Six months after the largest listing reform in three decades, what has Hong Kong exchange gained?

- 19 Chinese new-economy firms raised HK$115.8 billion in Hong Kong in the first nine months, more than double the HK$53.8 billion raised by 17 companies in New York, according to HKEX data

Six months after pushing through the biggest change in Hong Kong’s listing rules in three decades, what has the Hong Kong Exchanges and Clearing (HKEX) gained?

Its stock price has plunged nearly 19 per cent since April 30 when the reform kicked off, losing HK$60.53 billion (US$7.72 billion) in value.

When HKEX chief executive Charles Li Xiaojia touted the success of the listing reforms that the exchange operator had pushed through with the city’s securities watchdog agency, he described it as the biggest game-changer since 1993, when Chinese companies were able to raised capital in Hong Kong through H shares.

“It will not be in the single digits - more than a dozen companies will apply” to raise capital in Hong Kong, Li said at the time.

The reform opened the way for tech companies with weighted voting rights - commonly known as dual-class shares - and pre-revenue biotech firms to raise capital.

Six months later, Hong Kong’s key stock index is in bear market territory, interest rates are up, and the appetite for raising capital has shrunk. As many as 19 so-called Chinese new-economy companies raised HK$115.8 billion in Hong Kong in the first nine months, more than double the HK$53.8 billion raised by 17 Chinese new-economy companies in New York, according to the HKEX data.

While that was enough to help Hong Kong reclaim its crown as the world’s favourite market for IPOs, it could not have come at a worse time. The market is down, which means most of the companies are trading below their IPO prices, and that has scared other companies away from raising funds.

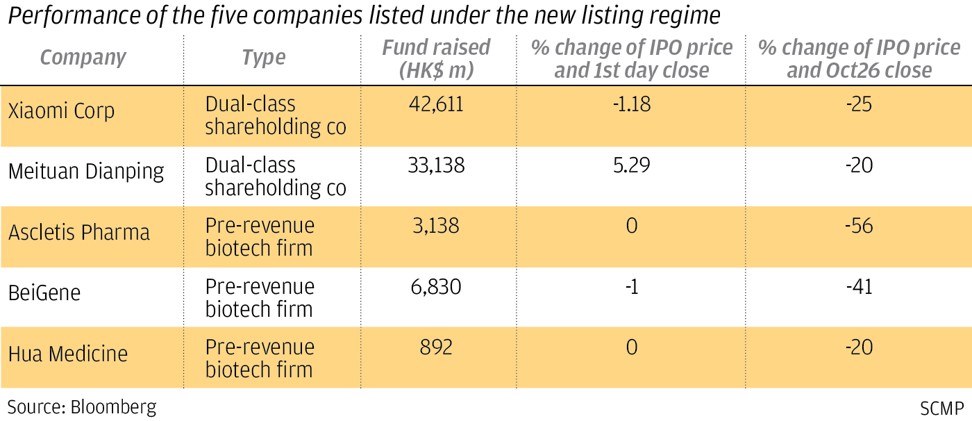

Four of the five companies that did list under the new rules, including the world’s fourth-biggest smartphone maker Xiaomi, either had a flat trading debut, or fell on their first trading day. Online food delivery Meituan Dianping was the only company to debut at a premium, according to Bloomberg data.

Even long-term investors had their fingers burnt, as these five stocks had fallen by between 20 to 56 per cent below their IPO price.

“This is definitely a disappointing set of results for the listing reform,” said Christopher Cheung Wah-fung, a veteran stockbroker who is also Hong Kong’s lawmaker representing the financial services constituency. “The number of new listings under the new regime is far fewer than expected. These stocks are not performing well, and investors have lost money. The benefit of the listing reform is far less than anticipated.”

The failure with Hong Kong’s listing reforms wasn’t merely the plunging stock prices, but the fact that the city remains the go-to market for Chinese companies, but not anyone else, said Kenneth Leung Kai-cheong, a lawmaker who represents accountants.

“There are many tech companies in the US, Israel, Singapore that need to raise funds,” Leung said. “The HKEX should encourage these companies to list here, to diversify our source of listing beyond just mainland China.”

Li could not be reached to comment. An HKEX spokesman said the exchange is “very encouraged” by the interest in Hong Kong’s new listing regime.

“Since HKEX’s listing reform, Hong Kong has overtaken the US to become the listing venue of choice for China’s new economy companies,” the spokesman said, adding that there are nine biotech firms and another two dual-class companies that are in the queue to raise money in Hong Kong. “It is early days but the progress so far is good.”