Chinese firms out in force at world’s biggest health care meet, even as country’s tech companies cool on US

- About 38 Chinese privately-owned and listed companies are attending the JPMorgan Healthcare Conference in San Francisco

- Attendance contrasts with 20 per cent decline in number of Chinese firms at annual CES consumer electronics trade show

More Chinese companies have flocked to this year’s JPMorgan Healthcare Conference, the industry’s largest investment symposium in the world, defying a steep slump in stock valuations in the sector and wider economic and political worries.

About 38 Chinese privately-owned and listed companies – an increase of 22.6 per cent over last year – have made presentations and attended one-on-one meetings at the event, which runs Monday through Thursday this week in San Francisco. Thirty-one firms attended the event last year, and 21 in 2017.

Why this Hong Kong tycoon’s family backed biotech firm ditches the city for Nasdaq listing

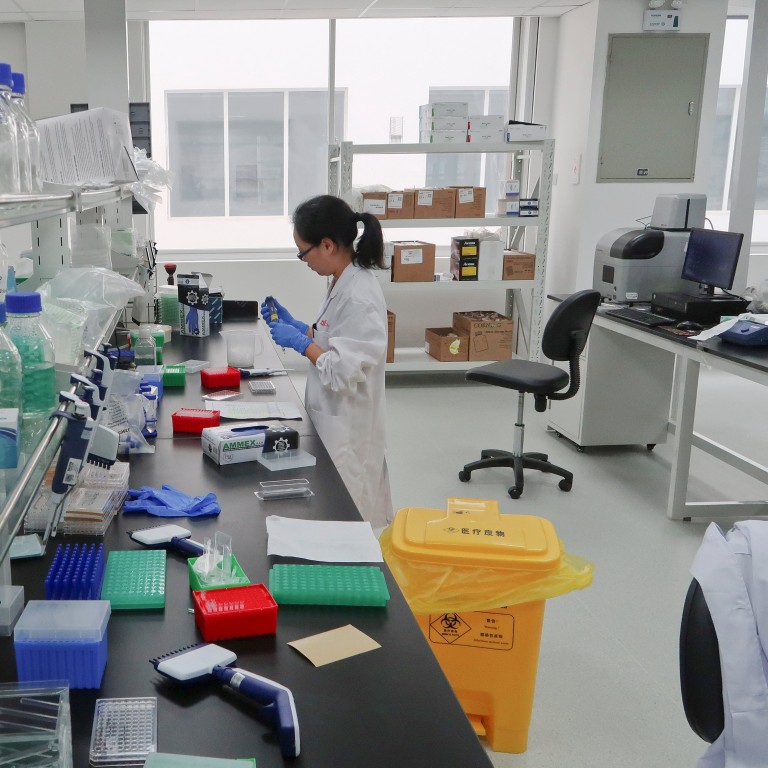

These companies include innovative drug developers, generic drug manufacturers, medical devices companies, online pharmacy and health care services platform operators, as well as outsourced manufacturing and clinical trial services providers. They are eager to share their investment stories and business updates with new and existing investors, as well as potential technology licensing and marketing partners from the United States and elsewhere.

The rising numbers also vindicate a move by Hong Kong to allow listings by pre-revenue biotechnology companies in April last year. Five such firms have listed on the mainboard of its stock exchange so far.

“China’s drug development has witnessed revolutionary and globally rare changes in the three years to 2018, resulting in over 40 new drugs being approved last year alone, compared to four in the 50 years to 2008,” Song Ruilin, president of the China Pharmaceutical Innovation and Research Development Association, told a panel discussion on Wednesday.

Frank Zhang Fangliang, chairman of chimeric antigen receptor T-cell (CAR-T) cancer therapies developer Genscript Biotech, told a panel: “Nowadays, the regulatory environment is almost the same as in the US … in the CAR-T area, China ranks just behind the US and is ahead of Europe and Japan in terms of the number of clinical trials. In some new segments, Chinese firms can be just as innovative as US firms.”

Many Chinese venture capital and private equity firms are also attending the conference with the aim of finding investment targets in the US, which has the world’s biggest and most innovative biotechnology and pharmaceutical industry.

These firms poured about US$4.5 billion into US biopharma companies last year in 85 deals, up from US$3 billion in 44 deals in 2017, according to Silicon Valley Bank, which has helped fund more than 30,000 start-ups, primarily in technology industries.

“China, historically being the destination of capital, has increasingly become the [originator] of capital,” Charles Li Xiaojia, chief executive of bourse operator Hong Kong Exchanges and Clearing and a former JPMorgan Asia chairman, who pushed hard for reform to allow pre-revenue biotechnology IPOs in Hong Kong, told a panel discussion on Monday.

China, historically being the destination of capital, has increasingly become the [originator] of capital

But, with laws passed last year to tighten the scrutiny of foreign investment in the US, Chinese acquisition of controlling stakes in established US biotechnology and pharmaceutical firms – something that has yet to happen – would be “impossible”, according to Brad Loncar, chief executive of Loncar Investments, a Kansas-based investment firm and biotech stock index provider.

The crash in stock prices has helped with the making of several multibillion dollar takeover deals between US biotechnology and pharmaceutical companies in the past few weeks, he added.

Loncar, however, also said so far the scrutiny and the Trump Administration’s export restrictions on high technology to China have not affected biotechnology cross-licensing cooperation deals between US and Chinese firms on new drugs development.

Hong Kong could become biotech listing hub, says BeiGene boss as Chinese drug maker gears up for US$1 billion flotation

The takeover deals, at big price premiums, have helped lift the Nasdaq health care Index with 699 constituents by 16 per cent from a 21-month low seen just over two weeks ago, when it had crashed 26 per cent from a record high in late September.

More than 450 companies are to make presentations at the four-day event, which is in its 37th year. It is expected to be attended by more than 9,000 industry participants and members of the investment community.

Ascletis Pharma, Asia’s first pre-profit listed biotech, plunges in Hong Kong three days after debut

China’s economic slowdown and the ongoing trade war between Washington and Beijing, involving tariffs worth billions of dollars and protracted negotiations on trade, intellectual property protection and market access issues, have been blamed.