watch and jewellery retailer Emperor Watch & Jewellery bought back for the first time since listing in July 2008 with 760,000 shares purchased on April 18 at 48 HK cents each. The trade was made on the back of the 216 per cent rebound in the share price since February 2016.The group announced its year-end results on March 14 with a profit of HK$159.691 million versus a loss of HK$64.821 million in the previous year. The stock closed at 50 HK cents on Friday.

Eagle Nice chairman and CEO Chung Yuk-sing recorded his first on-market trades the sportswear and garments manufacturer since August 2017 with 4.5 million shares purchased from April 9 to 19 at an average of HK$3.84 each. The trades, which accounted for 40 per cent of the stock’s trading volume, increased his holdings to 89.754 million shares or 17.96 per cent of the issued capital. The purchases were made after the stock rose by as much as 24 per cent from September 2017. The stock closed at HK$3.80 on Friday.