HNA Group reshuffles managers as it unwinds its asset acquisition spree after co-founder’s death

HNA revamps management as unwinding from aggressive investment

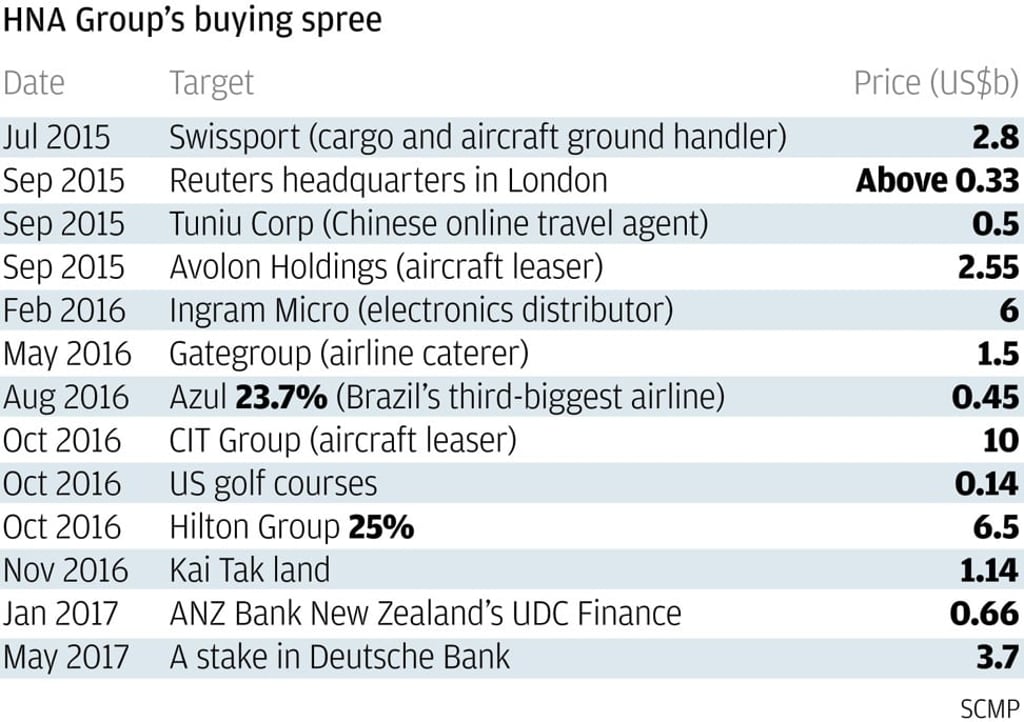

HNA Group, one of China’s largest global asset buyers of the past five years, has reshuffled its senior management team following the death of a co-founder, as it continues a process of unwinding its acquisitive business strategy to align with Chinese government priorities.

The company, which owns a range of assets from China’s fourth-largest airline to hotels, promoted Chief Executive Officer Adam Tan Xiangdong to chairman of the group’s overseas unit HNA International, a position left vacant by the demise early last month of Wang Jian. Tan, 51, will continue as CEO of HNA Group.

Wang was HNA’s de facto top decision maker before he died on July 3 from an accident during a business trip to France. After his passing, HNA’s co-founder Chen Feng was named group chairman.

“These changes will help us meet our commitment to refocus around our core aviation and tourism and logistics businesses,” Chen said in a press release.

Several other promotions and appointments were made in the group. Chen Chao was named executive chairman of HNA International and chief investment officer of HNA Group, succeeding Wang Shuang.