Hong Kong companies and directors step up buying of own shares as market weakens

Buying rose for a second straight week, with some directors who had been quiet for more than two years moving to support their companies’ shares

Hong Kong company directors were active in trading their own companies’ shares in the latest week, while buy-back activity by firms also rose, driven in part by a falling stock market that prompted moves to boost share prices.

Activity was notable in a long list of stocks from the exchange filings for the week of August 20 to 24, including We Solutions, Sino Biopharmaceutical, Giordano International, Huabao International, China Gas Holdings, Want Want China, Sun Hung Kai & Co and Hopewell Holdings.

In some cases directors who had been quiet for more than two years moved in to support their companies’ shares, with the timing suggesting that the shares were undervalued. Investors should particularly watch out for China Gas Holdings, with two directors posting rare acquisitions last week.

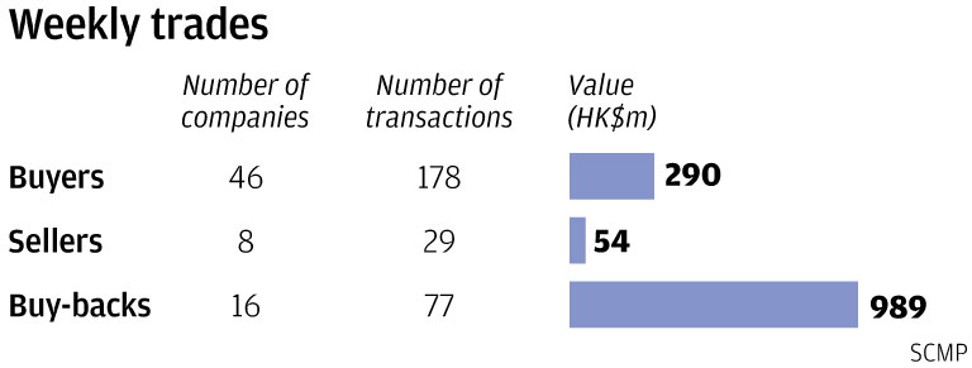

A total of 46 companies recorded 178 purchases worth HK$290 million (US$36.9 million) versus eight firms with 29 disposals worth HK$54 million. The buy figures were up from the previous week’s 30 companies, 144 purchases and HK$271 million and rose for a second straight week, while on the selling side, the number of firms and trades were up from the previous week’s four companies and 19 disposals. The selling value, however, was sharply down from the previous week’s HK$131 million.

Buy-back activity rose for the second straight week, with 16 companies making 77 repurchases worth HK$989 million, based on filings from August 17 to 23. The number of firms and trades was up from the previous five-day totals of 14 companies and 68 transactions. The value, however, was sharply down from the previous week’s HK$1.853 billion.

Chairman Eric Ho King-fung recorded his first on-market trades in electric vehicle manufacturer We Solutions since he joined the company in November 2016, with 320,000 shares purchased from August 22 to 23 at an average of HK$0.93 each.

The trades increased his holdings to 20.32 million shares, or 0.34 per cent, of the issued capital, and were made on the back of the 54 per cent drop in the share price since February’s HK$2.01. The stock closed at HK$1.03 on Friday.

Executive director Cheng Cheung-ling recorded her first on-market trades in biotechnology firm Sino Biopharmaceutical since her appointment in 2005, with 7 million shares purchased from August 23 to 24 at HK$9.38 to HK$9.94 each, or an average of HK$9.51 each.

The trades increased her holdings to 2.802 billion shares, or 22.17 per cent of the issued capital. The purchases were made after the stock fell by as much as 31 per cent from HK$13.60 in May. Despite the fall in the share price, the counter is still up since September 2013’s HK$2.19. The stock closed at HK$10.10 on Friday.

Clothing retailer Giordano International bought back shares while its chairman and CEO, Peter Lau Kwok-kuen, made a rare purchase. The buying totalled a combined 440,000 shares purchased from August 14 to 15 at an average of HK$4.39 each, and came after the stock fell by 18 per cent from HK$5.35 in the last week of May.

The company bought back for the first time since December 2017, with 240,000 shares purchased at HK$4.38 each. It had previously acquired 7.44 million shares from June to December 2017 at an average of HK$4.36 each, and 64.4 million shares from April 1994 to October 2000 at HK$0.355 to HK$5.78 each, or an average of HK$2.95 each.

Lau meanwhile recorded his first on-market trade since March 2014, with 200,000 shares purchased on August 15 at HK$4.40 each. The trade increased his holdings to 27.518 million shares, or 1.74 per cent of the issued capital. He previously acquired one million shares in March 2014 and 400,000 shares in June 2012 at an average of HK$4.96 each. The stock closed at HK$4.27 on Friday.

Elsewhere, Chu Lam-yiu, chairwoman and CEO of flavours and fragrances firm Huabao International, recorded her first on-market trades in the firm’s shares since January 2016, with 430,000 shares purchased from August 20 to 21 at HK$4.39 to HK$4.60 each, or an average of HK$4.47 each.

The trades, which accounted for 21 per cent of the stock’s trading volume, increased her holdings to 2.288 billion shares, or 73.62 per cent of the issued capital, and were made after the stock fell by as much as 22 per cent from HK$5.66 on June 14. The stock is down since January’s HK$6.05.

Chu previously acquired 59.4 million shares from December 2015 to January 2016 at an average of HK$2.69 each, 14.6 million shares in July 2012 at HK$3.65 each and 24.6 million shares in September 2011 at an average of HK$5.58 each. The stock closed at HK$4.60 on Friday.

Chairman Liu Minghui and executive director Huang Yong moved to support the share price of natural gas pipeline infrastructure operator China Gas Holdings after the stock fell by 30 per cent from HK$36.60 on June 5, with a combined 1.45 million shares purchased on August 17 at an average of HK$25.71 each.

They were the first on-market trades by Liu and Huang since December 2015 and December 2014, respectively.

Liu had previously acquired 8.97 million shares from January 2014 to December 2015 at HK$12.72 to HK$10.17 each, or an average of HK$10.67 each, and 69.5 million shares from July 2004 to December 2010 at HK$0.48 to HK$3.84 each, or an average of HK$1.55 each.

Huang had previously acquired 3.27 million shares from August to December 2014 at HK$15.00 to HK$11.39 each, or an average of HK$14.41 each. Huang was appointed to his post in June 2013. The stock closed at HK$25.45 on Friday.

The first on-market trades in food and drink producer Want Want China Holding by chairman and CEO Tsai Eng-meng since May 2016 were also recorded in the latest week. Tsai bought 19 million shares from August 15 to 22 at HK$5.85 to HK$6.36 each, or an average of HK$6.06 each.

The trades, which accounted for 13 per cent of the stock’s trading volume, increased his holdings to 6.261 billion shares, or 50.29 per cent of the issued capital. They were made after the stock fell by as much as 28 per cent from HK$8.11 on June 7.

He had previously acquired 35 million shares in May 2016 at an average of HK$5.70 each, 63.5 million shares from October to November 2015 at HK$6.31 each and 3.78 million shares in August 2010 at HK$6.09 each. The stock closed at HK$6.28 on Friday.

Chairman Lee Seng-huang recorded his first on-market trades in wealth management firm Sun Hung Kai & Co since September 2014, with 112,000 shares purchased from August 16 to 17 at HK$4.44 each. The trades increased his holdings to 1.233 billion shares, or 57.29 per cent, of the issued capital and were made on the back of a 16 per cent drop in the share price from February’s HK$5.27. The stock is also down from April 2017’s HK$5.79.

Lee previously acquired 3.95 million shares in September 2014 at HK$5.69 each, 37.2 million shares in June 2014 at HK$5.80 each and 2.05 million shares in December 2013 at HK$4.31 each. The stock closed at HK$4.48 on Friday.

Infrastructure firm Hopewell Holdings’ managing director Thomas Jefferson Wu recorded his first on-market trade in since May 2016, with 100,000 shares purchased on August 23 at HK$27.62 each. The trade increased his holdings to 29 million shares, or 3.33 per cent of the issued capital.

He previously acquired 1.08 million shares from April to May 2016 at an average of HK$24.97 each, 220,000 shares from February to December 2015 at an average of HK$27.60 each, and 1.75 million shares from November 2008 to March 2011 at an average of HK$23.91 each. The stock closed at HK$27.40 on Friday.