Li Shufu has a US$15 million dream for Geely’s London black taxis to ply the world’s city streets

London’s iconic black taxi, rescued from bankruptcy five years ago by China’s largest privately-owned carmaker, now occupies pride of place within the stable of its parent Zhejiang Geely Holding Group, in its three-decade journey from fridge maker to a leader in electric vehicles.

Assembled in a newly built factory five miles from its birthplace in Coventry in the British Midlands, the black cab now rolls off a refurbished plant that churns out 10 times more vehicles than before their takeover. A hybrid petrol-electric version is also being made half a world away in eastern China’s Yiwu, a city in Geely’s home province of Zhejiang.

“If you take this quintessentially London product and turn it into a zero emission, purpose-designed taxi, it can become a transport solution and a contributor to improving air quality in every major city across the globe,” said Chris Gubbey, chief executive of London Electric Vehicle (LEV), the Geely unit that now owns and operates the cab’s production. Geely’s founder Li Shufu wants to “bring the product to the new world and into the new generation,” he said in an interview with the South China Morning Post.

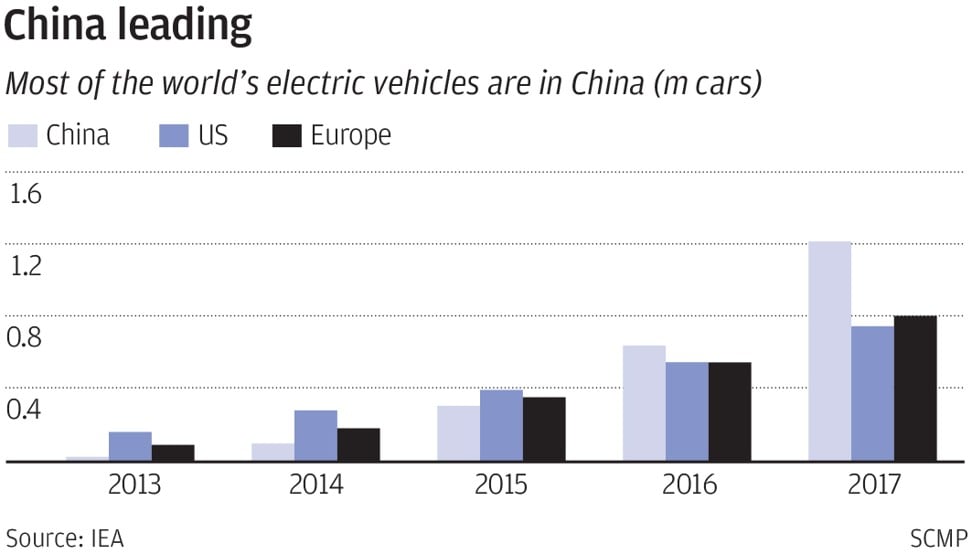

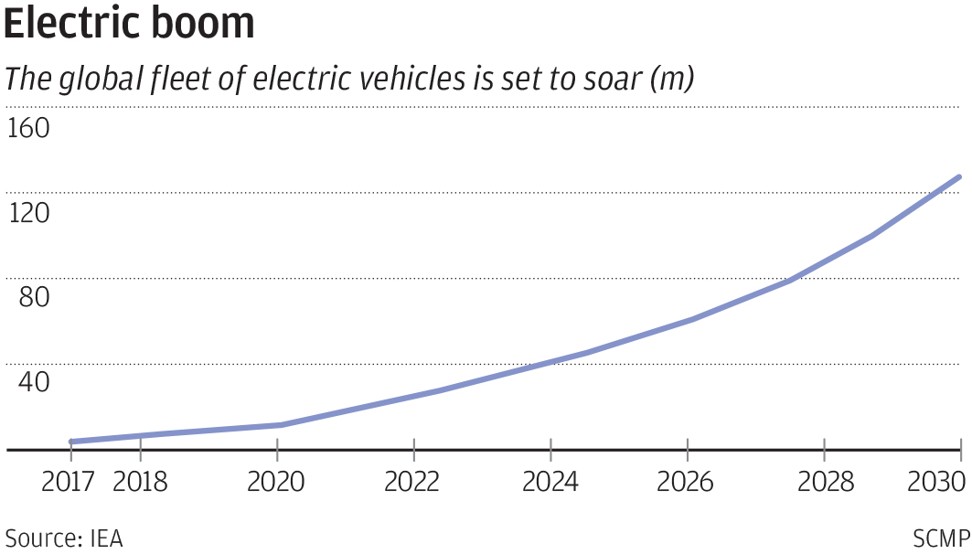

It’s the centrepiece in Geely’s portfolio comprising Volvo Cars of Sweden, Proton of Malaysia, and a 9.7 per cent stake in Germany’s Daimler. It’s a litmus test for Geely’s ambition to lead the world in electric vehicles, where Li – who started his career making refrigerators in 1986 before he assembled his first car, a Mercedes lookalike minicar in 2002 – promised in February that electric vehicles would make up 90 per cent of his company’s sales by 2020.

Geely paid £11 million (US$14.6 million) in 2013 for The London Taxi Company, followed by another £295 million to build a new factory with the annual capacity to assemble 20,000 vehicles, while another £30 million were invested to develop a commercial van.

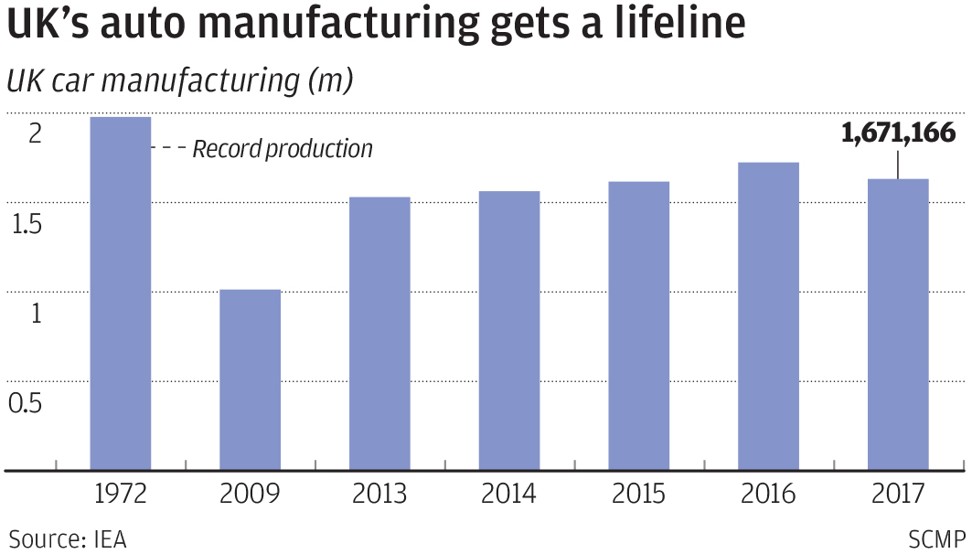

At 30,000 square metres, the plant is a minnow compared with Volkswagen’s showpiece in Wolfsburg, Germany, that can churn out 815,000 cars a year. Still, that is Britain’s first car factory in more than a decade, a reversal of fortune for an automotive industry that has all but been swallowed up by better-financed multinational brands.

Located at the Ansty Park industrial zone outside Coventry – the hub of what was once British motoring and the birthplace of marques such as Triumph, Jaguar and Daimler – the new investment expands the production 10-fold and doubles the staff size to 1,500 by 2020, making Geely one of the biggest employers in the city of 350,000 people.

To lead the endeavour, Geely hired Gubbey from Shenyang, where he was helping BMW assemble luxury cars in northeastern China.

The body of the TX hybrid electric taxi is made entirely of aluminium and composite panels. Gubbey said the company is increasing its output “week by week” to make up 80 per cent of the 21,300 taxis on London’s streets by 2020.

If just half of London’s fleet converts to TX, the city’s nitrogen oxide emissions could be cut by 4 per cent, he said. Its electric engine has a range of 70 miles (112 kilometres) with zero emissions, while a small petrol engine recharges the battery while on the road, yielding a total range of 400 miles before refuelling.

From the start of this year, London will only grant new taxi licences to “zero emission capable” vehicles. New zero emission capable taxis buyers are entitled to £7,500 in government grant to offset their costs, while owners of taxis 10 to 15 years old are offered up to £5,000 to take them off the road.

It is part of measures to help the city reach a goal for all taxis to be zero emission capable by 2033 and have the entire city become a zero emission zone by 2050.

Meanwhile, work began last month on a 7.2 billion yuan (US$1.1 billion) factory in Yiwu with the capacity for 100,000 electric vehicles a year. The Yiwu model, a variant of the black taxi, will be modified and adapted to Chinese preferences and tastes to serve a niche segment of premium ride-hailing services in China.

“Chinese taxi companies bought these models for the added [headroom] that catered to elderly passengers,” said IHS Markit’s automotive analyst Lin Huaibin. “This will probably continue to be the best source of demand in future.”

The model is also being exported. After an order last year for 225 TXs to the Netherlands and a partnership deal to sell in Scandinavia, the taxis are headed for sale in Germany, Gubbey said. He also aims to sell outside Europe next year, especially in right-hand-drive markets, including Hong Kong where it has had some discussions on potentially supplying to premium taxi service operators.

The UK’s impending exit from the European Union could post challenges for exports to the region, which bought 53.9 per cent of UK-assembled vehicles last year.

“Being out of the customs union and the single market will inevitably add barriers to trade, increase red tape and costs,” said Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders (SMMT) in March.

Li, who turns 55 next week, has a knack in picking up struggling companies in developed nations that had many decades of brand heritage and engineering expertise behind them – in the cases of Volvo Cars and the London cab’s previous owner Manganese Bronze – and integrating them into his China business.

Volvo Cars posted a record operating profit last year of 14.1 billion Swedish kronas (US$1.6 billion) with sales of 571,577 units, from a 2009 pre-tax loss of US$653 million before Geely’s takeover.

Volvo Cars last year bought 30 per cent of Geely’s new Lynk & Co car brand, with which is shares a set of common design, engineering and manufacturing efforts through the creation a joint venture.

It also announced mid last year that every car it produces from 2019 will be partially or completely battery-powered, ending production of solely combustion engine-powered cars.

It was the first major manufacturer to make such a bold move, which went hand in hand with Hong Kong-listed sister firm Geely Automobile Holdings’ plan unveiled in 2015 to have 90 per cent of sales coming from pure electric or battery and combustion engine hybrid ones by 2020.

“He wanted to bring the product to the new world and into the new generation,” Gubbey said. “Within the Geely family, we have the main experience behind the taxi which has been transported back to the family.”