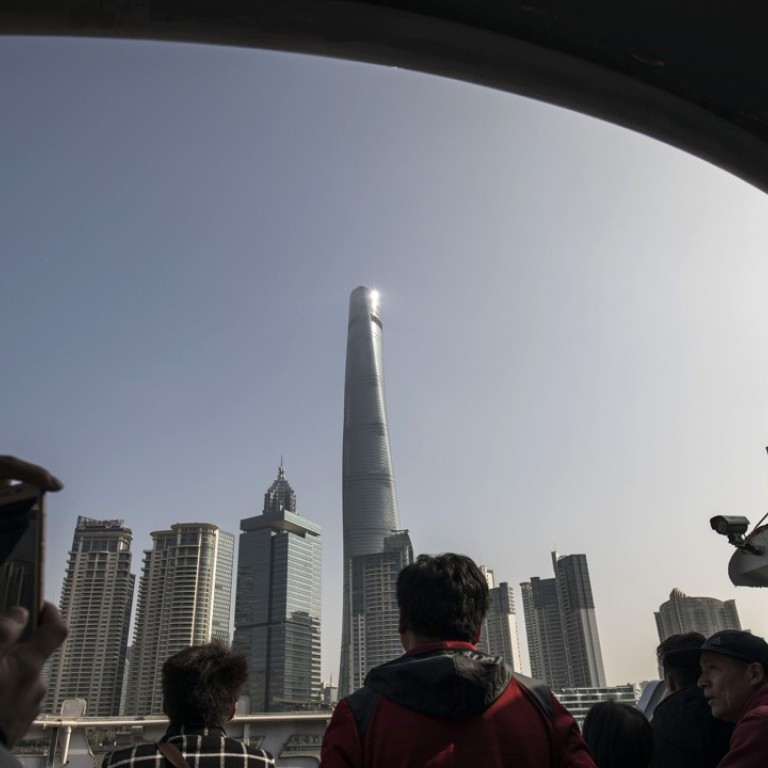

Companies drawn to Shanghai’s emerging districts amid cheaper rents, top class office space

Shanghai, China’s financial capital, is set to displace Hong Kong as Greater China’s biggest office market in 2020

Multinationals and state-owned companies are relocating from established central business districts in Shanghai to up and coming areas attracted by cheaper rents and increasing supply of grade A office space.

Amid the expansion of the city’s subway system, other non-CBD areas have seen a surge in the construction of office buildings, offering companies an alternative to established districts such as Lujiazui, Nanjing Road and People’s Square.

Shanghai Railway Station, the North Bund and Qiantan are among the emerging non-CBD areas that are starting to draw big tenants.

Besides, the mainland’s most developed metropolis is set to overtake Hong Kong as Greater China’s biggest office market in 2020.

By 2020, the city’s top grade office market will have a total supply of 11 million square metres (118.4 million sq ft), up from 6.6 million square metres in 2017, according to global property services firm JLL.

Hong Kong had about 8 million square metres last year, which will rise to about 9.2 million square metres in two years’ time.

Companies willing to relocate to these decentralised areas could see their rents fall by up to 40 per cent.

Dubbed as a “second Lujiazui”, Qiantan, along the eastern banks of the Pudong, is some 12 kilometres south of the city’s finance and trade heart of Lujiazui.

The Shanghai municipality envisions creating a new bustling commercial district at Qiantan, which will be in line with the standards set by Lujiazui.

State-owned developer Shanghai Lujiazui Group plans to construct 4 million square metres of new developments at Qiantan, of which 40 per cent will be allocated to high-end residential projects.

Qiantan, near the site of 2010 World Expo, has attracted a raft of multinational companies including US medical equipment maker Medtronic and Germany’s Covestro, one of the world’s largest makers of polymer.

Strong supply of new office space in Shanghai will continue to be the biggest challenge for the city’s office market, according to property services firm Savills.

“As a total of 2.4 million square metres of grade A office space, including those in the core and decentralised locations, is to be launched in the remainder of 2018, vacancy rates, as a result, are forecast to rise further,” the company said in a research report.

At the end of March this year, the vacancy rate at traditional CBD areas hit 12.4 per cent, up 0.5 percentage points from the previous quarter – 2.2 percentage points higher than the same period a year ago, Savills said.