HSBC joins the fray for online payments with PayMe app for Hong Kong’s TV shopping service

But analysts say deal might not lead to profits immediately

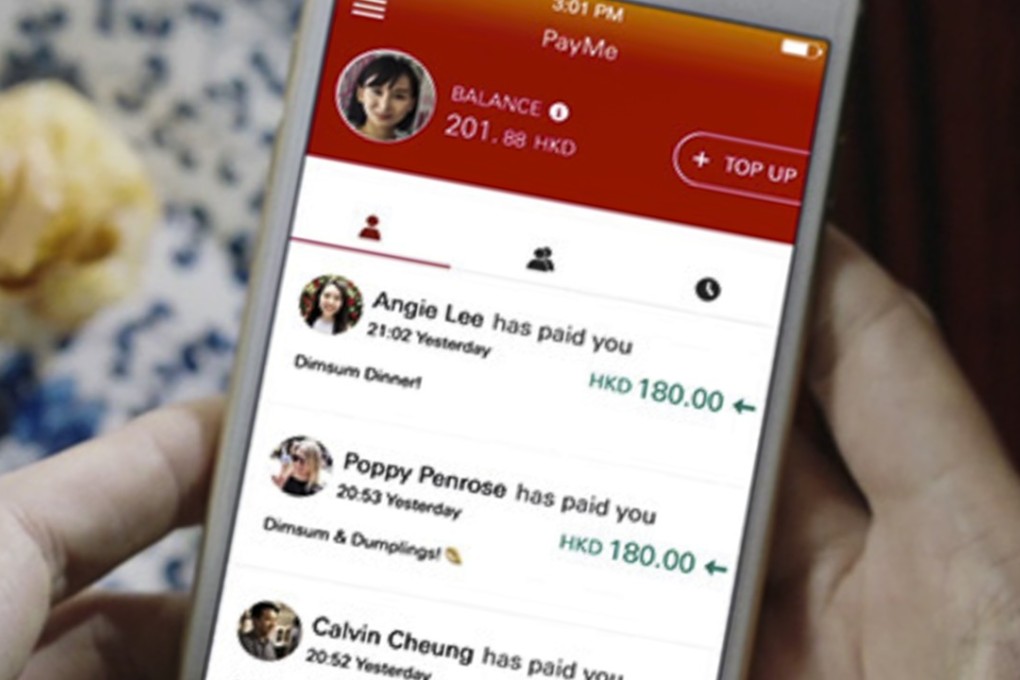

Users of PayMe, HSBC’s mobile payments app, will be able to use it on e-commerce platform HKTVmall this week, Hong Kong’s biggest bank announced on Monday.

The partnership with HKTVmall, which features more than 3,000 retailers selling everything from instant noodles to durians to restaurant and holiday coupons, marks HSBC’s first foray into online payments. But while the deal will benefit both parties, analysts said it might not lead to profits immediately.

It is a good first step for HSBC in the mobile payments market

“It is a good first step for HSBC in the mobile payments market. It might also help HKTVmall to further narrow down its losses,” said Louis Tse Ming-kwong, managing director at Hong Kong-based VC Wealth Management.

“Both companies, however, might need to invest in mobile payments infrastructure and promote [their services]. HSBC’s PayMe app will also need to compete with other mobile payment operators, such as Alipay. This is going to be a long-term battle and it will take time to see who will be the ultimate winner,” said Tse.

Launched last year, PayMe is used mainly to transfer small amounts of money for settling restaurant bills among friends, or for laisee.