Exclusive | Private equity group Warburg Pincus follows this golden rule when investing in China’s property market

Private equity fund Warburg Pincus has pursued a strategy of investing in specialised retail, logistics and data centres, while avoiding the residential sector

There is an old saying that “if you cannot beat your opponent, join them.”

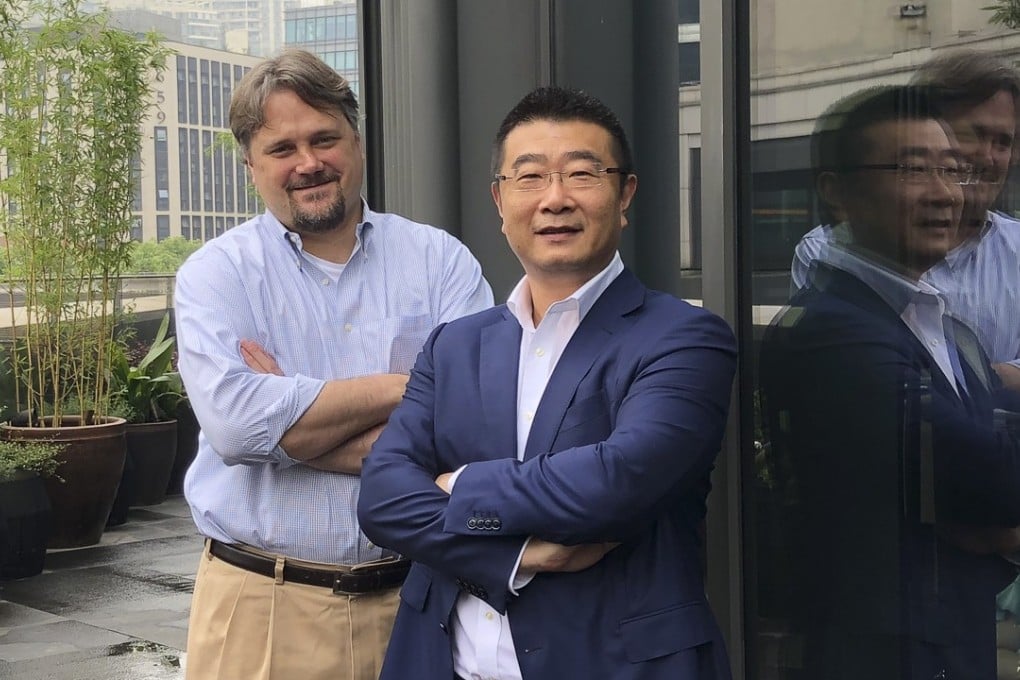

But Joseph Gagnon, managing director and head of Asia real estate at US private equity fund Warburg Pincus, opts for another alternative when investing in China: avoid direct competition with well established competitors.

And when it comes to China’s property market, that means steering clear of the residential sector, where nine of the 10 biggest listed real estate companies are focused, including Country Garden Holdings, China Vanke, and China Evergrande.

Gagnon said that it is too hard for foreign players to challenge these giants which, in some instances, have annual revenue of over 200 billion yuan (US$31.13 billion).

“Why fight the elephants?” said Gagnon, who joined Warburg Pincus in 2005 to head the firm’s real estate business in China and Asia.

“The traditional for-sale residential segment is a business that is hard for us to compete nowadays, though we did invest in some leading players such as R&F Properties and Greentown China Holdings more than 10 years ago. In recent years we have focused on subsectors which are out of residential, such as specialised retail, logistics and data centres.”