China’s corporate default storm continues to rage at the start of 2019 after a record year

- Midway into January five Chinese companies are already likely to default on 3.5 billion yuan (US$446.25 million) worth of debt

- Beijing Kang Dexin Composite Material tumbled 10 per cent on Tuesday after saying it’s likely to default on the payments of two corporate bonds

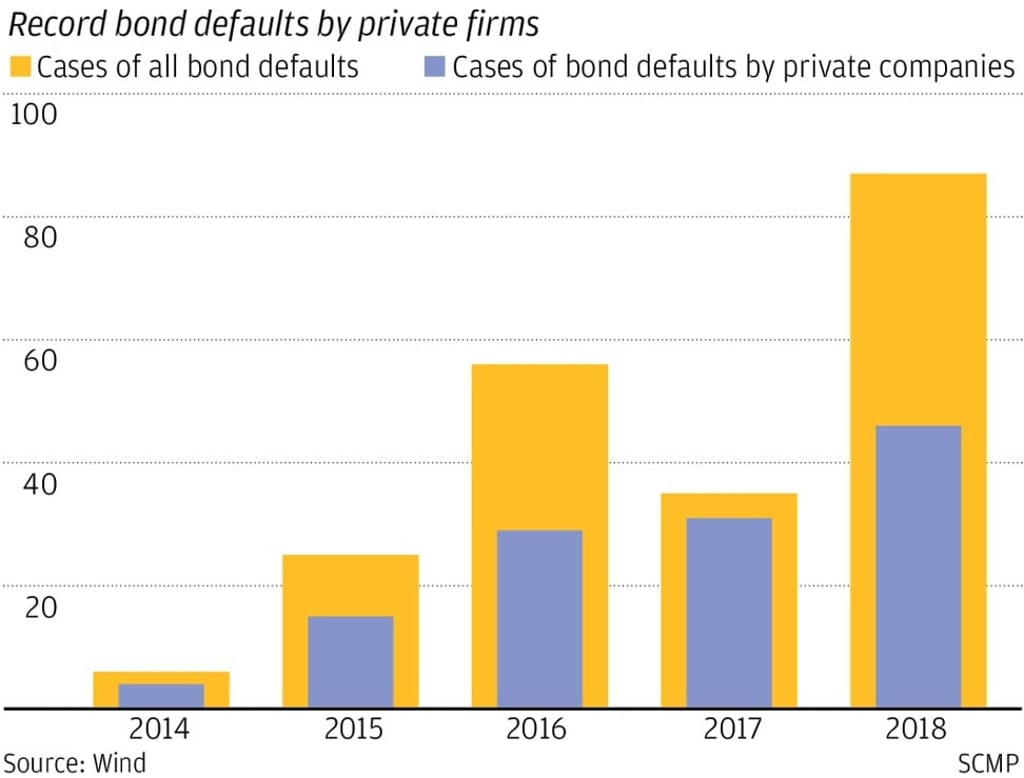

Two weeks into 2019, five Chinese companies are already likely to default on 3.5 billion yuan (US$446.25 million) worth of debt, after a record US$17 billion default wave took the country by storm in 2018 amid a worsening economic slowdown and soaring refinancing costs facing the cash-starved private sector.

Beijing Kang Dexin Composite Material, a hi-tech material firm that supplies optical film products to Apple and carbon fibre materials to Mercedes-Benz, tumbled by its maximum-allowed 10 per cent on Tuesday to a record low of 6.46 yuan on the Shenzhen Stock Exchange. Its market cap has plummeted 58 per cent in the past two months to 23 billion yuan from 54 billion yuan.

Tuesday’s plunge came after the firm announced it’s likely to default on the payments of two corporate bonds worth a combined 1.56 billion yuan. One is due on Tuesday, with an amount of 1.04 billion yuan, while the other will expire next Monday.

“The company has run into temporary cash flow problems since the fourth quarter, due to macro financing difficulties and slow cash collection of sales payments,” Kang Dexin said Tuesday on the Shenzhen exchange’s online interaction platform.

Moody’s Investors Service downgraded Kang Dexin’s ratings twice in 2018, citing concerns for the company’s worsening liquidity conditions, soaring refinancing costs, and elevated ratios of shares pledged as collateral for loans, which will increase the risks of a stock plunge when borrowers run into trouble.