China explores use of foreign expertise to speed up deep-sea wind power development

- Chinese firms can avoid the mistakes made by European companies by forming partnerships, says Ben Backwell, CEO of Global Wind Energy Council

- China on course to become the world’s largest offshore wind power market in next four years

China is poised to overtake Germany and the UK as the world’s largest offshore wind power producer by 2022, but it needs foreign know-how to cut costs and boost competitiveness, according to the head of Global Wind Energy Council.

“We think the best way for China to achieve that is to have foreign participation to enable the transfer of best practices in the European market,” said chief executive Ben Backwell in an interview.

Cost reduction is crucial to the nascent industry segment’s growth because from January 1, all large-scale wind farm development rights allocation in China will be subject to power price competitive bidding, with power price commanding a 40 per cent weighting in a developer’s competitiveness assessment. This will effectively end subsidies to developers via higher guaranteed power prices that have been in place for a decade.

Backwell said Chinese developers could learn from their European peers, especially in the more technologically challenging deep water areas and avoid the “steep learning curve and mistakes” they made along the way.

Chinese wind turbine maker Sinovel must pay US$59 million as punishment ‘for stealing trade secrets’

The council is backed by 1,500 equipment manufacturers, project developers, parts suppliers, financiers, power distributors and research members from over 80 nations.

Global offshore wind power generation capacity could grow to 129 gigawatts in 2030 from 17.6GW last year – an average rate of 16 per cent, and China would overtake the UK’s cumulative installation by 2022, Bloomberg New Energy Finance has forecast.

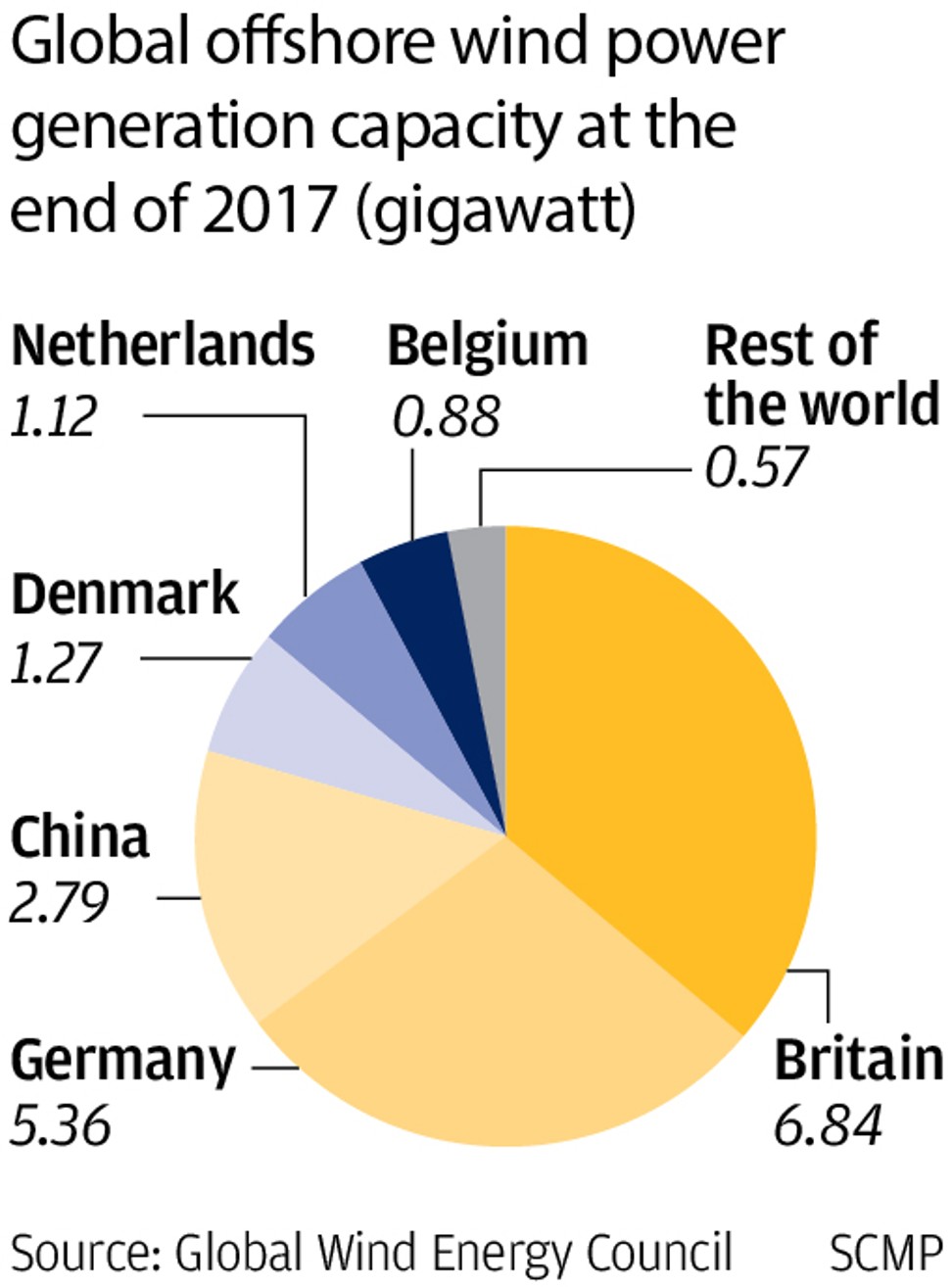

China’s offshore capacity stood at 2.8GW last year, trailing Germany’s 5.4GW and the UK’s 6.8GW, according to the council. In the overall market covering both on and offshore, China’s 188GW was more than double the 89GW of the United States, the No 2 market.

Offshore projects are more expensive than onshore ones to build but generate more power due to better wind resources and more powerful turbines.

So far, China’s wind power market is dominated by state-backed energy giants, and few foreign firms have won project development rights in the highly capital-intensive and cost competitive market.

But a round table discussion during last month’s China Wind Power exhibition and conference in Beijing signalled an interest in the idea of the Chinese industry tapping into foreign expertise to speed up development, Backwell noted.

The ‘real’ offshore projects, those in waters deeper than 10 metres and more than 10 kilometres away from the coastline, will become the next big thing and this is where Sino-foreign joint ventures will see the most mutual benefits

Foreign firms are not barred from China’s wind power industry, but they face challenges in obtaining project site information and local financing, and forming joint ventures with Chinese firms is the preferred market entry approach, said Qiao Liming, the council’s China director.

She added that as the less technically challenging “low hanging fruit” of shallow offshore projects have been heavily developed in the past decade, Chines firms will increasingly look at deeper water sites as growth drivers.

“The ‘real’ offshore projects, those in waters deeper than 10 metres and more than 10 kilometres away from the coastline, will become the next big thing and this is where Sino-foreign joint ventures will see the most mutual benefits,” she said. “But how many such ventures will be realised depends on the whether there is enough trust built for technology sharing and sustainable partnerships.”

Wan Ke, managing director of LOC China, a unit of London-based international marine and engineering consultancy LOC Group, said successful knowledge transfer from established markets such as Europe will help Chinese wind farm developers manage higher risks associated with offshore projects.

LOC is providing marine warranty services to a Chinese offshore wind energy project being built in Fujian province, the first time such services that help better manage project risks are being offered in the nation.

Still, not all Chinese project developers see the need for joint investments with foreign firms.

Wind farms operator China Longyuan steps up overseas expansion, follows Belt and Road

An official who declined to be named at state-backed China Longyuan Power Group, the world’s largest wind farms operator, said the firm has long had technological exchanges and learned from European firms, but thus far has not discussed partnerships in China.

“We are not short of funds, and having entered the offshore segment for a decade, our technical capabilities are mature in both shallow and deep water segments in terms of geological understanding and construction engineering, and we have our own intellectual properties,” he said.