Access to funding is holding Hong Kong back as a start-up hub as Singapore takes the lead

This despite the HK authorities launching a US$255m fund last September to encourage investment in local innovation and technology start-ups

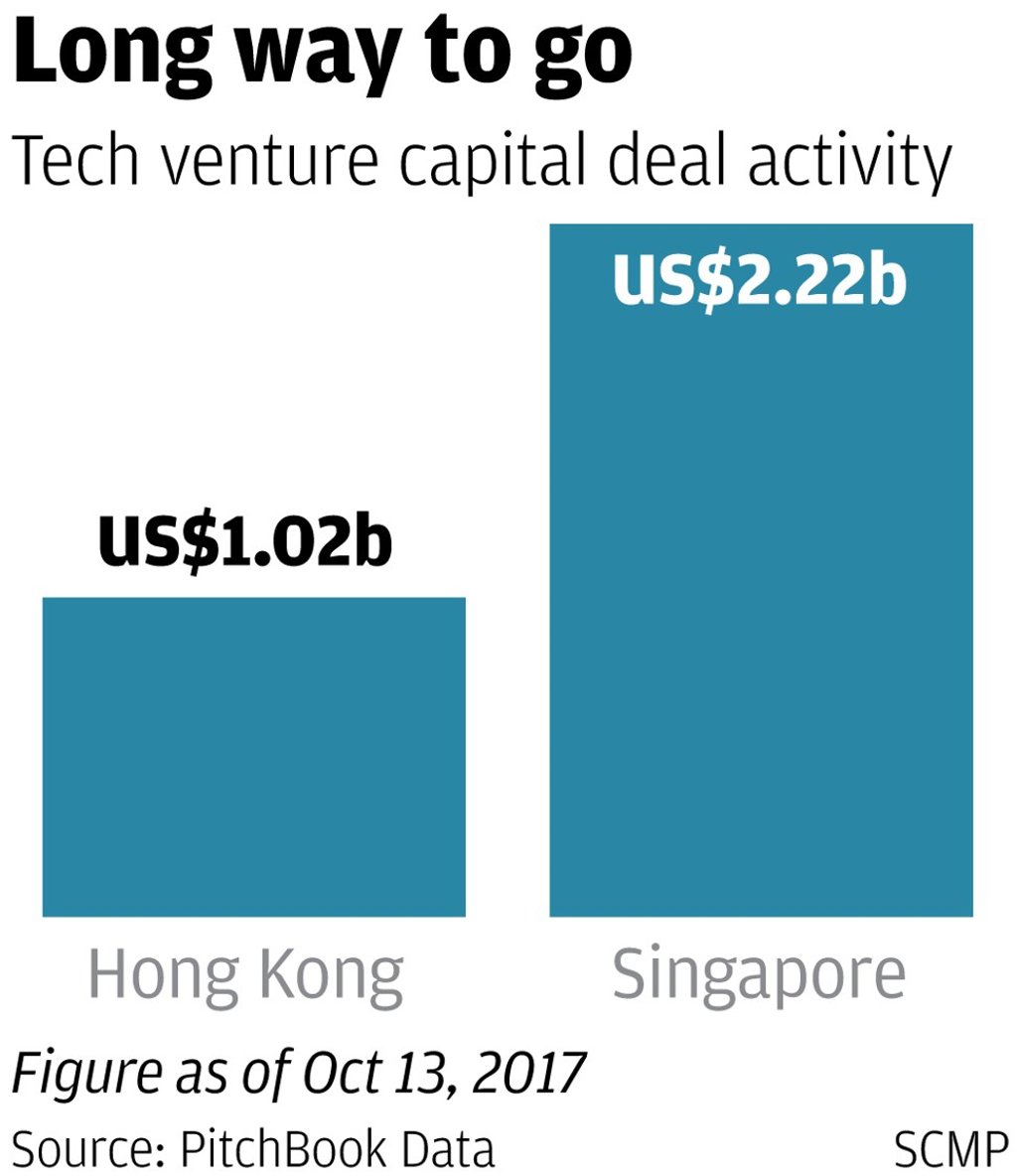

Singapore holds the upper hand on Hong Kong as a place to build a business, with access to funding remaining a challenge in the latter, despite a rising number of venture capital (VC) firms targeting Asia as a whole.

A lack of affordable talent is also holding Hong Kong back, even with its lack of government red tape compared with some rival markets, its proximity to China, and rapidly improving societal attitudes towards entrepreneurs, according to start-ups and advisers.

The Hong Kong authorities launched a HK$2 billion (US$255 million) fund last September to encourage investment in local innovation and technology start-ups, particularly digital, and in the 2018 budget, Chief Executive Carrie Lam allocated HK$200 million more to Cyberport, the government-owned business park, known as a creative digital community, in the east of Hong Kong Island within easy reach of the main business districts.

Tommaso Tamburnotti, however, who co-founded Easyship in Hong Kong in 2014, an online platform that provides cross-border logistics solutions to e-commerce companies, said “there is a lot of money [in Hong Kong], but it depends what you are looking for”, adding “Singapore is much better” for middle-stage funding, with more VCs.

Hong Kong has 70 VC firms, while Singapore has 86, according to data and intelligence company Preqin.