HNA reduces Deutsche Bank stake to 7.9 per cent after allowing derivatives to expire

HNA Group, one of Deutsche Bank’s biggest shareholders, cut its stake in the company two months after saying it wouldn’t as the Chinese conglomerate tries to raise US$16 billion to deal with financing problems at home.

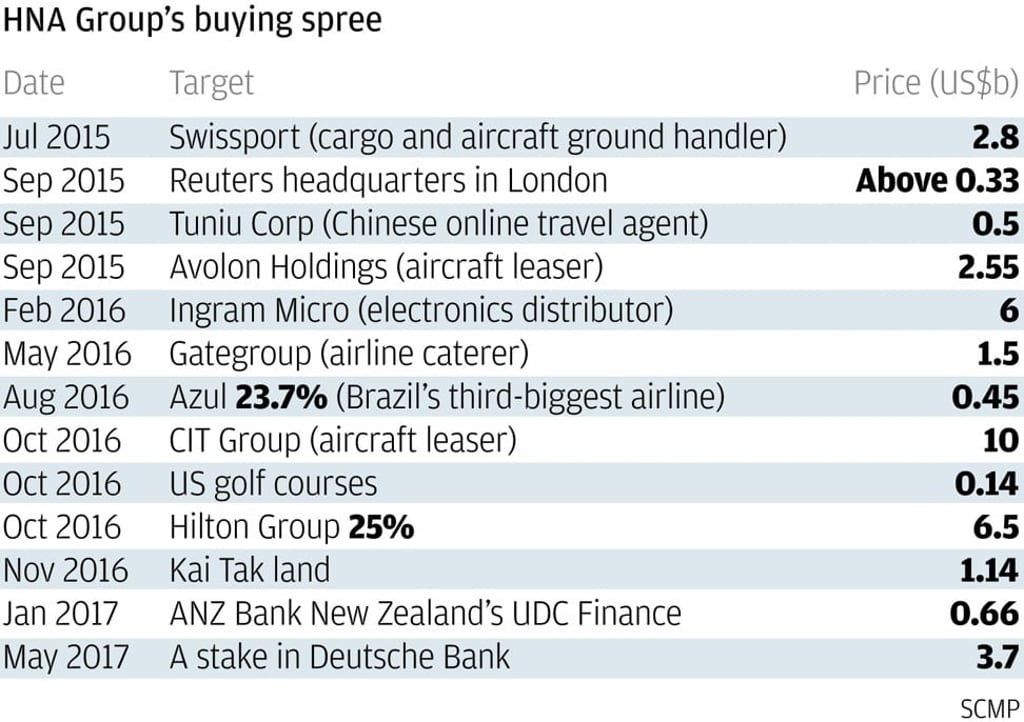

HNA, which shot to international prominence by spending more than US$40 billion on acquisitions across six continents since 2015, reduced its holding in the German lender to 7.9 per cent from 8.8 per cent as it allowed portions of a complex derivatives arrangement to expire, according to a filing on Saturday.

The move follows a string of negative news stories about Deutsche Bank, including a tumultuous management revamp and a report by Bloomberg News showing the company had inadvertently transferred 28 billion euros (US$35 billion) to one of its outside accounts.

HNA said it’s still committed to remain a “major investor” in Deutsche Bank. That’s the same language the Chinese company used in mid-February when it lowered its stake from about 9.9 per cent and said no further cut was planned. The decision was made “due to the current market environment,” a spokesman said by email on Saturday.