Trade war likely to be ‘prolonged’, denting confidence, credit rating agencies say

The escalating trade tensions between the US and China will have ‘unintended consequences’ for American businesses, according to Moody’s Investors Service

Credit rating agencies are becoming increasingly concerned about the potential impact of the escalating trade war between the United States and China as it looks to be more protracted and deeper than some had hoped.

In a new report on Friday, Moody’s Investors Service said that it now believes the economic tensions between the world’s two largest economies is likely be prolonged and will have “unintended consequences” for a number of American companies, including sellers of furniture, home goods and electronics.

“Industries that use more expensive imported or domestically produced inputs will be hurt,” Elena Duggar, the chairwoman of Moody's macroeconomic board, said. “Moving production chains will be costly and rising uncertainty will affect investment. The disruption will be higher in Asia than elsewhere given the region's integration in global supply chains.”

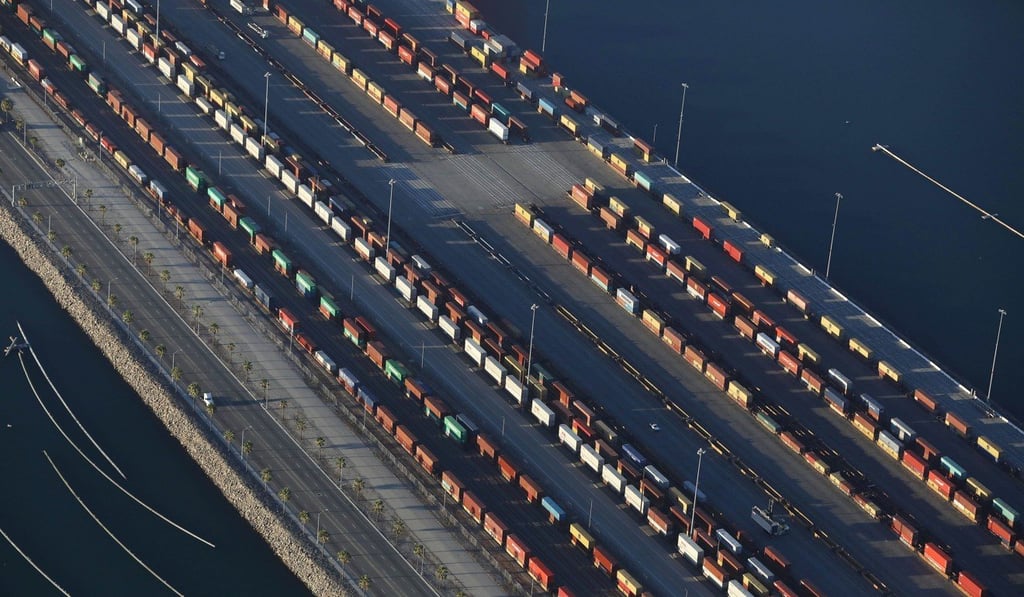

The US government has placed tariffs of up to 25 per cent on about US$250 billion of Chinese-made goods in the past few months and US President Donald Trump has threatened to add new levies on nearly all products made in China, or more than US$500 billion. China has introduced its own retaliatory tariffs on US goods in a tit-for-tat move.

The Trump administration is trying to overcome a US$376 billion trade deficit with China and combat what it claims are unfair trade practices by Beijing.

S&P Global Ratings said in a report this month that the ongoing trade tension had “dented confidence, evident in declining equity prices and a depreciating renminbi”. However, its forecast remains broadly unchanged, in part because of fiscal support by the Chinese government.