Lingering US-China tensions, economic slowdown could set stage for rough first half for investors, analysts say

- World Bank has warned that outlook for the global economy has ‘darkened’ in 2019

- KKR’s Henry McVey turns to Macbeth as he advises investors to be cautious, but stay in the markets

Optimism is rising that the United States and China can reach an agreement to end their months-long trade war, but tensions between the world’s two largest economies will continue to linger in what could be a very choppy start to the year for investors, say analysts and economists.

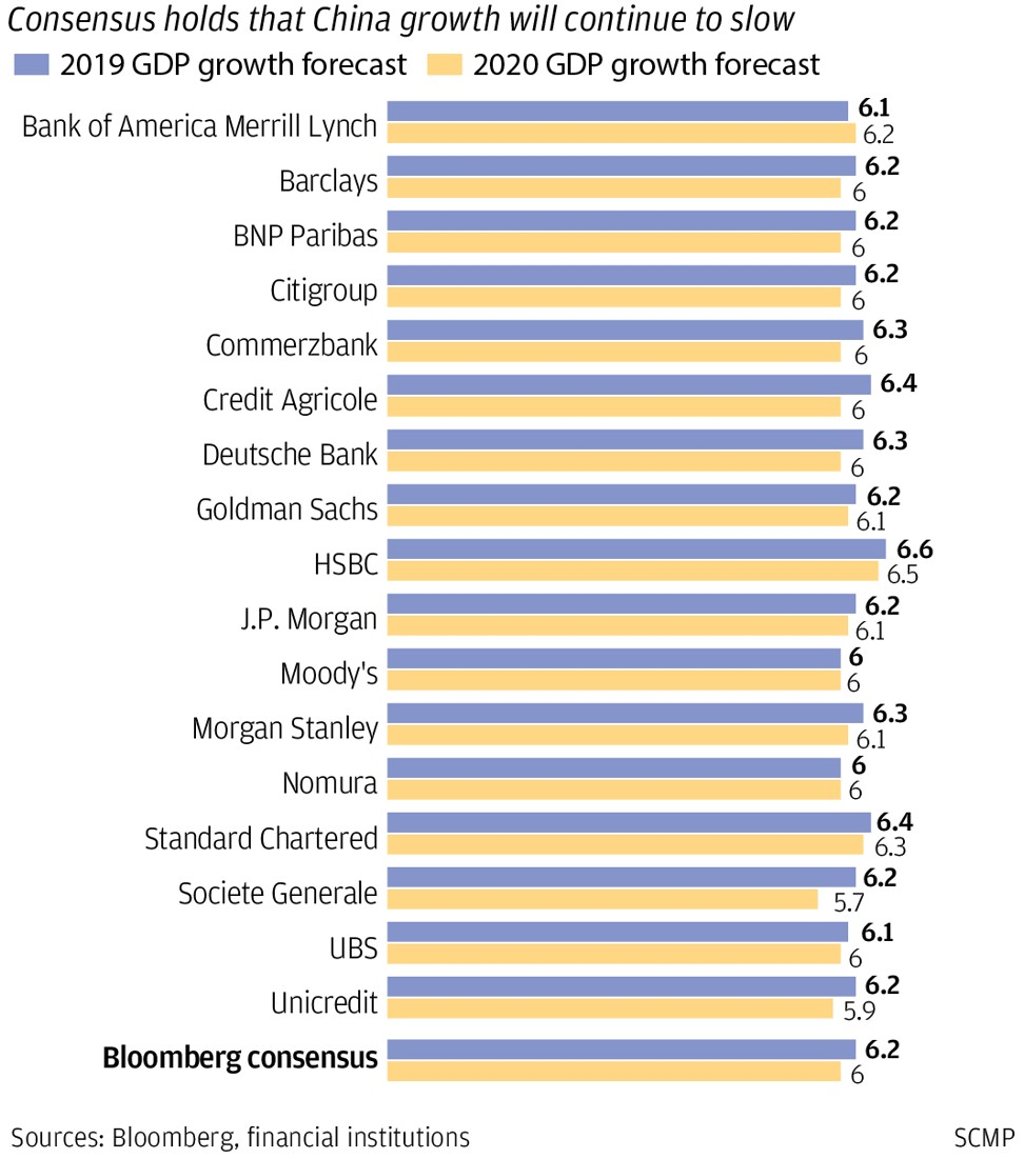

Trade tensions and softening investment are weighing on growth globally and rising fears that China’s economy may be slowing faster than previously thought.

In advising investors to stay in the market, but warning that it is “not business as usual”, Henry McVey, the head of global macro and asset allocation at private equity firm KKR, quoted Macbeth in his outlook for the year: “I am in blood. Stepped in so far that, should I wade no more, Returning were as tedious as go o’er”.

Against that backdrop, investors should expect rough seas in the first half of the year, even if the US and China cease their hostilities over trade, according to market observers.

“We expect China’s economic slowdown to intensify in the coming months,” said Jerry Peng, China strategist at Citigroup. “Consumption is weak, especially discretionary spending for automobiles, smartphones, home appliances. Without any kind of stimulus from the government, we expect it to remain subdued.”