Hong Kong’s MPF ranks near bottom of the class globally when it comes to adequate savings preparation, consultancy says

- Hong Kong’s MPF ranked 32nd on a list of 34 global pension schemes in terms of adequacy

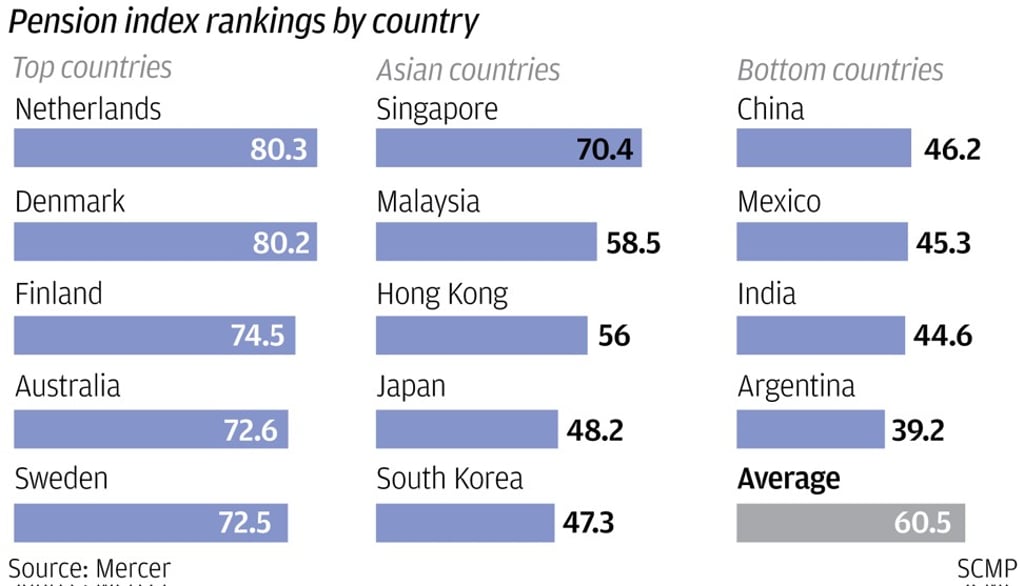

Hong Kong’s Mandatory Provident Fund ranks among the least adequate in the world in terms of seeing to the future needs of pensioners, ranking ahead of only India and Mexico among 34 worldwide markets tracked in a global study by pension consultancy Mercer.

The city’s mandatory pension fund scored 39.4 on an adequacy ranking of 100, which is below the global average at 61.1, ahead of India at 38.7 and Mexico at 37.3, according to the 2018 Melbourne Mercer Global Pension Index released on Monday.

Germany ranked top with an adequacy ranking of 79.9, followed by France at 79.5 and Denmark at 77.5, the Mercer report said.

This is the 10th annual report by Mercer but the first inclusion of Hong Kong. The index compares and give scores to different pension systems based on three aspects – adequacy, sustainability and integrity.

Stewart Aldcroft, chairman of Cititrust, derided Hong Kong MPF’s contribution level as “too low, too little to create a meaningful pool of money”.

The MPF requires employers and employees to each contribute 5 per cent of the individual’s salary at a combined contribution cap at HK$3,000 (US$382.55) a month.