Hong Kong conglomerate Goldin Financial’s stock soars on plan to sell property worth US$1.6 billion to chairman

Company also plans to buy remaining ownership of grade A office in Kowloon East for HK$5.6 billion from Pan Sutong

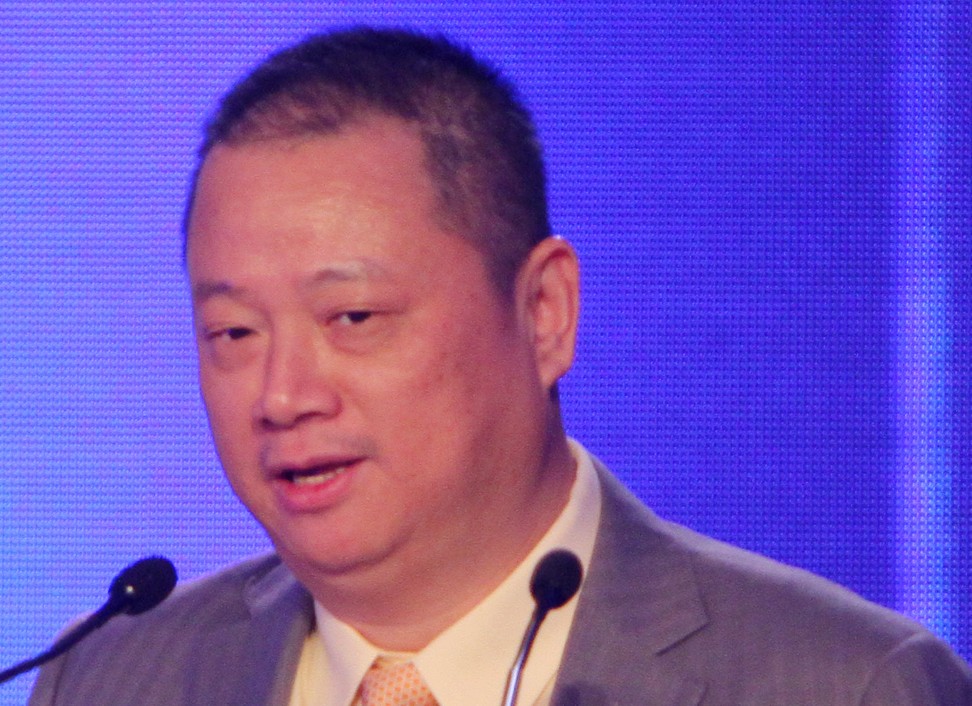

Hong Kong conglomerate Goldin Financial Holdings plans to sell two pieces of land in the city’s Ho Man Tin area worth HK$12.4 billion (US$1.6 billion) to mainland billionaire Pan Sutong, who is also the company’s chairman.

The company’s share price jumped as much as 18 per cent on Wednesday when it resumed trading after an 11-day suspension. By the close, it was up 8.9 per cent to HK$3.81, the biggest daily jump since February last year.

Daily turnover reached HK$41.3 million, with 10.5 million shares changing hands. Hong Kong’s benchmark Hang Seng Index declined 1 per cent to end at 30,328.15 on Wednesday.

Goldin Financial will sell a 60 per cent stake in a residential project on Sheung Shing Street for HK$6.4 billion, and a 50.1 per cent stake in a residential project at Ho Man Tin MTR station for HK$6 billion, according to a filing to the Hong Kong stock exchange.

The total gain from the sale before tax will be about HK$6.43 billion. Meanwhile, the company plans to buy the remaining 40 per cent ownership of Goldin Financial Global Centre, a grade A office in Kowloon East, for HK$5.6 billion from Pan.

“The transaction will help to enhance the cash position as well as gearing position of the company. The 100 per cent ownership of the grade A office building in Kowloon Bay will provide stable rental revenue,” Goldin Financial said in the filing.

“The transaction will provide the company with financial flexibility to capture potential new investment and property business opportunities that may arise in the future.”

“The prices are reasonable and in line with our valuation,” said Vincent Cheung, the deputy managing director for Asia valuations and advisory services at global real estate services company Colliers International. “It reflects the increase in the neighbourhood. Kerry’s Mantin Heights and Wheelock’s One Homantin in Ho Man Tin, for example, have drawn enthusiastic responses.”

Thomas Lam, head of valuation and consultancy at real estate company Knight Frank, said that unlike major Hong Kong developers, mainland developers would like to sell the land before completion to secure a profit.

“It is common in China. It could help the company to generate cash and strengthen its cash flow chain for other investment projects.”

Goldin Financial bid HK$6.38 billion to win the residential site on Sheung Shing Street in March 2016. The site yielded a gross floor area of 586,000 sq ft and is expected to provide 400 units of luxury apartments by 2020.

The company led a consortium that won the development rights for the residential project at Ho Man Tin MTR station in December 2016. This site yielded 742,700 sq ft, which can accommodate between 800 and 1,000 flats.

Pan, known for the under construction Goldin Finance 117 tower in Tianjin, which will be among China’s tallest buildings on completion, ranked No. 14 on the Forbes Hong Kong Rich List this year with a net worth of US$5.7 billion.