JPMorgan goes on a hiring spree to retool its China banking team for serving technology unicorns

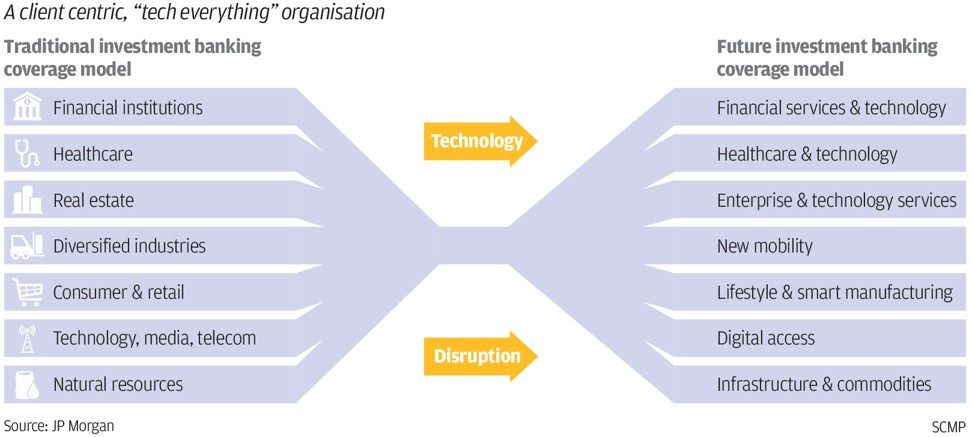

The reorganised China team will expand its workforce by up to 50 per cent, dividing the structure into seven new sectors: financial services and technology, health care and technology, enterprise and technology services, new mobility, lifestyle and smart manufacturing, digital access, and infrastructure and commodities

JPMorgan Chase & Co. said it’ll go on a hiring spree over the next three years, as it reorganises its China investment banking team into additional categories to serve so-called new economy companies that are expected to raise up to US$200 billion in capital over the next few years.

“The new economy in China is newer than, and very different from, many economies in the West,” said the bank’s co-head of Asia-Pacific investment banking Murli Maiya, aiming to turn the team into a “tech-everything” organisation. “In three to four years, our bankers would be obsolete, as our clients change in a way they can’t understand, so we have to force the change here. ”

The hiring also forms part of its plan to build a securities business onshore in China, once it is approved by local regulators. In May, the bank applied for approval to set up a majority-owned securities company in China.

The reorganisation of its China team, which began earlier this month, will expand its workforce by between 40 per cent and 50 per cent, while dividing the current structure into seven new sectors, comprising financial services and technology, health care and technology, enterprise and technology services, new mobility, lifestyle and smart manufacturing, digital access, and infrastructure and commodities.

The mainland, home to more than 160 unicorns, or start-ups with at least US$1 billion in valuation, is the main reason the bank is retooling its China team. The bank expects these unicorns to need to raise about US$200 billion through initial public offerings and private market placements in the next three years, said the bank’s China investment banking head Houston Huang.

“The old industry structure has become increasingly inefficient to cope with our business needs in China’s changing economic dynamics,” Huang said, adding that he wants the team to have a “tech DNA.”

“China is a leading player in the world unicorn race and the speed of growth is unprecedented, so we have to find a way to better serve the growing number of clients representing China’s new economy,” he said.

He added that they will hire more graduates in science, technology, engineering and mathematics (STEM) subjects, which are considered the key to China’s economic future.

Maiya said the new approach in China could potentially disrupt the 200-year tradition of Wall Street investment banking practise and set a test case for the world.

“Everywhere in the world, people are looking at what we do in China, because they want to see what’s happening. It could be a template of what we do in banking,” he said.

.