Geely Automobile and Agile Group have a big week as directors accumulate shares

There were several significant transactions last week with insider buys in Geely Automobile Holdings and Agile Group. There was also a rare purchase by the CEO and a buy-back in VSTECS Holdings.

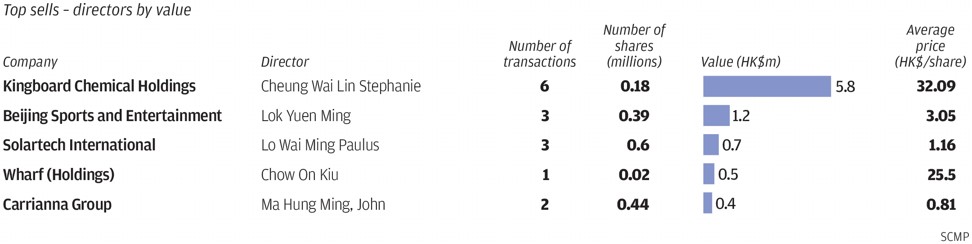

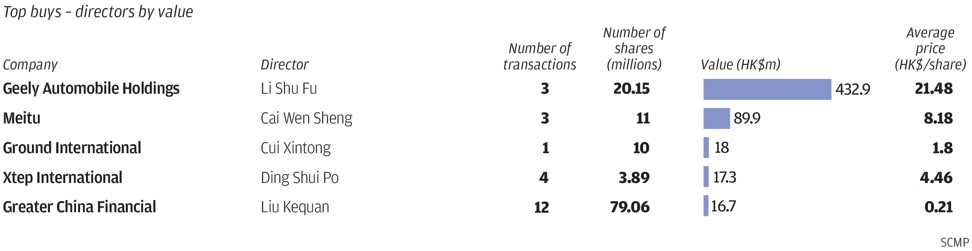

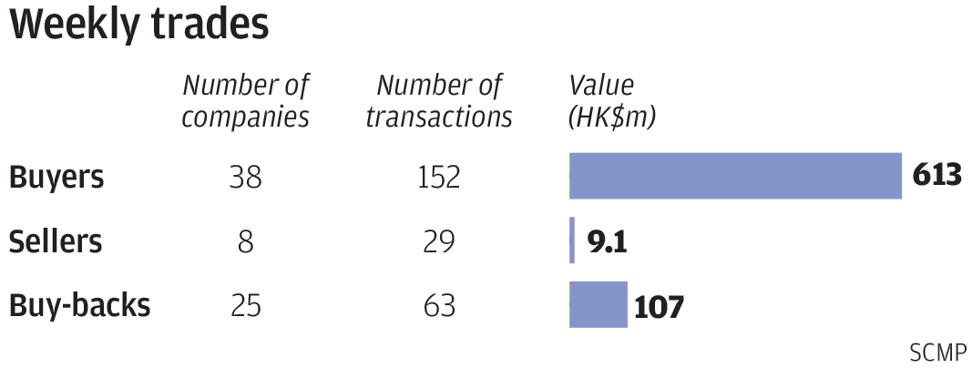

For the week, the buying among directors plunged while the selling fell, based on filings on the exchange during the holiday shortened week of April 30 to May 4. A total of 38 companies recorded 152 purchases worth HK$613 million (US$78.10 million) versus eight firms with 29 disposals worth HK$9.10 million. The number of companies and trades on the buying side were sharply down from the previous week’s five-day totals of 58 firms and 291 purchases. The buy value, however, was consistent with the previous week’s purchases worth HK$753 million. On the selling side, the number of companies and value were sharply down from the previous week’s 13 firms and HK$335 million.

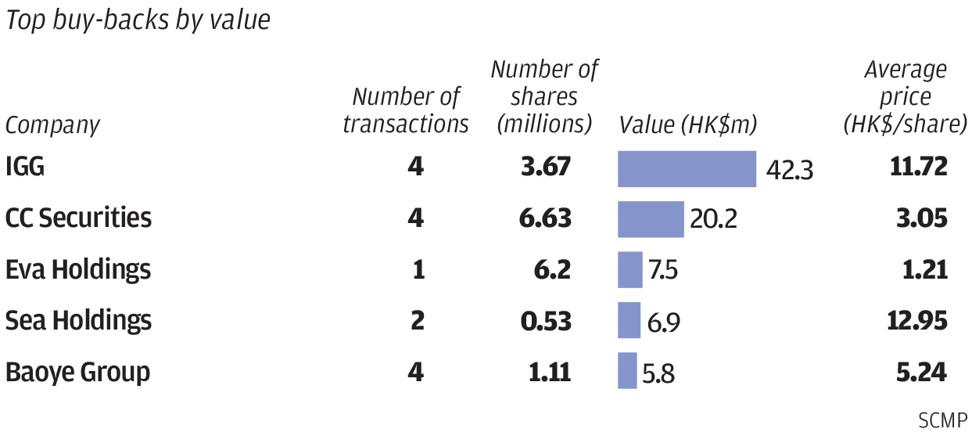

Aside from directors, the buy-back activity fell with 25 companies that posted 63 repurchases worth HK$107 million based on filings from April 27 to May 3. The figures were sharply down from the previous five-day totals of 32 firms, 120 trades and HK$327 million.

The top buyer among directors in terms of value was Li Shufu, chairman of Geely Automobile Holdings. The chairman resumed buying after the stock fell by 22 per cent from HK$27.50 on March 20 with 20.15 million shares purchased on May 2 at HK$21.48 each. The trade increased his holdings to 4.163 billion shares or 46.39 per cent of the issued capital. The fall in the share price since March was surprising as the company announced on March 21 a 108 per cent gain in annual profit to 10.63 billion yuan (US$1.67 billion). Among other purchases this year, the chairman acquired 18.83 million shares on January 19 at HK$24.99 each. The stock closed at HK$20.90 on Friday.

Chen Zhuolin, chairman and founder of Agile Group, recorded his first market trades in the mainland property developer since November 2017 with 950,000 shares purchased on April 23 at HK$15.35 each. The trade increased his holdings to 2.494 billion shares or 63.68 per cent of the issued capital. The purchase was made on the back of the 45 per cent rise in the share price since December 2017. He previously acquired 26.1 million shares from August to November 2017 at an average of HK$11.26 each. The stock closed at HK$15.54 on Friday.

There was a rare company buy-back and insider acquisition in VSTECS Holdings that saw chairman and CEO Li Jialin add to his holding in the IT products distributor. A combined 984,000 shares were purchased from April 25 to 26 at an average of HK$3.86 each. The trades accounted for 23 per cent of the stock’s trading volume. The purchases were made on the back of the 93 per cent rise in the share price since August 2017. Li recorded his first market trade since December 2014 with 578,000 shares purchased on April 25 at HK$3.86 each. The trade increased his holdings to 586.455 million shares or 40.09 per cent of the issued capital. The Group, on the other hand, bought back for the first time since August 2017 with 406,000 shares purchased on April 26 at HK$3.85 each. The sentiment is not entirely positive as Executive Director Chan Hoi Chau sold his remaining holdings of 1.14 million shares from March 22 to April 10 at an average of HK$4.20 each. The group announced its annual results on March 20 with profit up by 29.8 per cent to HK$716.441 million. The stock closed at HK$4.05 on Friday.