US memory chip maker Micron says Chinese officials visited its offices ‘seeking information’ in possible new trade war front

Local media reported that visits may have been sparked by concern about continued price increases for memory chips

Micron Technology Inc., the largest US maker of computer memory chips, said Chinese regulatory authority representatives visited its offices in that country, potentially opening another front in a growing trade dispute between the world’s two largest economies.

“Micron confirms that China’s State Administration for Market Regulation authorities visited Micron’s China sales offices on May 31 seeking certain information,” the Boise, Idaho-based company said in an emailed statement Friday. “Micron is cooperating with Chinese officials.”

ZTE sidelines two more senior executives amid negotiations

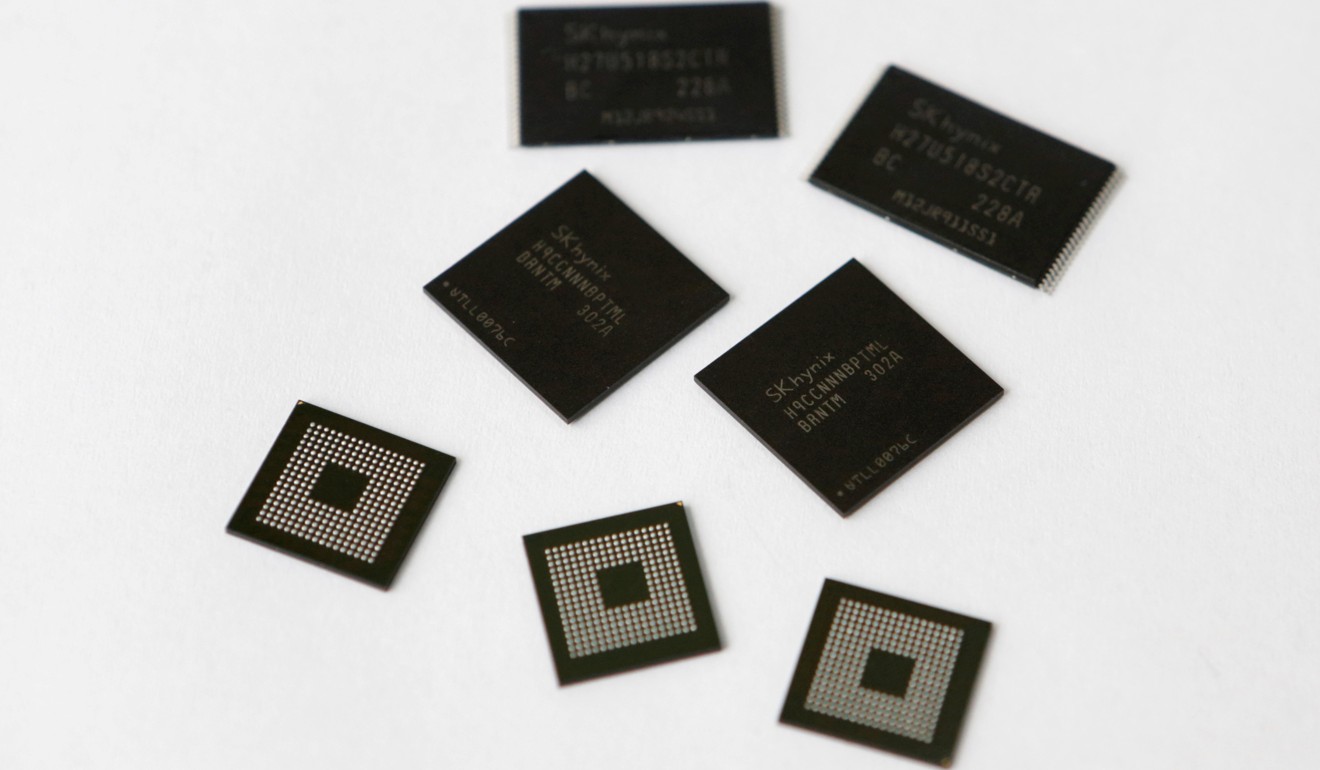

The memory chip market has been increasingly concentrated in the hands of Micron and its two Korean rivals, Samsung Electronics Co. and SK Hynix Inc. who have enjoyed record profits from the devices that are essential to everything from supercomputers to smartphones over the last year.

Chinese media reported that Samsung and SK Hynix also received visits from local regulators seeking information. Neither Korean company responded to requests for confirmation and comment.

Local media reported that visits may have been sparked by concern about continued price increases for memory chips.

Samsung projects rising Q4 income on China’s memory chips demand

Micron got about half of its sales from China last year, according to data compiled by Bloomberg.

China has been spending heavily on attempts to boost its domestic supply of semiconductors and lessen a bill that has exceeded the cost of oil imports.

China and the US are caught up in negotiations over the fate of ZTE Corp., China’s second-largest telecommunications equipment maker. The company has been banned from vital purchases of American technology after being caught violating sanctions against sales to Iran.

The moratorium has all but shuttered ZTE because it depends on US components – such as Qualcomm Inc. chips – to build its smartphones.

Why US sanctions on ZTE might be the best thing for China

Meanwhile San Diego-based Qualcomm, the world’s largest maker of phone chips, is waiting for approval of its acquisition of NXP Semiconductors NV from Chinese regulators. The deal was expected to be closed by the end of 2017.