China’s property barons fulfilled ordinary families’ dreams – and became fabulously wealthy

- Wang Jianlin has proven to be one of the property sector’s biggest experimenters, shifting to commercial real estate to find his money tree

Even as e-commerce and other hi-tech innovations have cranked out a new generation of billionaires, property moguls are still among China’s ultra rich, including one long-time survivor and nimble experimenter, Wang Jianlin.

Three out of China’s 10 richest billionaires made their fortunes in property, capitalising on economic reforms over the past 40 years that propelled property into one of the most important drivers of growth and creators of a middle class.

The three richest with property roots are: Xu Jiayin, chairman of Evergrande Group, worth US$36 billion (ranked 2 on Hurun’s latest China Rich List); Yang Huiyan, vice-chairman of Country Garden, worth US$21.6 billion (ranked 4), and Wang, chairman of Wanda Group, and his family, worth US$20.2 billion (ranked 5).

In China, home ownership has moved from a dream to an identity

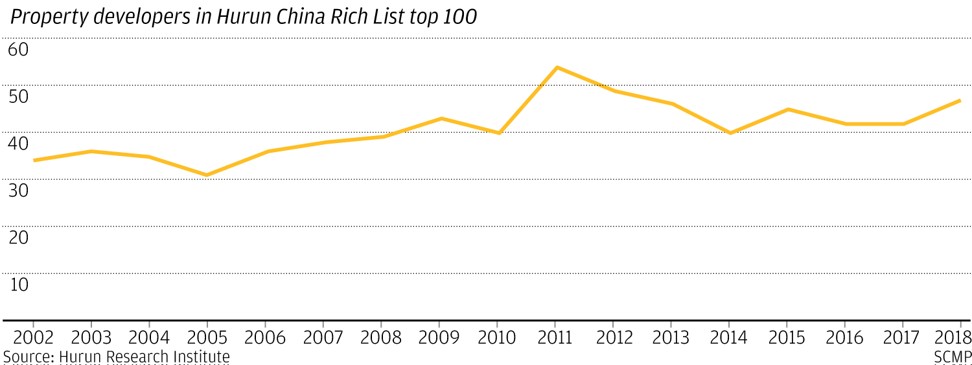

But, as property development has slowed and hi-tech has emerged as the new king, property developers have slipped in dominance on the rich list. Back in 2002, seven out of the top 10 on the Hurun China Rich List were property developers.

This year, about one-third of the 100 richest people in China were property developers, down from 54 of the top 100 in 2009.

“The property businesses are getting bigger and becoming more centralised and consolidated. And there are many new industries now coming up. That is also making a big difference,” said Rupert Hoogewerf, Hurun Report chairman and chief researcher.

Internet-related fortunes now rank high: Jack Ma, the founder of e-commerce giant Alibaba, the owner of the South China Morning Post, and his family are the richest, with US$39 billion. Pony Ma Huateng, chairman of social and gaming giant Tencent, is the third richest, with US$34.6 billion.

Fewer Chinese billionaires in latest Hurun rich list

Wang is the only property developer who showed up in the top 10 of the Hurun China Rich List every year in the past decade.

His Wanda Group, one of China’s largest commercial real estate companies, is a poster child of the country’s supercharged property story and how it created phenomenal wealth.

Like most Chinese developers, Wanda’s fortune grew along with the privatisation of China’s residential property sector in late 1990s and Chinese people’s thirst for better accommodation after decades of living in shabby welfare housing.

Chuck Liu, a senior executive of Wanda Group, recalled in an interview that property in China was in such a primitive phase and demand was so strong that even a design drawing could translate into sales.

Wang was among the earliest property titans to see the limits to residential development, which has an unstable cash flow and is vulnerable to any liquidity crunch.

Around 2000, Wang made a big decision: to gradually shift to commercial property, which could generate rent as a stable cash flow.

But the very success of the residential business had become a stumbling block for the shift toward commercial property. The shift encountered stiff opposition within Wanda. After three days of intensive discussion, 99 voted against the decision to shift to commercial. The one vote in favour came from Wang – and it was the one that mattered.

“At first, few people in Wanda would work in the commercial property unit. A simple reason is in the residential department one just needed to work three months a year and achieve great results. But in the commercial unit, you work throughout the year and achieve nothing,” Liu said.

After unsuccessful trials, Wanda found a new model that worked: using proceeds from sale of the nearby residential properties to invest in an entire mall. The model saved heavy upfront investment for a costly mall while securing assets that generated lasting rental income.

That spree abruptly ended in mid-2017 when Beijing started to check Wanda and other private conglomerates’ debt-fuelled cross-border investment. Wanda was forced to sell 13 of its tourism projects, and most overseas assets to survive. Wang lost his title as China’s richest man in 2017.

“Looking back, the lesson is that you can’t overstretch. In the future, Wanda will align all of its businesses with (government) guidance,” said Liu. “For example we disposed of ‘Wanda Cities’ in response to the government’s call to deleverage. We invested in health care because this is the sector that China needs,” he said.

Property developers’ wealth has shrunk in 2018.

China’s 100,000 developers are bracing for a giant shakeout

Xu’s wealth slid 14 per cent from last year, Yang’s fell 6 per cent, and Wang’s dropped 10 per cent.

But their position in terms of overall wealth is still considerably more than in America.

In this year’s Global Rich List from Hurun, 23 of the top 100 richest were from China and 33 were from the US. However, nine of the richest Chinese focused on or had businesses in the property industry while for the US, only Donald Bren, chairman and owner of Irvine Co, was a real estate developer. Bren’s wealth was listed at US$17 billion and he was ranked 73rd richest.

“Urbanisation in the US finished many years ago … now the US is sort of transitioning into a leader on the IT and financials. These are the two places where most of the money in the US is being made now. There is no opportunity, in the same way, like in China to make money from urbanisation progress [for US companies],” Hoogewerf said.

Up to 100 individuals will be honoured as part of the 40th anniversary of China’s reform and opening up, according to Communist Party mouthpiece People’s Daily, which published the nominee list on Monday as part of a five-day public review.

The extensive lists includes “honourable figures” from various professions and trades – entrepreneurs, scientists, economists, politicians, and even farmers, who have “made important contributions to China’s reform and opening-up” or “made outstanding achievement in building socialism with Chinese characteristics”

But in the corporate world, the list does not include entrepreneurs from the property or the financial industry. Only those in tech, manufacturing, or agricultural industries make the list.

Those corporate leaders honoured by Beijing include Jack Ma, Pony Ma, Robin Li, leaders of China’s three biggest internet conglomerates.