Japan outpaces China in race for outbound mergers as trade war, capital controls weigh on deal flow

- China was fourth worldwide with US$105.4 billion in deals, according to data provider Dealogic

- Chinese companies among most active deal makers in Asia outside Japan, according to Mergermarket

Driven by a massive tie-up between Takeda Pharmaceutical and the Irish drug maker Shire in May, outbound mergers and acquisitions from Japan outpaced China for the first time in five years in 2018, according to financial services data provider Dealogic.

Japanese companies accounted for 649 deals worth US$184.2 billion last year, making Japan the second-largest market for outbound M&A globally, according to Dealogic. That compared with 685 deals worth a combined US$79.5 billion in 2017.

Risk of ‘worse to come’ from trade war impact, legal experts warn

China was fourth worldwide with US$105.4 billion in deals, boosted by China Three Gorges’ US$27.5 billion acquisition of utility EDP-Energias de Portugal — the second-largest Chinese outbound deal on record, according to Dealogic.

It was the second consecutive annual decline since China reported a record US$217.6 billion in outbound deals in 2016. Chinese-led outbound deals were worth US$136.7 billion in 2017.

Japan clinched the top spot in Asia as a trade war escalated between the United States and China last year, threatening to destabilise global supply chains and leading to greater scepticism over Chinese-led deals.

Overall, global M&A volume reached its highest level since 2015, with US$3.35 trillion in deals, according to Dealogic.

“Boutique M&A financial advisers increased the pressure on global investment banks after increasing their share of global M&A volume to 40.9 per cent, equating to US$1.37 trillion in total volume, the highest percentage share on record so far,” said Dealogic. “However, it’s not just volumes where the boutiques are continuing to squeeze. Boutiques also accounted for US$11.2 billion of revenue with investment banks accounting for US$16.3 billion, keeping on par with the previous record year of 2016.”

The US remained the top market for outbound volume with deals worth US$233.3 billion last year, ahead of Japan and Canada.

China’s decline was driven by Beijing’s efforts to slow the outbound flow of capital and the rising trade tensions between the world’s two largest economies, according to Dealogic. For the US alone, the volume of Chinese-led deals has declined from 170 deals worth US$62.8 billion in 2016 to 81 deals worth US$12 billion in 2018.

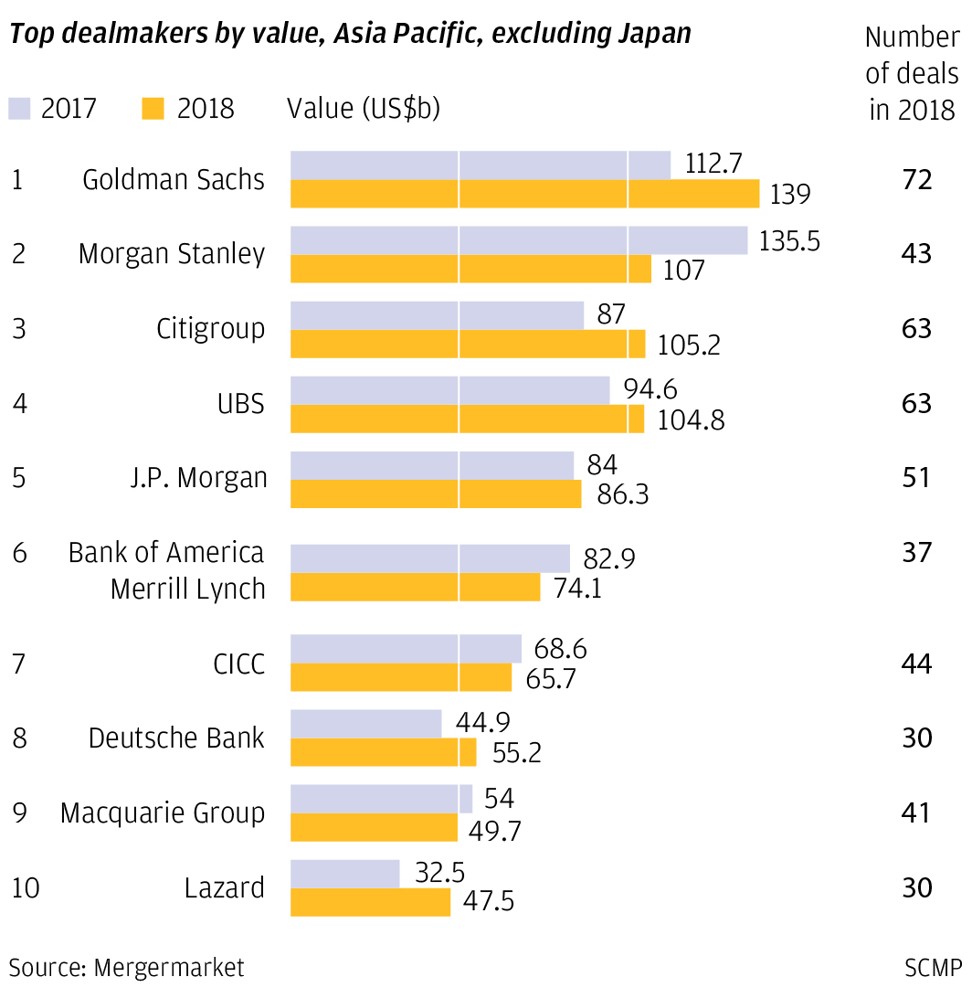

Despite the decline in outbound deals and increased scrutiny of transactions with ties to China, Chinese companies remained among the most active deal makers in Asia outside Japan, according to Mergermarket, a competing financial data and research firm.

Last year, the US greatly expanded its rules for reviewing foreign-led transactions and investments following increased national security concerns about China’s efforts to acquire technology.

Scepticism also has been growing in Europe, with the United Kingdom and Germany expanding their ability to block foreign deals involving certain critical technologies. The European Union is expected to adopt new rules later this year that would give its member nations a broader framework to review deals on national security grounds.

Amid trade war, scepticism over Chinese-led deals rises in Europe

Much of the concern has surrounded Beijing’s “Made in China 2025” programme, which is designed to improve the country’s domestic market share in several hi-tech sectors, including robotics and electric vehicles.

The value of outbound deals in Asia, minus Japan, topped US$160 billion last year, a 52.4 per cent increase, according to Mergermarket.

“China remained the most active investor outside the region following an acceleration of M&A approvals by Chinese authorities together with more attention being paid on target selection and deal structures,” said Mergermarket.

Overall, Asia-Pacific, minus Japan, accounted for 4,036 deals worth a combined US$717.4 billion in 2018, according to Mergermarket. That compared with 4,078 deals worth US$699.6 billion in the prior year.

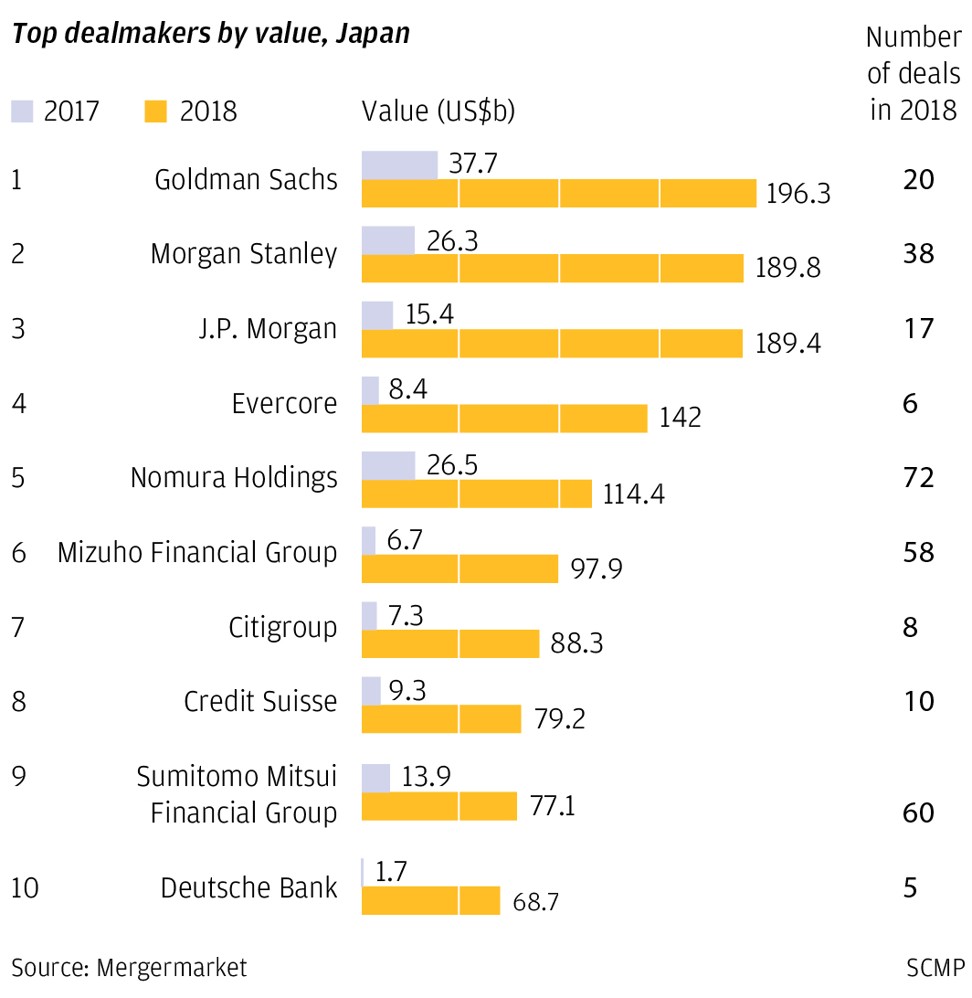

Goldman Sachs was the top deal maker in Japan last year, as well as the rest of Asia-Pacific, followed by Morgan Stanley, according to Mergermarket.