Investment bankers are quitting Goldman, Citigroup for biotech riches in Hong Kong

Investment bankers in Hong Kong are catching biotech fever.

At least seven senior bankers and analysts from top-tier securities firms have quit to join biotechnology companies in the city since December, responding to the industry’s growing demand for financial expertise after rule changes at Hong Kong’s stock exchange smoothed the path for biotech initial public offerings.

Richard Yeh, a health care analyst at Goldman Sachs, emerged as the latest example after people familiar with matter said last week he was to join CStone Pharmaceuticals as chief financial officer. Firms including Lazard, Bank of America, Deutsche Bank, Citigroup and Jefferies Group have all seen similar departures in recent months.

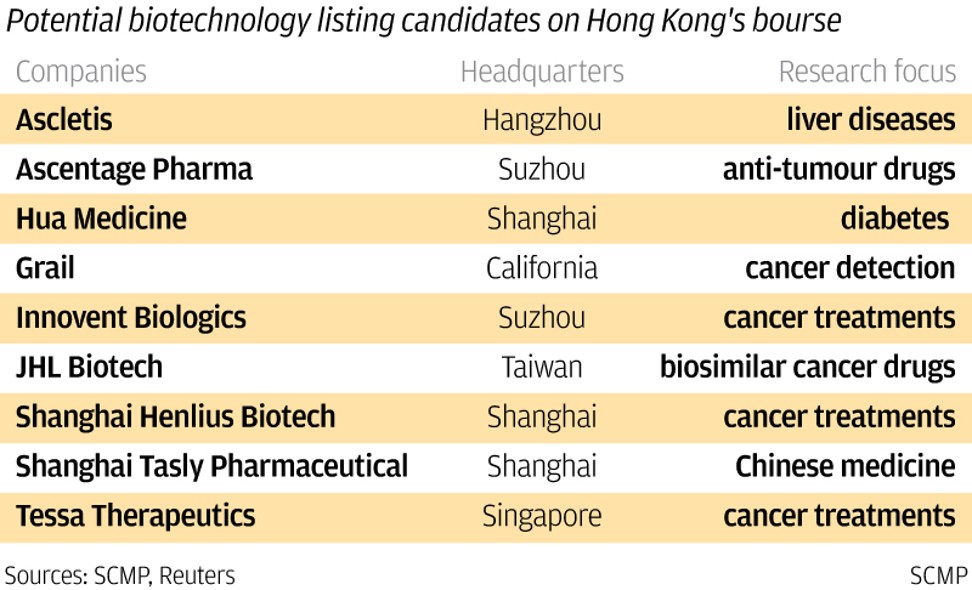

Like their predecessors in the 1990s internet boom and the more recent cryptocurrency gold rush, financiers in Hong Kong are joining the hot start-ups of the moment in hopes of hitting the stock-option jackpot. At least 16 biotech firms are pursuing IPOs in the former British colony, seeking to raise upwards of US$3 billion, according to company filings and people familiar with the matter.

“During the dot-com era, everybody wanted to go into one of the internet start-up companies because it was the new thing, it was exciting, with the possibility to make a lot of money if the company made it to an IPO,’’ said Stephen Peepels, a capital markets lawyer at Hogan Lovells in Hong Kong. “I think it is analogous to the health care industry in Hong Kong right now.”

While smaller biotech companies are attracting capital around the world, fundraising activity in Hong Kong is shifting into overdrive after an April decision by the city’s exchange to allow IPOs of unprofitable biotech businesses -- part of the biggest shake-up of the bourse’s listing rules in two decades.

“We are seeing a very good level of interest from quality issuers and we expect a healthy pipeline for the next couple years,” said David Lau, head of Hong Kong investment banking at JPMorgan Chase & Co.

JHL Biotech, which hired former Bank of America deal makers Ellis Chu and Lee Henely in May, is among firms lining up to sell shares in the city, people with knowledge of the matter said. The developer of cheaper alternative cancer drugs plans to raise about US$350 million in an IPO next year, said one of the people, who asked not to be identified because the details are private.

“I’m getting in on a sector where I see huge potential,” Chu said in a phone interview. “Biotech is an industry that’s exploding, yet still in its infancy in China. There are all sorts of tailwinds.”

Of course, biotech start-ups are notoriously risky and it’s anyone’s guess which of the new crop of upcoming Hong Kong IPOs will prove successful over the long haul. But for those who join winners, the payday can be huge, said John Mullally, a director handling financial services recruitment at Robert Walters in Hong Kong.

“If you’re getting in at an early enough stage, these start-ups are going to reward you with a certain amount of equity,” he said. “The upside could be innumerable.’’