China plays pivotal role in diagnostics provider Ortho’s future, says its global chief

The company expects China sales to grow by 20pc annually against an estimated 14pc increase in the mainland’s IVD market

Global in-vitro diagnostics services and products provider Ortho Clinical Diagnostics plans to build Chinese manufacturing capacity and enter deals with local peers to maintain a 20 per cent sales growth in mainland China, according to its global chief.

The New Jersey-headquartered company was banking on the mainland, its “No. 1 growth country”, to play a pivotal role in its strategic expansion, be it involving an acquisition or a public offering, or remaining a privately-held firm, said Martin Madaus, Ortho’s chairman and chief executive in an interview this week in Shanghai.

Madaus said the company was expected to ramp up its revenue by 20 per cent annually in mainland, or five times its global average growth pace.

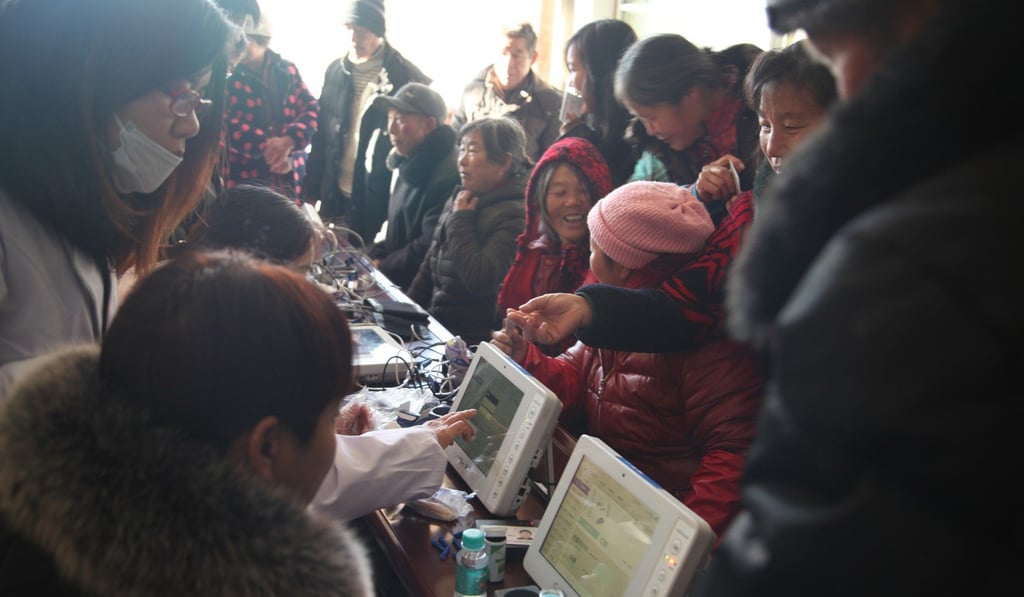

China’s in-vitro diagnostics (IVD) market is projected to grow at a compound rate of more than 14 per cent by 2021 according to market research firm Technavio. The growth is driven by the increased incidences of chronic and infectious diseases and growing health consciousness among a growing middle class and affluent population.

“US is our base and it has been the historical strength of Ortho Clinical Diagnostics,” Madaus said. “But we feel that China will be equal in the next five or six years, not in sales yet, but in terms of importance.”

The mainland and Hong Kong accounted for 15 per cent of the company’s US$1.8 billion in global sales last year, while the US market made up for nearly half of that total.