More Chinese unicorns prefer to raise capital in Hong Kong than any other market, survey shows

Four of every 10 so-called unicorns picked Hong Kong as the preferred market for an IPO, according to a PwC survey of 101 of these companies, each with at least US$1 billion in valuation

Hong Kong stands out as the preferred market for raising capital among China’s most valuable companies, according to a survey that vindicates last year’s overhaul in the city’s stock listing rules.

US stock markets come in second at 25 per cent, followed by China’s yuan-denominated A-share market in third place with 23 per cent, according to the survey of C-suite executives including founders and chairmen.

“Hong Kong is the preferred capital market partly due to the latest tweaks in its listing measures, including the support for biotechnology companies and dual-class structures, reflecting the determination to embrace the new economy by the stock exchange,” said Gao Jianbin, PwC’s leader for China technology, media and telecommunications leader, in Shanghai.

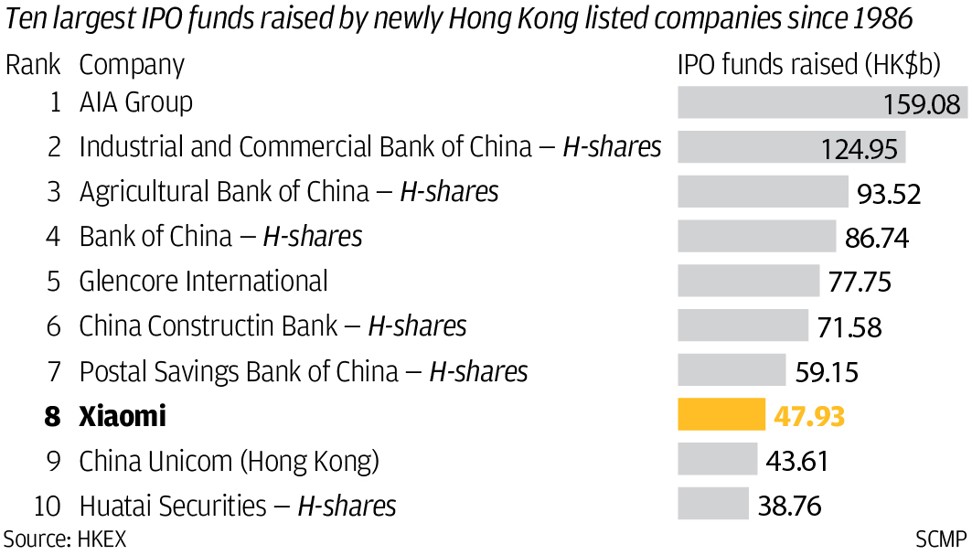

The survey is the latest vindication for Hong Kong Exchanges and Clearing (HKEX), which last year pushed through a controversial overhaul of the city’s listing regulations along with the securities regulator. The amendments, the most extensive in three decades, were to help the bourse regain its pole position as the world’s largest market for fundraising, after losing the 2017 crown to New York, Shanghai and Shenzhen.

The changes have paid off, as the exchange awaits the US$6.1 billion listing next week by Xiaomi the world’s fourth-largest smartphone maker. Meituan-Dianping, the world’s fourth-most valuable technology start-up at US$60 billion, is also filing to raise funds in the city.

The flurry of new listings this year will help Hong Kong claw its way back to the top three spots in global IPO rankings, from the fifth rank during the first half, PWC’s rival Deloitte said earlier.

To compete, China’s securities regulator has shown that it can fast track IPO applicants in a matter of days, instead of the typical two-year wait. The China Securities Regulatory Commission (CSRC) is also rolling out a class of Chinese depositary receipts (CDRs) to allow domestic investors to partake in the offshore listings of Chinese companies, opening up an additional avenue to raise capital.

Still, some unicorns will wait and see the results of real listings before making the decision to jump into the CDR fray, Gao said. Xiaomi, which was supposed to be the pioneer for the CDR programme, last week postponed its CDR plan, marking a setback for the Chinese government’s overtures.

Hong Kong also enjoys the advantage of being an established capital market and global financial centre, complete with transparent and predictable procedures and rule of law, Gao said.

The survey found that 64 per cent of the companies have a listing plan in the next two years and 21 per cent called it an urgent task. About 75 per cent of the respondents have been running business for less than eight years while the remaining ones have been in operation within four years.

In the survey, unicorn companies listed talents drainage and disruption on capital chain as the two biggest potential challenges or crisis they are concerned about.

HKEX is itself a publicly listed company, its stock rising by almost 19 per cent in the past 12 months.