Shanghai to create a tech board for start-ups, unicorns to raise capital, upping the ante with Nasdaq and Hong Kong

- President Xi Jinping made the surprise announcement during his opening speech at the China International Import Expo in Shanghai

- Details remain scant, but the shares of Hong Kong Exchanges & Clearing Limited fell 3.2 per cent after Xi’s unexpected announcement

In a surprise announcement, China’s president ordered the establishment of a new equity bourse in Shanghai to help technology companies raise capital, upping the ante with Nasdaq and the newly reformed Hong Kong stock exchange as the market of choice for start-ups.

The unexpected announcement was made by Chinese President Xi Jinping during his opening speech at the China International Import Expo, which starts today in China’s financial hub.

Xi also instructed the commencement of a pilot programme whereby companies that want to raise capital through initial public offerings (IPOs) need only register themselves, thereby giving the China Securities Regulatory Commission (CSRC) a limited role in setting prices and in determining the timing of IPOs.

“The capital market will become more efficient, which will be helpful for value investing,” said Li Lifeng, a strategist at Sinolink Securities in Shanghai. “In the long run, the creation of the technology board on the Shanghai exchange will help build the city into China’s technological innovation centre.”

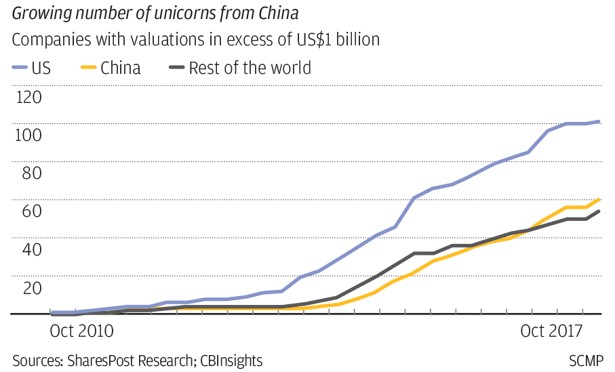

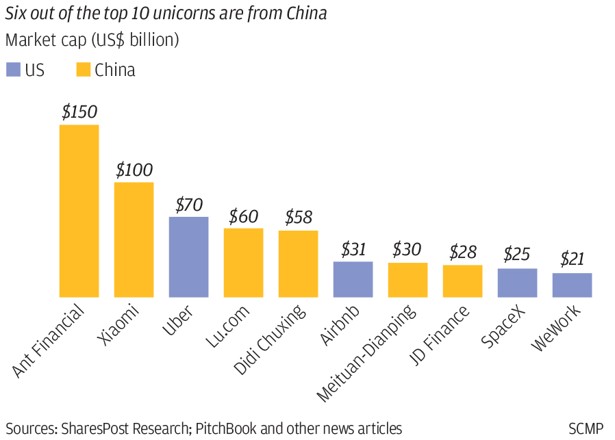

The move is the latest iteration of the Chinese government’s exercise in techno-nationalism, after a failed attempt to arm-twist Xiaomi and other large tech companies to issue Chinese Depositary Receipts in Shanghai.

Alibaba Group Holding, Baidu, Tencent Holdings, Xiaomi and a host of China’s largest technology companies earn the bulk of their earnings in China, but raise their capital in offshore markets, and are thus held by overseas investors. Due to China’s capital controls, the average stock investor - there are 120 million A-shares accounts, more than the Communist Party’s membership - isn’t able to own these stocks or partake in their capital gains.

“Many investors have been complaining that the best companies, including those with dual-class shareholding structures, have gone to the US or Hong Kong to list,” said Dai Ming, a fund manager at Hengsheng Asset Management in Shanghai. “The new board could accommodate either the small companies or the unicorns.”

To be sure, this isn’t China’s first attempt at a technology board. In 2009, authorities established the ChiNext on the Shenzhen Stock Exchange to help innovators and start-ups raise capital. Almost a decade later, there are more than 700 companies listed on the board. Transactions, however, were less than 7 per cent of the value of shares that change hands on the Shenzhen bourse, and less than 5 per cent of trading on the larger Shanghai exchange.

“The Shanghai Stock Exchange will study and work on the trial plans for the tech board, and the IPO registration system, under the guidance of the CSRC, and will implement the plans after a public consultation,” the bourse said in a statement published on its official WeChat social media account. “The tech board will be independent from the existing Main Board,” and can test the proposed IPO registration, the exchange said.

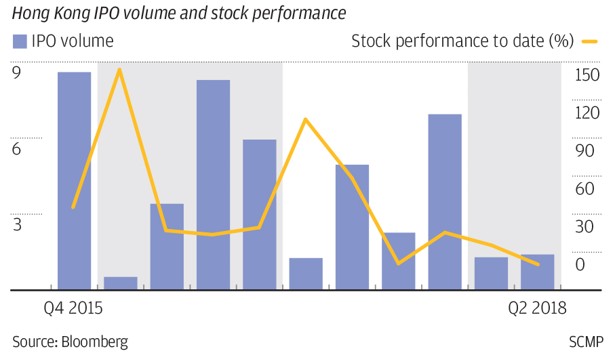

Details of the new Shanghai board remains scant, but that has not stopped investors from bailing out of Hong Kong Exchanges & Clearing Limited. The operator of the Hong Kong bourse, which is itself listed, fell by as much as 3.2 per cent to HK$220 after Xi’s unexpected announcement.

The bourse operator, which pushed through the largest reforms in its listing regulations last year, was on track to regain its global crown in IPOs this year.

IPO crown eludes Hong Kong as Xiaomi does not live up to its blockbuster billing

“The new board may distinguish itself from ChiNext by allowing the listings of companies from not only China, but also overseas, or at least those from the Belt and Road-related nations,” said Wang Chen, a partner at Xufunds Investment Management in Shanghai. “It is an ambitious plan as China wants to build Shanghai exchange into a global financing and investment platform.”

Still, the stock market as a whole wasn’t cheering the new move, as the new board has the potential to sap the market of funds, which are already in short supply. The Shanghai Composite Index, which briefly reversed its opening losses, fell by as much as 1.4 per cent after Xi concluded his speech, on track for its worst trading day in five. The Shenzhen Composite Index fell by as much as 1.4 per cent, its first day of declines in five.