Ping An Insurance sees fintech and other technologies as key business development area

China’s second-largest insurer seeks to build on a ninefold surge in profit from its tech division in the first half

Ping An Insurance (Group), China’s second-largest insurer in terms of premiums, plans to make its technology business a key development area, building on a surge in profit from the division in the first half of the year.

The company has been steadily expanding its presence in fintech and other technology areas in recent years, and profit from the business rose ninefold to 4.2 billion yuan in the first half, representing 7 per cent of overall operating profit, compared with less than 1 per cent last year.

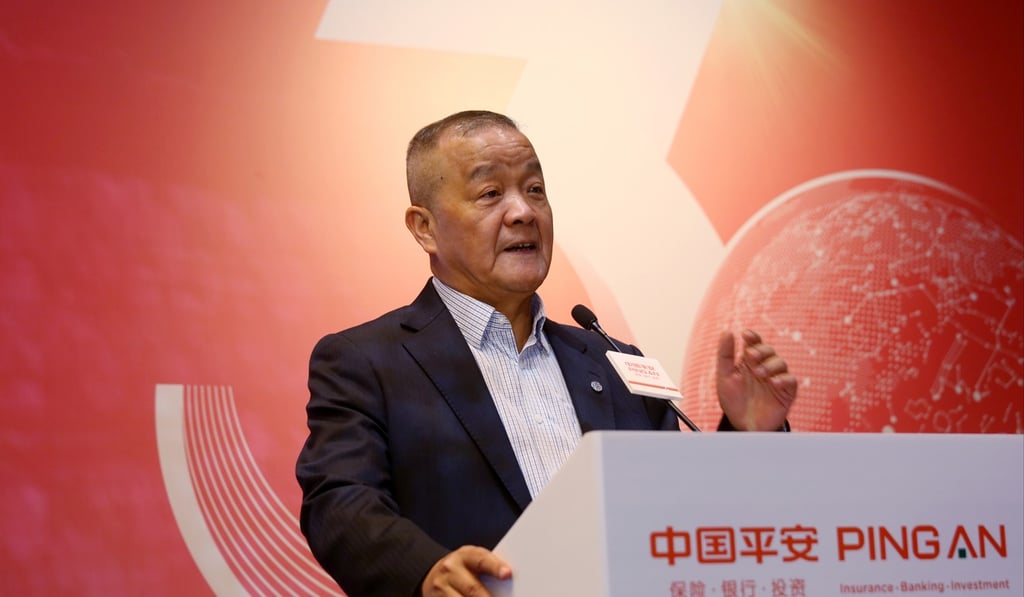

“In the future, focusing on retail customers, Ping An will strive to become a world leading, technology-powered retail financial services group. We will leverage technology innovations to create greater value for customers,” founding chairman Peter Ma Mingzhe told a briefing on the company’s half-year earnings.

One example of its tech push is the US$1 billion Ping An Global Voyager Fund, which focuses on fintech and health care related technologies.

The insurer on Tuesday reported a 34 per cent growth in net profit for the first half of this year, beating expectations of a 26 per cent rise in a Bloomberg survey. Driving the growth was a 24 per cent increase in profit from the life and health business to 35 billion yuan, which represents 59 per cent of its operating profit.