How ‘dark pool’ operator Liquidnet is using AI to help traders make better decisions

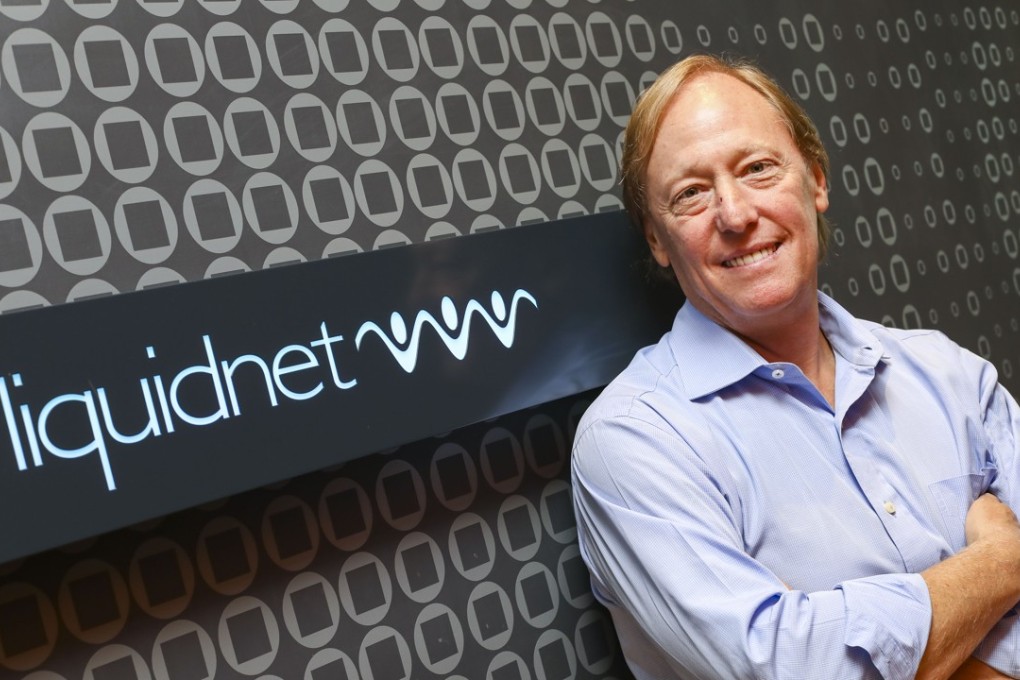

Liquidnet, the largest “dark pool” operator in the Asia-Pacific region, has introduced artificial intelligence and machine learning tools as customers increasingly turn to new technologies to manage their portfolios, according to its founder and chief executive Seth Merrin.

Dark pools are electronic trading platforms that have emerged in the past decade in advanced markets. They allow traders to buy or sell large blocks of shares without having to disclose their identities, the volumes or prices, unlike traditional exchanges.

They are popular with asset-management companies, pension funds and insurance firms which need to conduct a lot of large transactions, because they are cheaper and easier to carry out via electronic trading platforms.

Merrin founded Liquidnet in 2001 in the US and later expanded into Europe and Asia-Pacific. The platform has seen trading volume in Asia-Pacific of US$42 billion so far this year, up 57 per cent from a year earlier. Hong Kong and Japan, its two largest markets in the region, have both doubled their volume of trade year to date.

In the US and Europe the figure is US$608 billion, up 23 per cent from 2017.

“The rising turnover shows institutional investors are more and more in favour of using electronic platforms to trade. It is also because we have introduced a new digital analysis tool for the customers, which adds turnover to our platform,” Merrin said in an interview on a recent visit to his Hong Kong office in Wan Chai.