Li Hejun, once China’s richest man, seeks to take troubled Hong Kong-listed Hanergy unit private

- Hanergy unit goes from darling of China’s investors to suspension to US$27 billion privatisation

- Hanergy Thin Film’s shares were suspended three years ago after plummeting by almost half in about an hour

Hanergy Mobile Energy Holding, whose chairman was briefly China’s richest man before falling foul of regulators, is offering HK$210.7 billion (US$26.9 billion) to privatise its Hong Kong listed arm, whose shares were suspended three years ago.

The proposed move, announced on the company’s website, could mark the closing of a chapter in the rags-to-riches story of 50-year-old Li Hejun, the renewable energy tycoon ranked by the Hurun Report as China’s wealthiest man in 2015 with US$26 billion to his name.

The Hong Kong-listed unit, Hanergy Thin Film Power Group, was once the darling of investors, its share price skyrocketing and handing Li riches beyond his wildest dreams.

But it all came crashing down – along with Li’s reputation – in 2015 when the stock lost almost half its value in a little over an hour and Li found himself under investigation for incompetence and negligence in his duties.

Hanergy Thin Film’s shares have been suspended ever since, with the last closing price giving the company a market value of US$21.1 billion.

Li and his companies own three quarters of the unit, which means most of the funds to be coughed up by the parent firm would end up in his own pocket, potentially helping to replenish some of the wealth he has lost.

According to this year’s Hurun report, he is now the 89th richest Chinese magnate with an estimated fortune of US$4.34 billion.

A mechanical engineering graduate from Beijing Jiaotong University, Li once told New Fortune magazine that he had never worked for anyone before starting his own electronic-parts trading venture after borrowing 50,000 yuan (US$7,200) from a professor.

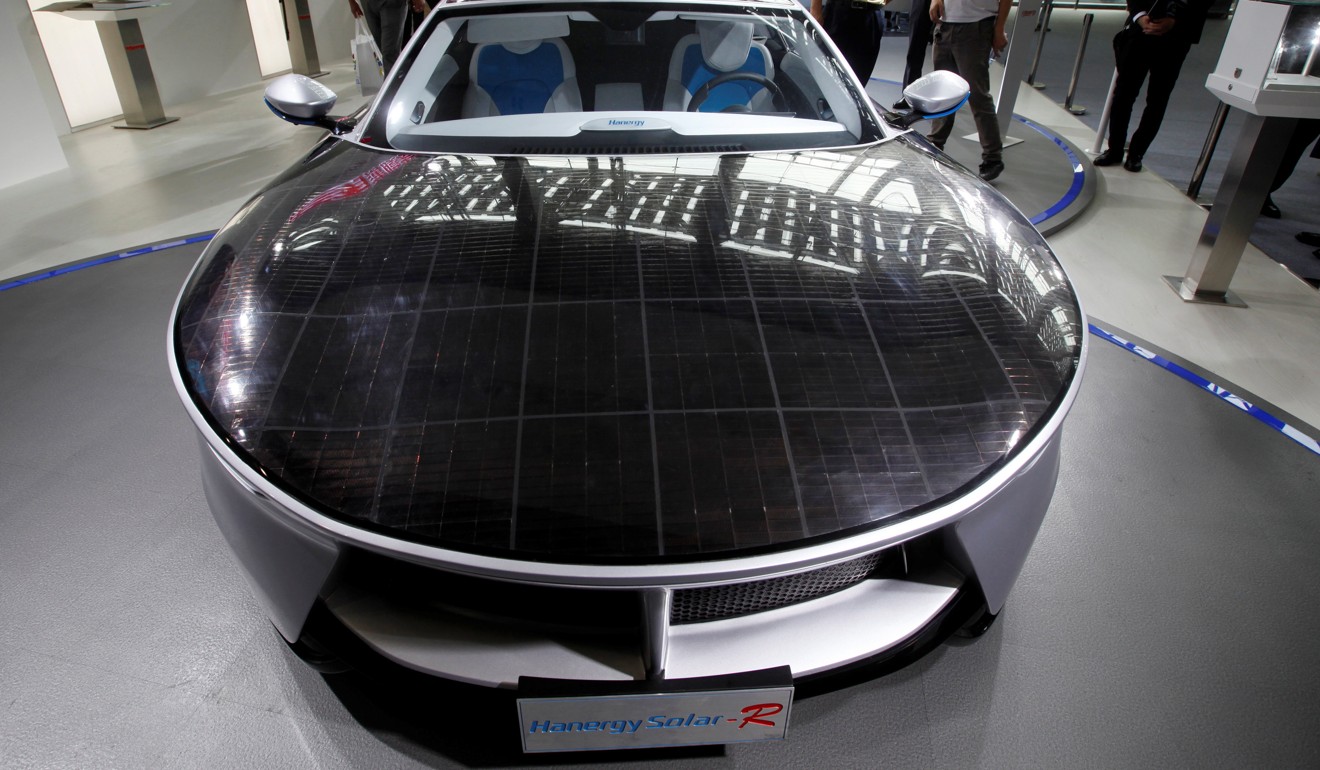

After successfully shepherding a large hydro-power project from scratch to completion over a decade, Li, a big fan of solar energy, in 2012 moved into the thin-film solar panels industry, a niche market most mainstream panel makers chose not to pursue.

In the book he wrote and published in 2014, New Energy Revolution: the Power to Change China and the World, he said the “solar revolution” would be key to helping the country achieve lasting prosperity.

Hanergy Mobile, a unit of Li’s privately-owned Hanergy Holding Group, will offer no less than HK$5 per share to take over all of the Hong Kong-listed unit, with aims to list it later on a mainland Chinese market, the company said in a statement on its website on Tuesday.

The offered price represents a 28 per cent premium to the last trading price of Hanergy Thin Film of HK$3.91 before it was suspended from trading its shares three years ago.

At HK$5, the deal would value the listed unit’s entire 42.15 billion issued shares at about HK$211 billion.

Li, who shot to fame as China’s top tycoon three years ago when Hanergy Thin Film’s market valuation reached stratospheric levels, fell from grace in September last year when the Securities and Futures Commission successfully won an order from the courts to ban him from being a director of any company in Hong Kong for eight years.

The court found that as chairman and executive director of both Hanergy Thin Film and the parent firm, Li had breached his duties to Hanergy's shareholders in a number of deals and loans between the two companies where there was a clear conflict of interest.

By effectively giving the parent company US$8.5 billion in loans to buy solar-panel production lines from the listed unit, the latter booked handsome profits that drove up its share price, at the same time racking up huge accounts receivable whose sustainability was questionable. Hanergy Thin Film also made major prepayments to the parent for building solar farms.

The SFC said Li had also failed to exercise reasonable care and diligence in connection with an undisclosed loan of 900 million yuan (US$129.7 million) provided by a mainland subsidiary of the listed unit to the parent company in March 2014.

His directorship ban, however, did not extend beyond the city. Li maintains his chairmanship at Hanergy Mobile Energy Holding and leads the board that approved the privatisation plan.

Hanergy Mobile said the decision for the privatisation was because Hanergy Thin Film “has been suspended for over three years” and the move would “protect the interests of middle and small shareholders”.

The boards of both Hanergy Mobile and the listed unit have approved the plan, it added.

The proposal, however, would need approval from the listed unit’s independent shareholders under the Hong Kong takeover code.

A spokesman for Hanergy Thin Film declined to comment when asked why the privatisation offer had not been officially announced via a filing to the Hong Kong stock exchange, a requirement for any deal to go ahead.

The SFC said it had no comment on the privatisation proposal.

Established in 1994, Hanergy Holding engages in hydro, wind and solar power generation, and production of thin-film solar panels and the equipment to manufacture them. It has branches across the mainland and abroad. The company has about 15,000 employees, according to its website.

The listed unit’s share price had surged more than sevenfold in the 12 months before a sudden sell-off in May 2015, which saw its value nearly halve in just over an hour before trading was halted at the request of its board. The rally led its market value above HK$300 billion (US$38 billion) at one point, making it the 16th-largest firm listed on the Hong Kong stock exchange, more valuable than blue chips like Hang Seng Bank and MTR.

Christopher Cheung Wah-fung, a lawmaker who is also a veteran stockbroker, said the privatisation price was reasonable.

“The privatisation proposal will be attractive to small investors as they could at least cash out some of their investment,” Cheung said.