Munich and Singapore tipped to emerge as global fintech hubs, survey finds

- Banks, financial institutions and fintech-focused private equity and venture capital firms all prepared to spend more on deals, according to Reed Smith poll

- Distributed ledger technology focused on non-cryptocurrency applications and on regulation compliance software best value for money

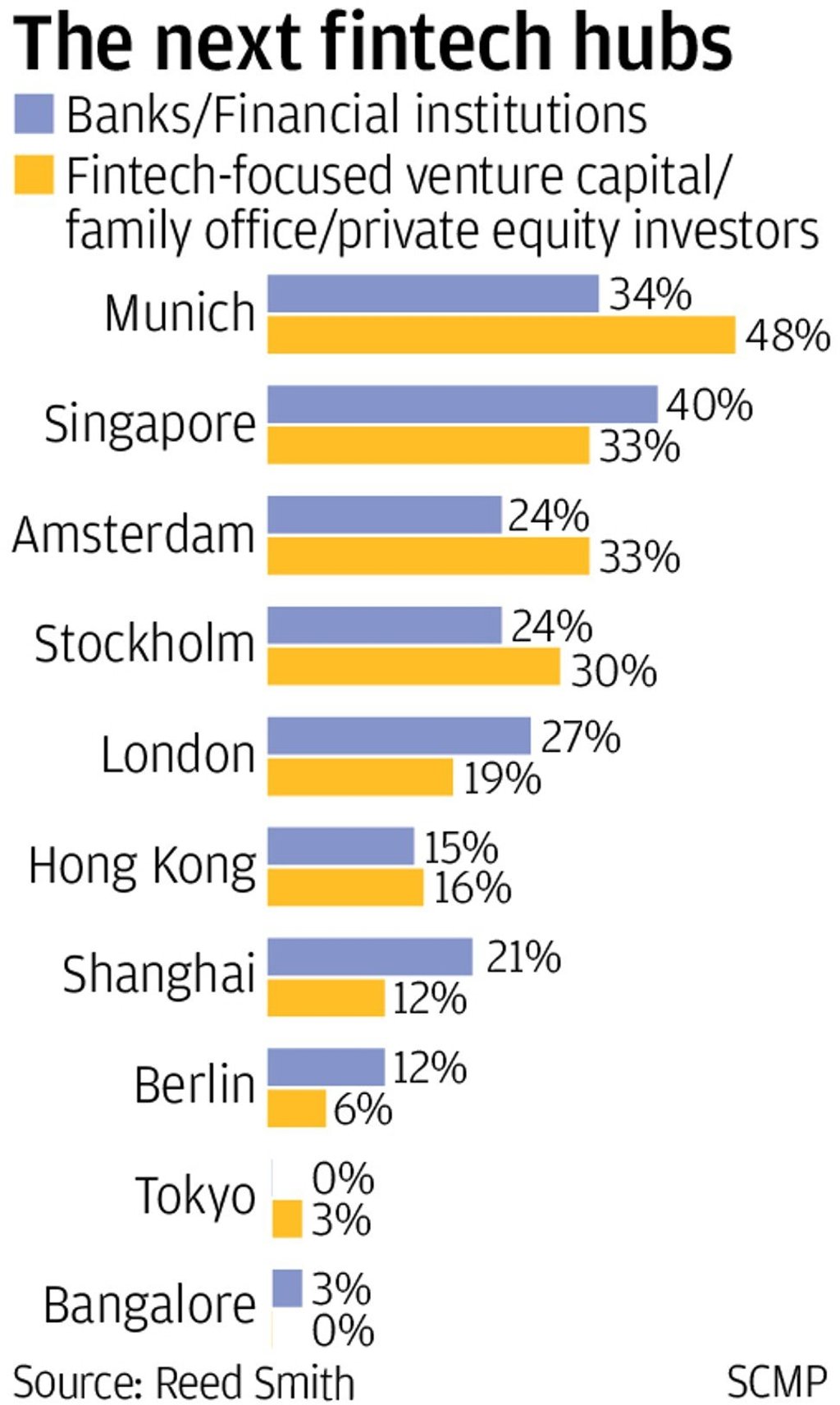

Munich, Singapore and Amsterdam are likely to emerge as the top three global fintech hubs over the next two years, according to a survey of 100 senior financial executives by US law firm Reed Smith.

Nearly 50 per cent of venture capital and private equity investors and 34 per cent of bank respondents picked the German city of Munich. The next most popular pick was Singapore, chosen by 40 per cent of bankers and 33 per cent of private equity and venture capital investors.

“Munich has a significant financial sector and has been offering office space and other incentives. They are designing it to attract start-up companies,” said Matthew Gorman, partner at Reed Smith in Singapore. He added that Singapore had taken similar measures.

Hong Kong remains vigilant against risks of virtual assets even as fintech investments more than double, financial minister says

“Singapore has done a good job creating a friendly ecosystem. The Monetary Authority of Singapore has been heavily engaged with the fintech sector.”

Andreas Splittgerber, Munich-based partner at Reed Smith, said Munich was home to a number of large, engineering companies such as Siemens and BMW, which meant there was more talent and more money available for research and development based start-ups.

The survey also found that merger and acquisitions activity in the financial technology sector is likely to grow substantially over the next two years globally, with banks, financial institutions and fintech-focused private equity and venture capital firms all prepared to spend more money on deals.

“Deal making is only going to increase in the future,” the report quoted a venture capital executive as saying. “With so many technological advances in the sector, we must all be prepared to invest to stay in the game.”