Apple becomes first US publicly traded company to hit US$1 trillion in market valuation

But the company could lose its capitalisation lead to the likes of Alphabet or Amazon.com if it does not develop a major new product or service

Apple became the first publicly-listed US company worth US$1 trillion on Thursday, crowning a decade-long rise fueled by its ubiquitous iPhone that helped transform it from a niche player in personal computers into a global powerhouse spanning entertainment and communications.

Apple hit the US$1 trillion mark when its shares reached US$207.04 around midday in New York. They rose to an all-time high of US$208.38 before falling back slightly. The shares are up around 23 per cent so far this year.

The achievement seemed unimaginable in 1997 when Apple teetered on the edge of bankruptcy, with its stock trading for less than US$1, on a split-adjusted basis, and its market value dropping below US$2 billion.

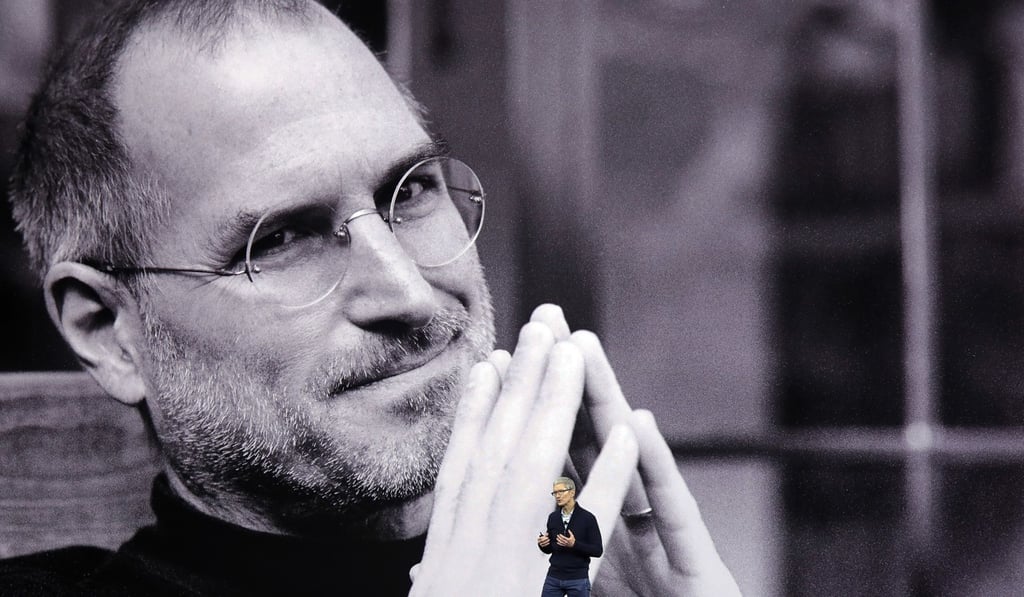

To survive, Apple brought back its once-exiled co-founder, Steve Jobs, and turned to its archrival Microsoft for a US$150 million cash infusion to help pay its bills.

Since then, it has changed how consumers connect with one another and how businesses conduct daily commerce. Jobs eventually introduced popular products, such as the iPod and iPhone, that subsequently drove Apple’s rise.