Xiaomi shares fall after mainland bourses block them from Chinese investors in Stock Connect pool

Xiaomi’s shares fell on the Hong Kong exchange, reversing four consecutive days of advances, as the smartphone maker found itself caught in a turf war between the local bourse and mainland exchanges in their race to be Asia’s fundraising hub for technology companies.

Shares of the Beijing-based company ended Monday’s trading down by 1.9 per cent, after starting the day with a 9.6 per cent tumble. The stock had risen for four straight days last week, and was just short of the HK$22 that Xiaomi had sought for in its initial public offering last month.

In a weekend announcement, the Shanghai and Shenzhen exchanges unexpectedly put a temporary halt on accepting Xiaomi into the pool of eligible shares under the southward tranche of the Stock Connect programmes. That means mainland Chinese investors would not be able to buy or sell Xiaomi’s Hong Kong-listed shares under the cross-boundary investment channel.

At issue is the inclusion of companies with weighted voting rights (WVRs), or multiple classes of stocks, among the 484 members of the Hang Seng Composite Index.

Xiaomi, the first WVR stock to be listed in Hong Kong after last year’s overhaul of listing regulations to encourage technology start-ups and new economy companies to raise capital in the city, is scheduled to be included in the index on July 23.

Instead, the rug was unexpectedly pulled from under Xiaomi by Chinese regulators, who have yet to allow WVRs to list in Shanghai or Shenzhen, and have so far failed to get their Chinese depositary receipts (CDRs) off the ground.

The Chinese regulator wants to “stop the WVRs and instead promote the depositary receipts,” said Louis Tse Ming-Kwong, managing director of VC Asset Management in Hong Kong. “The new economy stocks listed in Hong Kong will be a global trend, but at this juncture, the Chinese regulator doesn’t want Chinese investors to lose money in Hong Kong.”

Unlike mainland exchanges, stock prices in Hong Kong aren’t tampered by circuit breakers that halt declines or surges at 10 per cent, which make for a wild ride for inexperienced investors. Furthermore, Chinese authorities are wary about reopening the flood gate for the yuan to take flight, especially when the domestic stock and currency markets are slumping from the trade war with the US, Tse said.

The stakes are high for the exchange operators, particularly since HKEX is itself a publicly listed company.

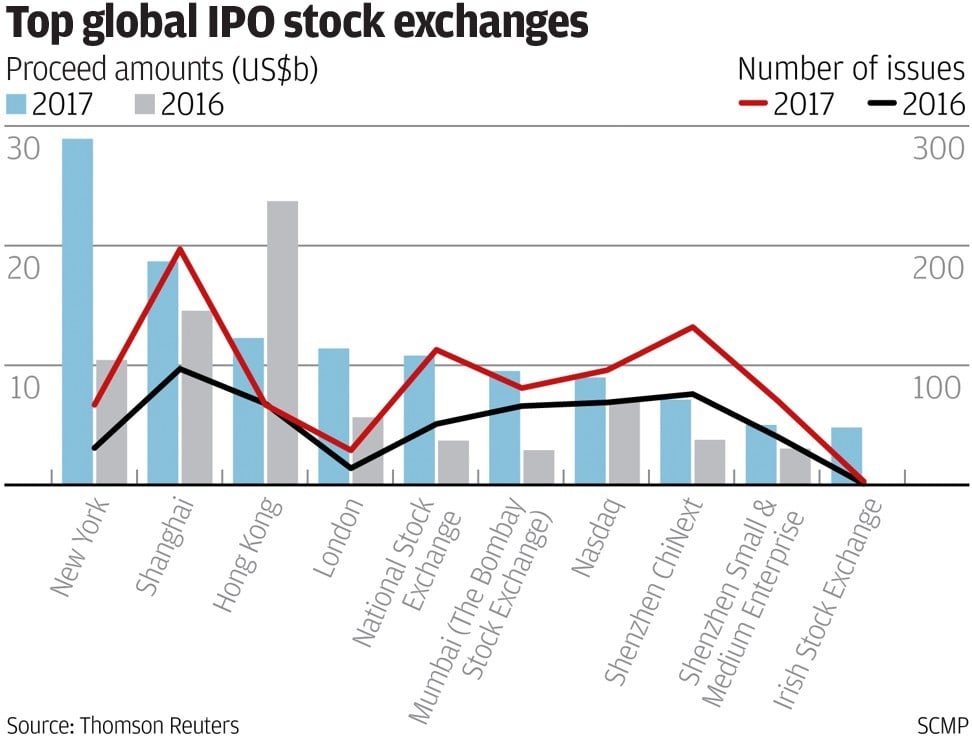

Hong Kong was surpassed by Shanghai for the first time last year in global IPO rankings, losing the top spot to New York and falling to third place.

Since then, the HKEX and the Securities and Futures Commission (SFC) have pushed through the largest overhaul of listing regulations in three decades to allow tech and biotech companies to raise capital in the city.

To compete, China’s regulator pulled out all stops to attract technology companies, approving their listings in days, as opposed to the usual two-year wait for non-technology listings to get regulatory clearance. The regulator also created CDRs for Chinese investors to partake in the earnings of the country’s biggest overseas-listed tech companies, like New York-listed Alibaba Group Holdings, and Xiaomi in Hong Kong.

“Prior to the listing of the first company with WVRs in Hong Kong, [the market operator] tried to reach a consensus with the mainland exchanges on the inclusion of the companies in the list of eligible securities” for mainland Chinese investors to buy and sell in, HKEX said. “HKEX will continue to maintain close communications with the mainland regulators and exchanges with an aim to confirm the timetable to including WVR companies [in the eligible list] and to provide mainland investors with a convenient channel to invest in new economy companies.”

“For Xiaomi or any other Chinese companies listed in Hong Kong, Chinese investors will already have accounts in Chinese or local brokerages,” Tse said. “From time to time there is intervention [from the mainland], but it is not a bad omen for any new shares listed in Hong Kong, or for the market as a whole.”