Directors snap up shares in energy and textile companies; Link Reit continues its share buy-backs

Insider share trading activity fell for a third straight week, as is consistent with rules that prohibit director trading ahead of earnings results

Heavy acquisitions were seen in the energy and textile sectors in a sluggish week for director purchases and buy-backs due to the onset of the reporting season, according to filings with the Hong Kong stock exchange last week.

Directors of energy stocks have good reason to be bullish as the crude oil price has gained nearly 50 per cent from a year earlier.

Crude oil explorer and producer IDG Energy Investment Group acquired 43.5 million shares from July 10 to August 2 at an average of HK$1.18 each in its first buy-back since 2001, when it snapped up 800,000 shares from March to April at an average of 24 HK cents each.

The latest trades, which accounted for 51 per cent of the stock’s trading volume, were made after the stock fell as much as 64 per cent from November 2016.

Shares in IDG Energy closed at HK$1.22 on Friday.

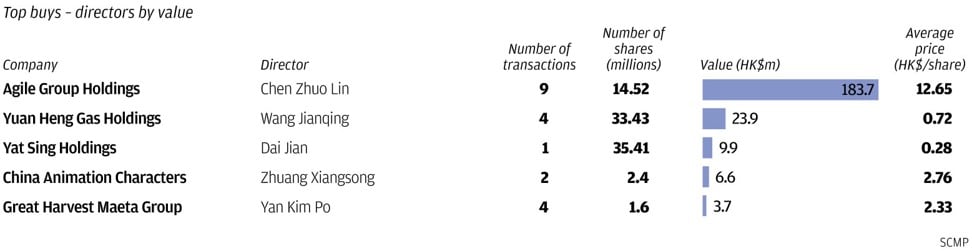

At Yuan Heng Gas Holdings, an oil and gas trader, chairman and chief executive Wang Jianqing bought 33.4 million shares from July 27 to 30 at an average of 72 HK cents each, picking up where he left off in September last year when he acquired 235.8 million shares at an average of 63 HK cents each.

The latest trades, which accounted for 84 per cent of the stock’s trading volume, increased his holdings to 55.66 per cent of the issued capital. They were made on the back of the 26 per cent drop in the share price since January.

His purchases last year were also made after a sharp fall in the share price – of 19 per cent since February. The trades proved timely as the stock rebounded to 96 HK cents in January this year.

In June, the company announced a profit of 212.42 million yuan (US$31.09 million) for the year to March, a turnaround from a year earlier when it reported a loss of 91.33 million yuan.

Shares in Yuan Heng closed at 71 HK cents on Friday.

On the flip side, directors of textile stocks have moved in to support the share prices of their battered companies due to the escalating trade war between the United States and China.

The most significant deal came from intimate and sports apparel manufacturer Regina Miracle International, where executive director Liu Zhenqiang bought 200,000 shares, or 0.01 per cent of the issued capital, on July 31 at HK$6.27 each in his first on-market trade since his appointment in June 2015.

The trade was made on the back of the 42 per cent drop in the share price since September 2016 from HK$10.82.

Earlier in the month, executive director Antony Yiu Kar-chun acquired 192,000 shares, or 0.01 per cent of the issued capital, from July 3 to 4 at an average of HK$5.89 each, also marking his first trade in the company since he was appointed to his post in June 2015.

Directors have good reason to be bullish as the company reported in June a 146 per cent gain in annual profit to HK$240.19 million (US$30.61 million)

Shares in Regina Miracle closed at HK$6 on Friday.

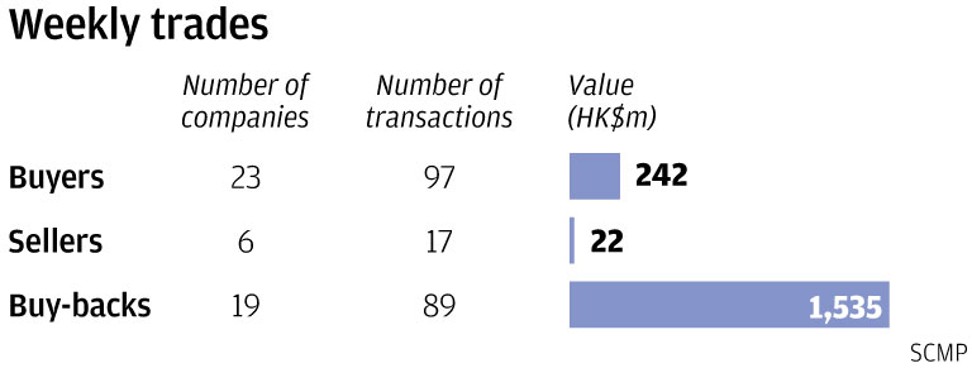

In the broader market, insider activity fell for the third consecutive week as director purchases and buy-backs are prohibited one to two months before the announcement of earnings results.

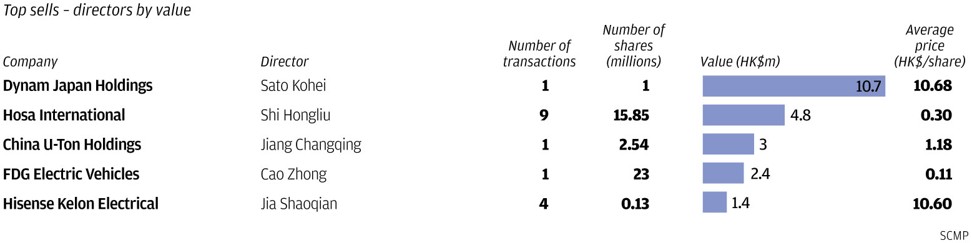

Based on filings with the exchange last week, 23 companies recorded purchases worth HK$242 million, down from 52 firms and HK$720 million in deal value in the previous week.

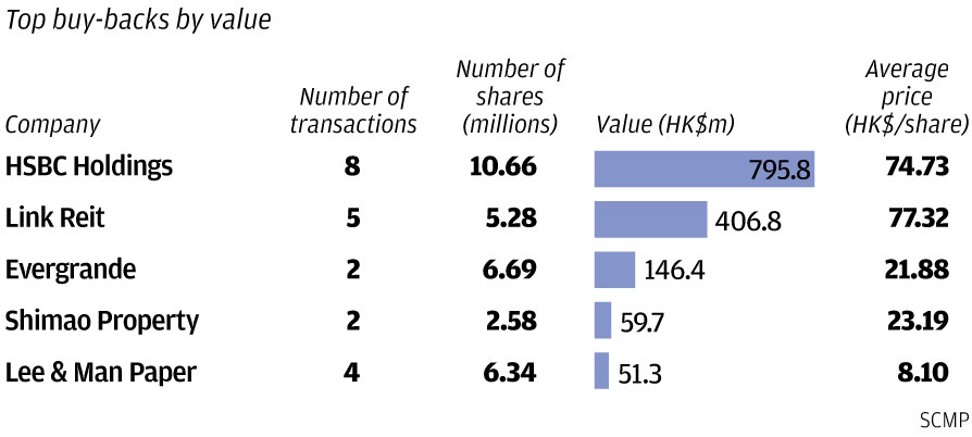

In the buy-back front, HK$1.54 billion worth of deals were filed by 19 companies last week, compared with HK$2.35 billion of trades from 36 firms previously.

Among the deals that stood out were those by Link Real Estate Investment Trust, a retail and car park operator, which bought 16.7 million units from July 5 to August 2 at an average of HK$75.30 each after the trust rose as much as 20 per cent from its acquisition prices earlier this year.

The trades, which accounted for 17 per cent of the trust’s trading volume, came after the group acquired 35.5 million units from January 15 to March 23 at an average of HK$68.53 each.

The reits latest buy-backs have pushed its total repurchases this year to nearly HK$4 billion and helped bolster the stock, which has gained 3.6 per cent so far this year, compared with the 7.5 per cent decline in the Hang Seng Index.

That bullishness is due to strong earnings, which some community groups have criticised as contributing to higher prices of retail goods in the poorest parts of the city.

Shares in Link Reit closed at HK$75.05 on Friday.

Robert Halili is managing director of Asia Insider