Hong Kong’s MPF ranks near bottom of the class globally when it comes to adequate savings preparation, consultancy says

- Hong Kong’s MPF ranked 32nd on a list of 34 global pension schemes in terms of adequacy

Hong Kong’s Mandatory Provident Fund ranks among the least adequate in the world in terms of seeing to the future needs of pensioners, ranking ahead of only India and Mexico among 34 worldwide markets tracked in a global study by pension consultancy Mercer.

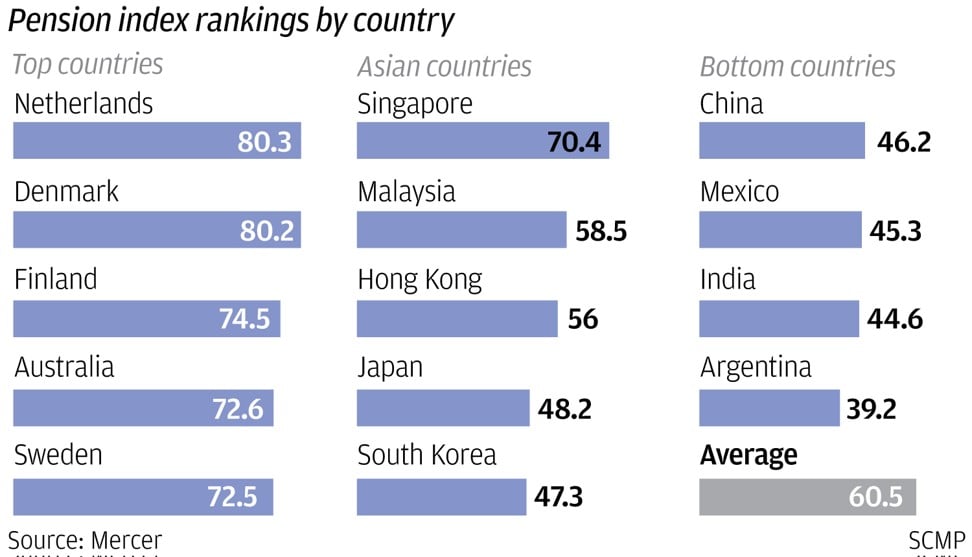

The city’s mandatory pension fund scored 39.4 on an adequacy ranking of 100, which is below the global average at 61.1, ahead of India at 38.7 and Mexico at 37.3, according to the 2018 Melbourne Mercer Global Pension Index released on Monday.

Germany ranked top with an adequacy ranking of 79.9, followed by France at 79.5 and Denmark at 77.5, the Mercer report said.

This is the 10th annual report by Mercer but the first inclusion of Hong Kong. The index compares and give scores to different pension systems based on three aspects – adequacy, sustainability and integrity.

Stewart Aldcroft, chairman of Cititrust, derided Hong Kong MPF’s contribution level as “too low, too little to create a meaningful pool of money”.

The MPF requires employers and employees to each contribute 5 per cent of the individual’s salary at a combined contribution cap at HK$3,000 (US$382.55) a month.

In comparison, Singapore’s scheme requires employers to pay 17 per cent and employees 20 per cent of the monthly salary without a cap.

Malaysia’s scheme requires employers to pay 13 per cent and employees to pay 11 per cent of monthly salary without a cap.

On a broader scale that included sustainability and integrity, Hong Kong’s MPF was given an overall score of “C”, or third in Asia, trailing Singapore and Malaysia.

“Hong Kong lost out to Singapore and Malaysia in Asia as the MPF has a shorter history and much lower contribution level,” said Rex Auyeung, a retired pension expert.

“Malaysia’s Employees Provident Fund was set up in 1952 which was the earliest pension scheme in Asia. Singapore came slightly later when it launched the Central Provident Fund in 1955. In comparison, Hong Kong is almost half a century behind as the MPF started only in year 2000,” Auyeung said.

Still, pension experts said the local monthly contribution levels needed to be bumped up to keep pace with other progressive retirement schemes.

“At such a low level of contribution, even for those who start to contribute to the MPF at age 20, it would not be enough for their retirement at age 65,” Aldcroft said.

“The government should introduce more tax incentives to encourage both companies and individuals to voluntarily contribute more to the MPF,” he said.

Financial Secretary Paul Chan Mo-po in February proposed to give tax deduction of up to HK$36,000 a year for those who voluntarily top up their MPF.

“If Hong Kong MPF wants to catch up with other pension schemes, the government should increase the contribution level to 7 or 10 per cent, or even higher. It should also remove the combined contribution cap at HK$3,000 as the higher income group could afford to pay more. The government should also consider a basic allowance to all pensioners, in addition of the MPF,” Auyeung said.

Janet Li, wealth business leader for Asia at Mercer, said the MPF and other pension plans last year matched only about 45 per cent of the income earned by men before retirement in Hong Kong, and about 50 per cent for women. This was below the replacement ratio of 63 per cent in Organisation for Economic Co-operation and Development countries.

“This shows Hong Kong retirement plans did not offer enough to retirees. Besides the low contribution rate of the MPF, this was also because of the lack of other social security [options made available] by the government,” said Li.

She, however, said Hong Kong’s pension rating should be higher in the same study next year.

“The Hong Kong government has already announced a plan to offer tax incentives, to encourage voluntarily contributions to the MPF, next year. It has also proposed a plan to scrap the offset mechanism to improve the MPF,” said Li.

Kenrick Chung, chief commercial officer of Charter Management Group, said a tax incentive would encourage more voluntarily MPF contributions.

“However, Hong Kong should not push a mandatory increase in the contribution level similar to Singapore’s CPF. Hongkongers would prefer to keep more salary for their own use,” Chung said.

“The Hong Kong government should allow employees to withdraw some money from the pension plan to buy their own home or for medical use, as is the case in Singapore and Malaysia,” Chung said.

A spokeswoman of the Mandatory Provident Fund Schemes Authority said the authority will assess contribution levels as part of its review every four years.

“Any change to the current statutory requirements, be it the contribution rate or the maximum income level, needs to be thoroughly discussed and considered by different stakeholders in the community,” she said. “The MPFA always encourages scheme members to get an early start in planning for retirement and to save more for their retirement, for example, by making voluntary contributions.”

Still, many Malaysian pensioners say it can be hard to make ends meet under the current contribution levels.

A 69-year-old Malaysian who identified himself as a retired insurance executive said the Malaysian EPF may be good for higher income groups, but is not sufficient for everyone.

“For low income groups, especially, it will not be enough, especially if the retirees’ lifespan is long,” he said.

“Many retirees continue to work part time or full time to supplement his or her income. Some become Uber or Grab drivers for this purpose,” he said.

Northern European countries ranked top of the Mercer pension index with Netherlands at 80.3 and Denmark at 80.2. Argentina ranked bottom of the global list with 39.2.

The Mercer report said Hong Kong should consider tax incentives and increase the labour force participation rate for older workers.

Mainland China scored 46.2 this year, down slightly from 46.5 in 2017. Mercer urged mainland officials to increase the minimum level of support to the poorest individuals and to offer more investment choices for members.

(Corrects India’s ranking to 38.3 in second paragraph.)