Beware the bear as US-China trade war looms over Hong Kong stocks

With Washington set to impose tariffs worth US$34 billion on Chinese goods by as early as the end of the week, and with Beijing set to retaliate, investors face a rough ride

Hong Kong investors are bracing for a rough ride on the city’s stock market as the countdown starts to a possible trade war between the US and China, with Washington set to announce tariffs worth US$34 billion on Chinese goods by as early as the end of the week.

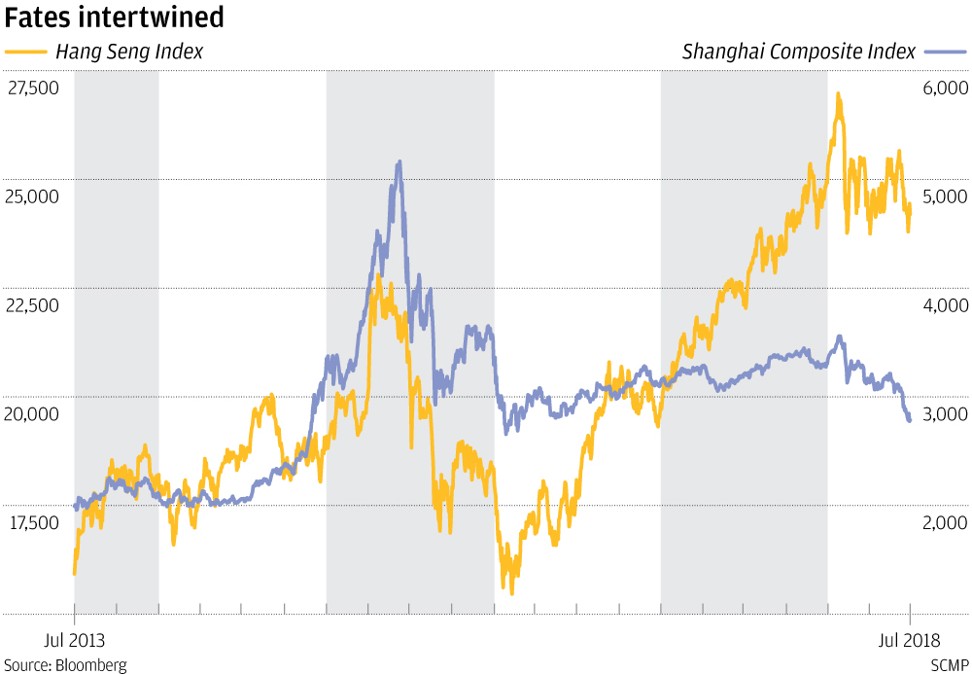

The Hang Seng Index closed 1.4 per cent, or 409.54 points, lower at 28,545.57 on Tuesday, recovering some ground after falling as much as 3.3 per cent earlier in the session, but is still its lowest level in nine months. It is now just 7 per cent from officially being a bear market.

The index had risen 36 per cent in 2017, making it the best performer among major global bourses.

The Shanghai Composite Index fell as much as 1.9 per cent before ending the day up 0.4 per cent at 2,786.89. It has lost 16 per cent this year and is the worst-performing index among the world’s major markets. It officially became a bear market last week.

China stocks tumble, pushing equity valuations below 2015 lows

Reassuring comments from Chinese central bank governor Yi Gang, implying that the bank may intervene to stabilise the yuan currency, restored a small measure of confidence across the markets.

But with Beijing promising to retaliate if the US tariffs go into effect, Hong Kong stocks would be caught in the crossfire and could join mainland bourses in a bear market, pulling the Hang Seng Index further away from the record highs set in January.

“Even though so far China’s response has been rather mild, many investors seem to worry it is the calm before the storm,” said Karine Hirn, a Hong Kong-based partner at East Capital Asset Management, which has US$4 billion of assets under management.

Hong Kong officials have previously warned of the impact of a trade war on the city, which is mainland China’s third-largest trading partner and which counts the US as its second-largest export market. The tensions have been weighing on stocks for some weeks.

“The bull run on Hong Kong stocks has already peaked and there will be a downside in the second half of the year,” said Cliff Zhao, chief strategist at CCB International Securities in Hong Kong.

“A small rebound would probably be seen in July and August, but that will not change the overall trend.”

Yuan falls for 14th straight day to lowest level since August

Adding to the gloom in markets are signs that the mainland Chinese economy may be losing some momentum, with an index of manufacturing for June coming in weaker than expected. At the same time, the authorities are still pursuing a campaign to crack down on the amount of loose credit in the economy, squeezing companies’ financing options.