‘Green’ investments are not just about saving the planet – they’re about making more money, bank studies show

People who put their money into so-called green investments are not always doing it out of a sense of benevolence or concern for the environment.

According to separate studies by two leading international banks, they are increasingly making their decision for a slightly more selfish reason: financial gain.

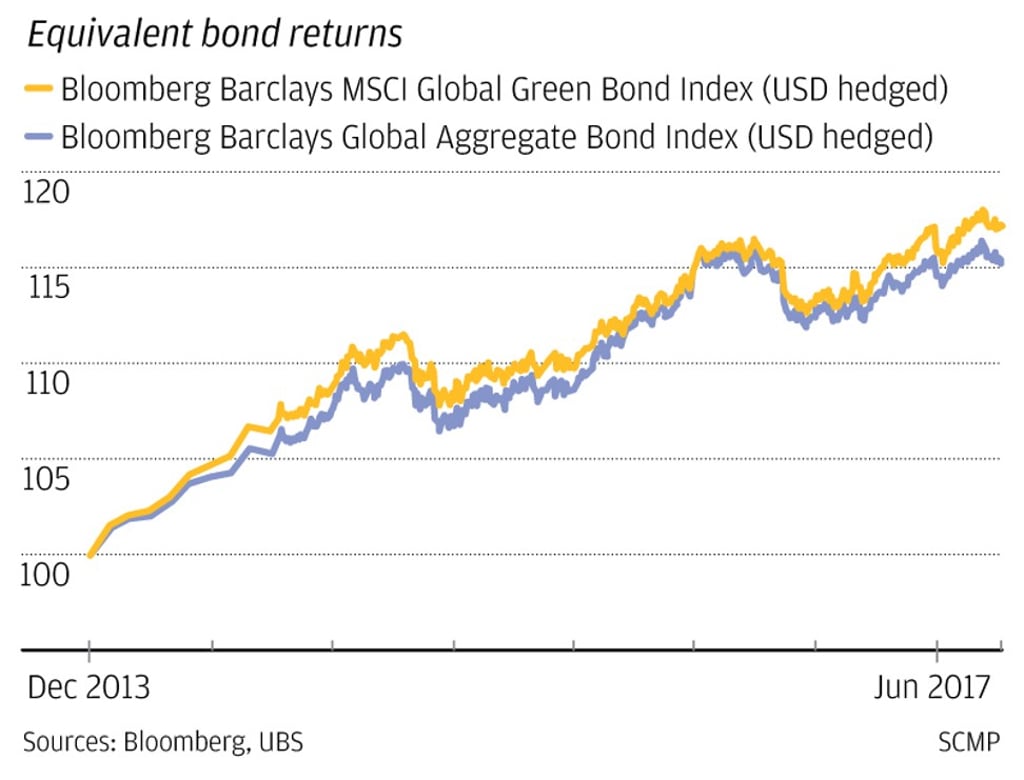

“Globally, investors do not associate sustainable investing with a trade off of financial returns. Fifty per cent of the investors surveyed expect sustainable investing to outperform financial investment,” said Amy Lo, chairman and head of Greater China at UBS Wealth Management.

“And of those who are already investing in sustainable investment, 93 per cent believe sustainable investing will outperform traditional investment.”

The UBS survey found that globally 82 per cent of investors believe sustainable investments will perform better or at least on par with traditional investments. In Hong Kong, half of those surveyed expected sustainable investments to outperform traditional alternatives.

The Swiss investment bank surveyed about 5,300 people with at least US$1 million in investible assets excluding property across 10 markets: Brazil, China, Germany, Hong Kong, Italy, Singapore, Switzerland, the UAE, the UK, and the US. The survey was conducted between June and August 2018.