Xiaomi’s value cut by almost half as smartphone maker prices IPO at the lower end of the price range

Xiaomi, which was billed as the world’s largest technology fundraising this year, has had to pare back its fundraising ambitions further as it priced its shares at the lower end of a price range, trimming its IPO size by nearly a quarter to HK$37 billion (US$4.7 billion).

The Beijing-based smartphone maker priced its stock at HK$17 per share, the lower end of the price range of HK$17 to HK$22, according to several bankers familiar with the matter. That would value the eight-year old company founded by Lei Jun at US$54 billion, about half of the US$100 billion sought.

Trading of Xiaomi’s shares will commence on July 9 on the main board of the Hong Kong stock exchange.

The company started taking orders from institutional investors last week, with three of China’s richest tycoons - Li Ka-shing, Jack Ma Yun, and Pony Ma Huateng - pouring in their personal fortunes to back the firm. Li, the former chairman of Hong Kong’s largest conglomerate CK Hutchison Holdings, bought US$30 million of Xiaomi’s shares, said his company’s co-managing director Canning Fok Kin-ning.

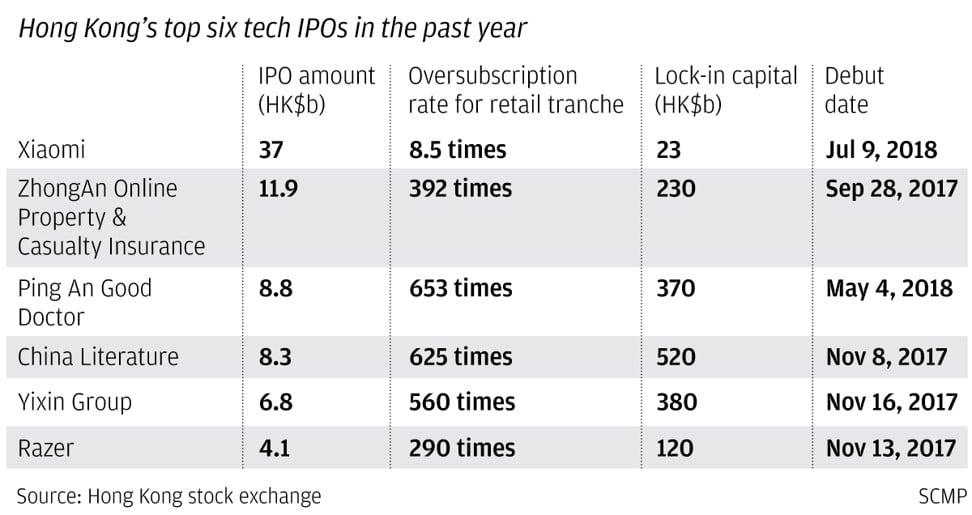

On the retail front, the company received 109,446 applications for 1.03 billion shares at the end of a four-day offer period, with the retail portion overbought by 8.5 times, compared with 109 million shares available in the tranche. It has locked up about HK$23 billion of capital.

Brokers said the retail response is “not that bad” given the size of the offering, and considering that the cost of funds measured by Hong Kong’s interbank offered rate had soared to a decade high. But it’s a stark contrast to the frenzy seen in the city’s smaller stock offers, like the 625 times oversubscription rate received in China Literature’s US$1.45 billion offer, which locked up more than HK$520 billion of capital, equivalent to a third of Hong Kong’s money supply.

ZhongAn and the four biggest tech listings since then – e-publisher China Literature, online car retailer Yixin Group, gaming hardware maker Razer and Ping An Good Doctor – all attracted enormous oversubscriptions and locked in huge amounts of capital.

Online health care platform Ping An Good Doctor’s IPO was oversubscribed by more than 650 times, while Yixin’s offer was 560 times overbought.

The frenzy has fizzled out. Of the 87 companies that raised funds in the city this year, 53 per cent of the total traded at prices below their offering prices in their first month of trading, according to Bloomberg data. And 20 companies fell below their offering prices on their trading debut.

Xiaomi’s seven cornerstone investors, who will lock up the shares for six months, have agreed to acquire US$548 million worth of shares, according to the prospectus.

US chip maker Qualcomm has committed US$100 million, the only foreign company among the cornerstone investors. China Mobile, the country’s biggest telecom operator, will also invest US$100 million in Xiaomi.

CICFH Entertainment, a state-backed industrial fund, will be the biggest cornerstone investor with an input of US$192 million.

Xiaomi plans to use 30 per cent of the proceeds for research and development, 30 per cent to expand and strengthen its capability in the so-called internet of things, 30 per cent for global expansion, and the rest for working capital and other corporate purposes.