VPower leads rare share buy-backs and insider purchases in shortened week of Hong Kong trading

Thirty-nine recorded 179 purchases worth US$28.29 million versus 11 firms with 34 disposals worth US$22.21. The number of companies on the buying side was not far off the previous week’s 5-day total of 42 firms

There were several rare transactions last week with buy-backs in Yongsheng Advanced Materials and China New City Commercial Development, insider buys in NagaCorp Limited and VPower Group and sales in FDG Electric Vehicles, based on filings on the Hong Kong exchange during the holiday-shortened week of May 21 to 25.

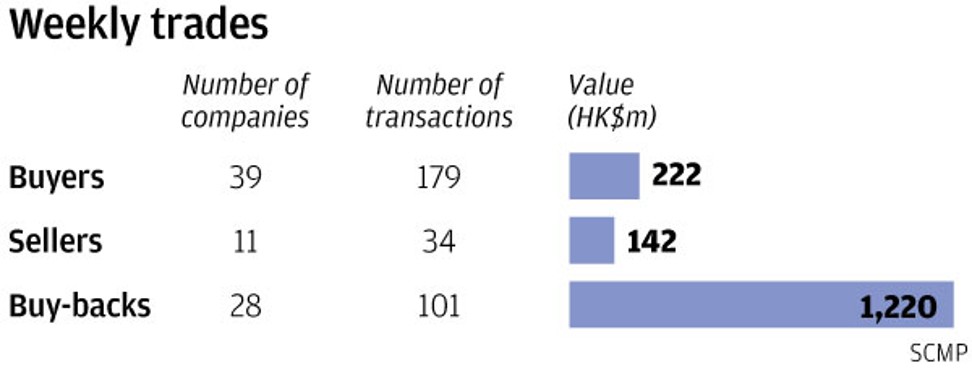

Thirty-nine companies recorded 179 purchases worth HK$222 million (US$28.29 million) versus 11 firms with 34 disposals worth HK$142 million (US$22.21). The number on the buying side was not far off the previous week’s 5-day total of 42 firms, while the number of purchases was sharply down from the previous week’s 273 acquisitions.

The buy value, on the other hand, was sharply up from the previous week’s purchases worth HK$172 million. On the negative side, the number of firms and trades were consistent with the previous week’s 12 companies and 41 disposals.

The sell value, on the other hand, was sharply up from the previous week’s disposals worth HK$38 million.

Aside from directors, buy-back activity remained high with 28 companies posting 101 repurchases worth HK$1.12 billion based on filings from May 18 to 24.

The 4-day figure was consistent with the previous 5-day totals of 27 firms, 142 trades and HK$1.16 billion.

There were several rare transactions last week with buy-backs in Yongsheng Advanced Materials and China New City Commercial Development, insider buys in NagaCorp Limited and VPower Group and sales in FDG Electric Vehicles.

Yongsheng Advanced Materials, a polyester filament yarns manufacturer and dyeing services provider, bought back for the first time since listing in November 2013 with 3 million shares bought on May 18 at HK$2.35 each.

The trade was made on the back of the 44 per cent rise in its share price since February from HK$1.63. The stock is also up since September 2015 from HK$1.32. The group’s buy-back price was higher than its initial public offering (IPO) price of HK$1.18. The company announced its annual results on March 26 with profit up by 16.4 per cent to RMB 92.1 million (US$14.41 million). The stock closed at HK$3.02 on Friday.

Commercial property developer China New City Commercial Development resumed buying back after the stock fell by as much as 74 per cent from its acquisition prices in May 2016 with 9.8 million shares bought from May 17 to 18 at HK$1.42 to HK$1.14 each, or an average of HK$1.25.

The trades accounted for 22 per cent of the stock’s trading volume. The group previously acquired 1.9 million shares in May 2016 at HK$4.32 to HK$4.12 each or an average of HK$4.22 each.

The repurchases since May 2016 are the company’s first buy-backs since listing in July 2014. Its last buy-back prices were near the IPO price of HK$1.30.

China New City announced its annual results on March 21 with profit up by 232 per cent to RMB 488.5 million. The stock closed at HK$1.39 on Friday.

CEO Chen Lip Keong recorded his first on-market trades in hotel and casino operator NagaCorp Limited since July 2015 with 12.95 million shares bought from May 23 to 25 at HK$7.34 to HK$7.02 each or an average of HK$7.09 each.

The trades, which accounted for 29 per cent of the stock’s trading volume, increased his holdings to 2.852 billion shares or 65.72 per cent of the issued capital. The purchases were made on the back of the 122 per cent rebound in the share price since June 2017 from HK$3.31.

He previously bought 7.15 million shares in July 2015 at HK$5.19 to HK$5.98 each or an average of HK$5.46 each, 22.9 million shares from February to December 2009 at HK$0.56 to HK$0.84 each or an average of HK$0.70, and 7.8 million shares from January to October 2008 at HK$1.96 to HK$1.21 each or an average of HK$1.45. The stock closed at HK$7.04 on Friday.

Co-founder and chairman Lam Yee Chun recorded the first corporate shareholder trades in power generations systems provider and operator VPower Group since the stock was listed in November 2016 buying 1.15 million shares from May 17 to 23 at HK$3.41 to HK$3.65 each or an average of HK$3.47. The trades, which accounted for 23 per cent of the stock’s trading volume, increased his holdings to 1.808 billion shares or 70.59 per cent of the issued capital. The purchases were made after the stock fell by as much as 38 per cent from HK$5.47 in March.

Despite the fall in share price, the chairman’s purchase prices were above the IPO price of HK$2.88. The company announced its annual results on March 26 with net profit up by 49.2 per cent to HK$331.3 million. The stock closed at HK$3.46 on Friday.

Chairman and CEO Cao Zhong recorded his first on-market trades in vertically-integrated pure electric vehicle original equipment manufacturer FDG Electric Vehicles since his appointment in 2014 with 140.8 million shares sold from May 15 to 17 at HK$0.21 to HK$0.146 or an average of HK$0.166.

The trades, which accounted for 12 per cent of the stock’s trading volume, reduced his holdings to 8.374 billion shares or 37.36 per cent of the issued capital. The disposals were made after the stock fell by as much as 82 per cent from HK$0.83 in May 2015.

The sales were also made after the company issued a profit warning on May 5, largely due to an expected increase of over 130 per cent in its loss attributable to the shareholders for the year ended 31 March 2018. The group is expected to release its year-end results in the last week of June. The stock closed at HK$0.17 on Friday.