Hong Kong’s smart city vision in a fog as mobile firms and satellite operators fight over 5G bandwidth

The dispute centres on who can use a crucial part of the broadband spectrum needed for the next-generation networks that would power a smart city

Hong Kong’s vision of becoming a technology-driven smart city has run into a snag as mobile operators and satellite companies find themselves stuck in complex negotiations over the right to use a crucial part of the wireless broadband spectrum.

At issue is the so-called C-band, a frequency range key to developing next-generation, ultra-fast 5G networks, which themselves are crucial to the functioning of a smart city. In Hong Kong, the C-band is used by the city’s two satellite operators, AsiaSat and APT Satellite, under a legally binding arrangement, but the four mobile operators want access to it to pursue their 5G ambitions.

Hong Kong unveiled its “Smart City Blueprint” at the end of 2017, saying it aimed to enhance the city’s attractiveness to global businesses and “inspire continuous city innovation and sustainable economic development”. But any delays could prove costly as mainland China and other countries in the region forge ahead with their own smart plans.

“I think Hong Kong should definitely not be complacent,” said Irene Chu, head of new economy for KPMG China. “There are major government initiatives in the Greater Bay Area and smart cities. A lot of these things demand bigger capacity, as provided by 5G.”

The Greater Bay Area plan envisages integrating Hong Kong, Macau and nine cities in southern Guangdong province into a business, science and technology hub. China, Chu said, has already allocated spectrum for 5G in first-tier cities, with pilot projects due to launch in 2019. The investments are huge, she said, but demand would also be huge.

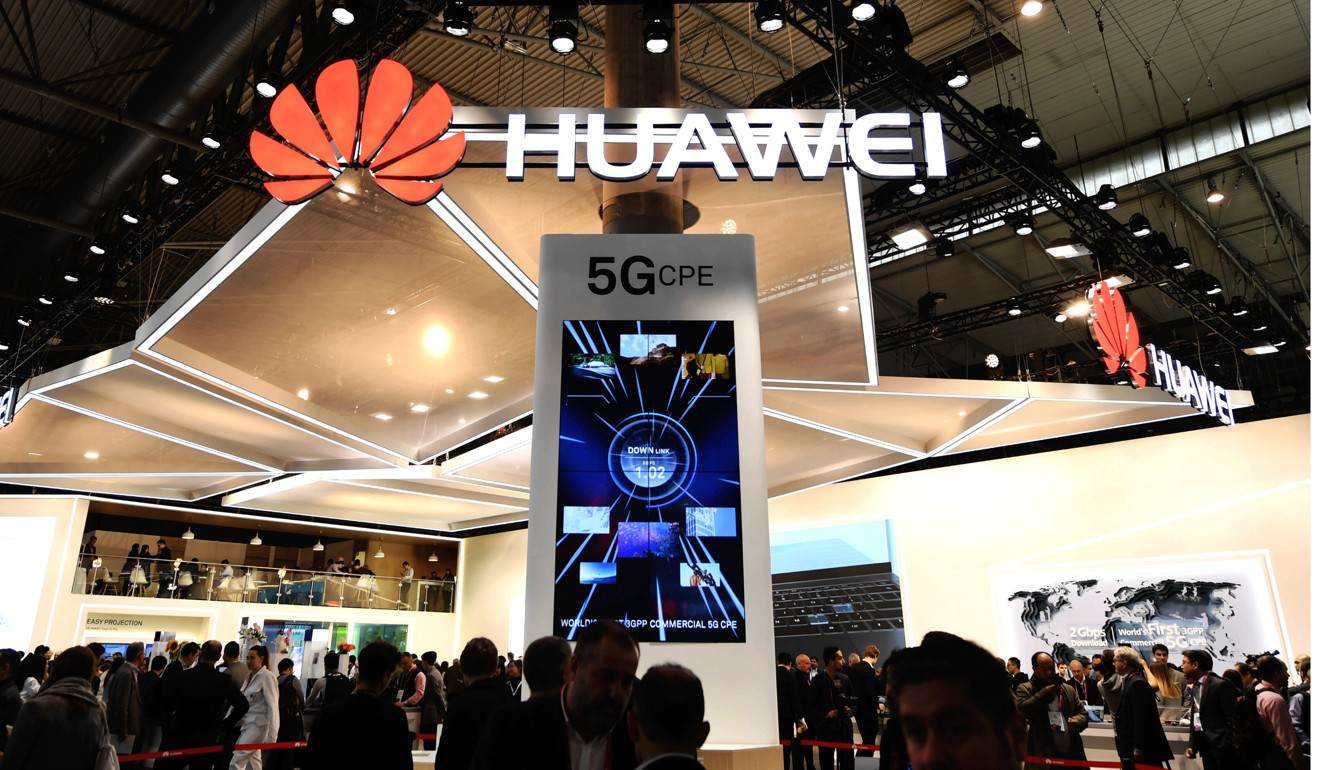

5G promises significantly higher levels of data transmission and speed that will connect smartphones, self-driving cars, the internet of things – smart home appliances for example – and all the other aspects of technology that make a city smart. For telecoms operators, that means new revenue streams.

A report by consultancy McKinsey in June noted that Asia’s major cities, and their tech-savvy younger generations, are poised to play a more crucial future role in making urban life easier through the use of smart technology. It particularly noted the mainland Chinese cities of Shenzhen, Beijing and Shanghai, as well as the South Korean capital Seoul, as being ahead of the curve.

Other analysts have noted the success of Singapore’s Smart Nation plan and pointed out that Hong Kong has been slow to adopt technology and encourage innovation, potentially putting it at a disadvantage.

Hong Kong did not appear in the top 20 of the 2017 Global Smart City Performance Index, which is compiled by market researcher Juniper Research and sponsored by chip maker Intel. The index, released in March, had Singapore at the top, with Seoul, Tokyo and Hangzhou in China among Asian cities in the ranking.

On Hong Kong’s key C-band question, it will be down to the city’s Communications Authority to make a decision. It is currently holding consultations on the subject.

In March this year, the authority made its first attempt to solve the problem, promising mobile operators they could have part of the C-band from April 1, 2020, but at the same time setting up exclusion zones around satellite earth station facilities, one in Tai Po and the other in Stanley, where 5G would not be available to prevent any interference with satellite signals.

The proposal has pleased neither side. The four mobile operators – China Mobile, HKT, Hutchison Telecom and SmarTone – are unhappy that there would be gaps in their coverage, with some estimates saying that over 700,000 people would not be able to get 5G because of the zones. The operators also complained they could not get started on their networks because they did not know which parts of the spectrum they would get.

“If I get the spectrum in pieces, it’s no good. It’s not only about getting spectrum, but having it whole. We [operators] need to see a plan,” said Hutchison Telecom co-deputy chairman Cliff Woo Chiu-man.

The satellite companies, who operate the city’s 12 communications satellites, for their part say they want to see a proper plan rather than resorting to exclusion zones, which they say would in any case not be big enough to prevent signal problems.

One of the biggest issues with the authority’s plan however is that the government-backed Hong Kong Science Park, which has set up an innovation centre to develop 5G technologies, and the Chinese University of Hong Kong, which is also researching 5G, would not actually be able to have 5G services because they are located in one of the planned exclusion zones.

“We are shocked by this,” said Hutchison’s Woo. “It is embarrassing that CUHK and HKSP could be deprived of 5G.”

Hong Kong Science Park, which received a HK$40 billion (US$5.1 billion) funding boost from the government in March, will look at workarounds of its own when it comes to establishing 5G research labs, according to Peter Yeung, head of the electronics and ICT clusters at the park.

The Communications Authority has set up a working group to look into the issue of exclusion zones. “Everyone has a legitimate reason to be there, and we have to balance interests. But it’s not as impactful as people say it is,” said Anthony Seeto Yiu-wai, a member of the authority, in an interview late last month.

Telecoms firms have further argued that the world is moving satellite operators away from C-band, as 5G is regarded as a higher-value usage of the wavelength. They have also proposed moving Hong Kong’s satellite dishes to more remote locations and reducing the size of the exclusion zone, as well as shielding the earth stations from mobile signals via a technological solution, although such solutions do not exist yet.

AsiaSat has opposed those ideas, citing cost and technical issues. Its CEO, Roger Tong, said in an emailed statement that the key point is that new operators should protect satellite firms, and the real issue is not the size of any exclusion zone but accepting that proper planning has to take place.

Planning should include frequency selection as well as shielding from both sides, with exclusion zones being the last resort, he said.

In an earlier open letter to the Communications Authority and posted online, Tong had said that the expense of relocating earth stations or providing some form of technical shielding should not be borne by the operators, and that ways of preventing interference between mobile signals in the C-band and existing satellite communications needed further study.

APT Satellite did not respond to requests for comment.