Government agrees to pay HK$300 million for Hong Kong’s biggest audit reform in a decade

- The cash will enable the Financial Reporting Council to triple its staff, who will keep an eye on the auditors of 2,000 listed companies in Hong Kong

The Hong Kong government has agreed to pay HK$300 million (US$38 million) towards the biggest overhaul of accountancy regulation in a decade.

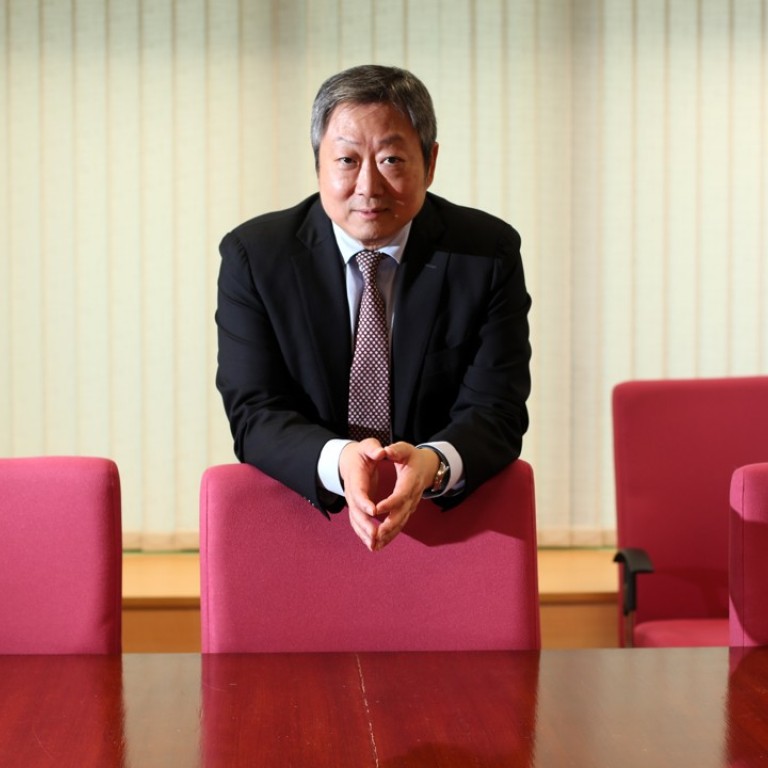

The money will enable the watchdog, the Financial Reporting Council, to triple its headcount to inspect, investigate and discipline auditors in more than 2,000 listed companies, according to newly appointed chairman Kelvin Wong Tin-yau.

Wong said he expected lawmakers to vote in March for reforms that would see the toothless Financial Reporting Council transformed into a fully empowered independent regulator of auditors in the second half of 2019.

“This will be an important reform of the regulation of auditors, who act as a gatekeeper to the quality of the listed companies’ financial statements. This will bring Hong Kong in line with international standards,” Wong said in an interview.

Wong, who is Cosco Shipping Port's executive director and deputy managing director, took up his latest role from former chairman John Poon. The council requires the chairman to be a non-accountant, to ensure its independence.

The Financial Reporting Council was set up by the government 10 years ago to investigate the auditing failures of listed companies. After it finished an investigation, it was required to pass the case back to the industry body, the Hong Kong Institute of Certified Public Accountants, to determine the penalty.

The government last year proposed a law change to allow the council to take over inspection and disciplinary power from the HKICPA, which is not an independent body.

The audit reform is seen as another government push to enhance the quality of Hong Kong’s stock market, the third largest in Asia, as it competes with the US and Shanghai for more technology firms to list.

The government had initially wanted the council to be financed by a levy on investors, another paid by audit firms, and funds from the Securities and Futures Commission and Hong Kong Exchanges and Clearing.

Lawmaker Kenneth Leung Kai-cheong in February told the Post he had urged the government to provide HK$300 million in seed money as it had done for other regulators such as SFC and the Insurance Authority.

The government’s funding together with the investor and auditors’ levies would cover core operation costs without the need for HKEX and SFC funds, Wong said.

The council will triple its annual budget from HK$30 million to HK$90 million while its headcount will rise from 27 to 73, Wong said.

The budget is still much lower than comparable watchdogs such as Hong Kong’s SFC at HK$392 million (US$50 million), the US Public Oversight Board US$$250 million and Britain's Financial Reporting Council at £35 million (US$48.4 million).

“The budget is still lower than international counterparts but it is much higher than before. We will review it after some time of operation,” Wong said.

The law change will also allow the Financial Reporting Council to fine accountants up to HK$10 million or three times their auditing fee.

Leung said he opposed this and would submit a proposed change to the bill on Monday to remove the cap.

“The HK$10 million maximum penalty is too high and may lead to some small firms’ collapse. Australia and Canada will not impose fines on auditors while Singapore only has a fine of up to S$100,000 (US$72,621). The fine level in Hong Kong is substantially higher than international standards,” Leung said.

Meanwhile, Wong said the council has made a submission to the HKEX on its controversial plan to require listed companies to suspend trading if their auditors refuse to give their financial statement a clean bill of health.

“The Financial Reporting Council urged the HKEX to change its proposal as it may lead to many companies being suspended from trading,” Wong said.

“It would be better if once the companies and their auditors find they have a disagreement, they should tell the HKEX before announcing the results. The three parties will then try to find a solution for that before announcing the result,” Wong said.