Exclusive | Club Med’s owner Fosun has a strategy to help everyone live until 121 years old: technology

- Fosun will put 100 billion yuan of its war chest to work over the next few years to acquire technology companies that can augment its health care business

Fosun International, the holding company of one of China’s biggest private-sector conglomerates, has a strategy to increase its share in the US$8.7 trillion global health care market: technology.

“Technology advancements can improve efficiency and increase production,” said Fosun’s founder and chairman Guo Guangchang, during an interview last week with the South China Morning Post at his head office, overlooking the famous Shanghai Bund. “We will advance from our existing businesses with technology transformation. While we could not invest in every sector, we will focus on health care as it's the centre of people’s lives.”

Fosun, mainly through its listed unit Shanghai Fosun Pharmaceutical, has accelerated its health care investments in the past couple of years. Its CAR T cell therapy, a type of adoptive cell transfer, is considered one of the most advanced forms of cancer treatment.

“Humans can live longer when cancer is no longer a threat to life, and health care can be managed with lower costs,” said Guo, who turns 52 next February. “Living till you are 121 years is no longer a dream.”

As part of the technology push, Fosun and Nadsaq-listed Intuitive Surgical - a distribution partner for 13 years - will research and assemble in Shanghai the latest export version of the da Vinci surgical robot, designed to help surgeons perform minimally invasive surgery.

Guo founded Fosun with three alumni of Shanghai’s Fudan University 26 years ago with 38,000 yuan in capital, naming their company Fosun, which can be interpreted as “stars of Fudan”.

He turned it from a start-up into one of China’s leading private-sector conglomerate with total assets of about US$85 billion as of December 2017, with US$2.1 billion in net profit. The group’s interests span property, health care, finance, tourism and culture-related businesses

The new focus will help the Chinese conglomerate differentiate itself from other Chinese businesses as Beijing authorities cast a keen eye over the operations of financial institutions, and put a ceiling on overseas real estate investments to avoid capital flight, analysts said.

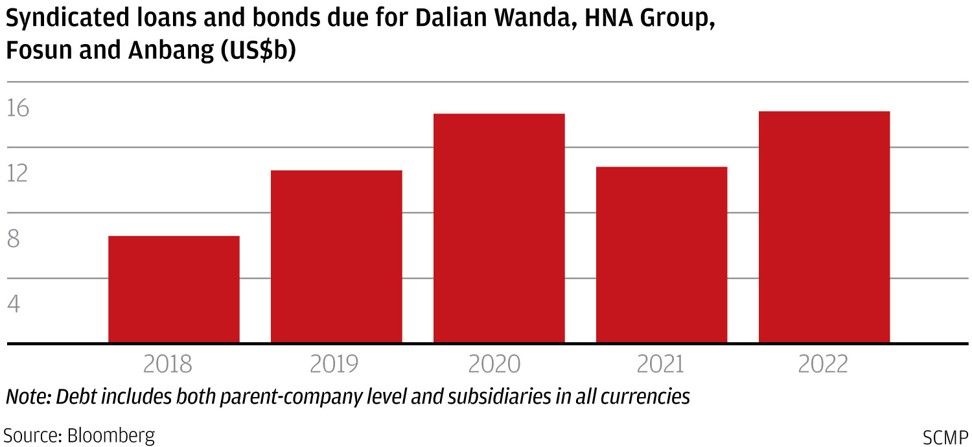

That could not have come a moment too soon. Last year, Fosun was put under Beijing’s scrutiny alongside Anbang Group, Dalian Wanda Group and HNA Group for their profligate deal making and overseas acquisitions.

In its annual China Financial Stability Report published on November 2, the People’s Bank of China raised the alarm of so-called “grey rhino” risk in the financial system.

Fosun owns about 154 billion yuan of assets in insurance, including Portugal’s biggest insurer Fidelidade Cia de Seguros SA, bought in 2014 for €1.04 billion (US$1.186 billion)

It followed up on this with the purchase of hospital operator Espirito Santo Saude SGPS SA the same year, capping off its acquisition spree with the purchase of Banco Comercial Portugues SA in November 2016 for €174.6 million.

“We have no intention of creating any insurance company. We do not want to be a financial holding company either. But why do we involve into financial and insurance? We want to meet customers’ needs,” Guo said.

Fosun has already shed six businesses between 2015 and 2017 valued at more than US$3 billion from its overseas portfolio, reducing the group’s gearing ratio to 60 per cent as of last year, considered a manageable level, according to Morgan Stanley.

Historically, the group’s relatively high leverage, complicated business structure, and aggressive overseas expansion have triggered significant investor concerns, but “we believe these issues are diminishing”, according to Morgan Stanley’s analysts Jenny Jiang and Vincent Qin.

Upcoming catalysts for Fosun include the listing of its tourism and leisure group Fosun Tourism, which owns Club Med. The company has been approved to raise up to US$1 billion in the Hong Kong stock market, although it remains to be seen if the final fundraising size would be cut amid the current market rout.

“Investments in innovation needs massive capital and time,” Guo said. “We want to invest in a smart and efficiency way. We will team up with other parties globally. There are a lot of good start-ups in Israel and we will cooperate with them.”